Of many diliar towards physician real estate loan, sometimes referred to as a family doctor loan. Doctor money is actually a kind of mortgage which enables doctors so you’re able to build a down-payment away from less than 20% and prevent purchasing individual home loan insurance (PMI). There are various financial institutions offering physician mortgage brokers. A few of them was national, anybody else are local. In the for every single county, there are at the very least multiple banking institutions having a d. These pages gives an introduction to doctor lenders and you will what you should look for whenever inquiring regarding an effective bank’s d.

Conventional Mortgages

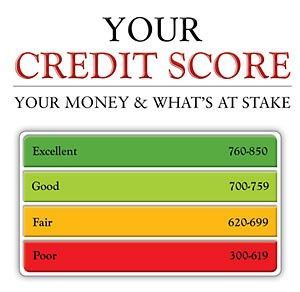

Toward general population, a conventional mortgage is the regular types of mortgage anyone follow. A common requirement that all individuals have read is that you need a beneficial 20% down payment to find a property. According to brand of assets you are purchasing (domestic, condo, etc.), this may not be entirely true. Sure, if you have good 20% advance payment, your options abound. not, most banking institutions enable consumers to place less than 20% down nevertheless secure financial support. The fresh hook was, they want that pay an additional monthly fee to cover the price of personal home loan insurance coverage, or PMI.

What’s Personal Financial Insurance coverage (PMI)

Personal financial insurance is insurance coverage that you pick to afford mortgage loan balance in the event you standard on your own loan. That it turned well-known about wake from financial regulations adopting the 2008 homes debacle. Really loan providers immediately is PMI when you look at the funds in which the deposit are lower than 20% of your own cost. PMI normally will set you back a supplementary how to get direct express emergency cash 2022 $100-300/times which will be extra to your financing bundle and usually paid from escrow membership. Frequently it’s built-into the loan in itself and you may cannot tell you up as an extra range product.

To help you remove PMI on the loan, the loan-to-worthy of proportion to your house should be less than 80%. Eg, if the a house are purchased to possess $400,100 having a beneficial ten% down payment, the initial mortgage taken out was $360,one hundred thousand. More than some years, your house hypothetically values so you’re able to $450,100 additionally the loan equilibrium is actually paid off in order to $340,000. Yet the loan to value proportion try 75.5%, so that the debtor might be permitted get rid of the PMI rates from their loan. Always a property appraisal (at the borrower’s expense) must persuade the financial institution the present day home well worth. In case your PMI is created on loan itself, up coming a great refinance are needed to find the PMI got rid of in the picture. For this reason, if you’re considering that loan that will require PMI, it’s always best to feel the PMI as a unique range product, which is easy to remove which have an appraisal, rather than an effective re-finance.

Mortgage brokers to own Medical professionals

Financial institutions recognize that doctors is actually book as compared to general public and tend to be glamorous individuals. He has got employment safety, earn nice income, and you can shell out their fund timely and in full. This means that, certain financial institutions offer another type of medical practitioner mortgage to draw medical professionals because consumers. As stated prior to, doctor financing allow dI, though he is and make a down payment out of lower than 20%.

The mark market for such money is medical professionals exactly who has actually has just registered routine. A doctor which ran off while making $sixty,000/season within last year from property so you can $300,000/seasons immediately, has the capacity to comfortably spend the money for monthly payments toward an effective $600,one hundred thousand home loan. However, they probably have not secured the $120,000 you’ll need for a great 20% downpayment. The banks just who render a great d has actually known this problem and you will created a solution for it. Today, an early on doctor can acquire the house they need with while the nothing as the zero % off (built on the d) and not have to pay money for home loan insurance rates!

Full revelation, zero percent off is offered by a select few regional banking companies in fact it is not available in most says. An everyday medical practitioner financing program will need 5% off having finance around $750,one hundred thousand (specific goes around $1,000,000) and 10% down above those individuals thresholds. When you are getting significantly more than $step 1.5M, really banking companies will require more 10% down on good dI.

Really medical professionals imagine capable ask people bank should your lender have a great d and you can guess the lending company understands what they’re talking about. When up against one to concern, very mortgage officials have a tendency to react with, Obviously we provide doc lenders. They imagine youre simply inquiring whenever they provide mortgage loans getting medical professionals, just like they give you mortgages for engineers, schoolteachers, and you will firefighters. In this condition, the de as all other conventional mortgage that have lower than 20% off and include PMI.

In place of asking if a financial also provides a doctor real estate loan, practical question has to be phrased correctly. You could inquire, Could you render physician home loans that waive the newest PMI needs into finance getting medical professionals that have less than an excellent 20% downpayment? If they do, you might proceed to inquiring her or him in regards to the some conditions.

On the physician mortgage, do you know the lowest down payment criteria for different loan brands? That’s where there is certainly from the limit loan proportions when you are getting off 5%, 10%, an such like.

Keep in mind, anyone individual youre dealing with are arguably more significant than the financial in itself. If you’re dealing with some one within a bank that gives medical practitioner funds, but the people actually regularly their d, they probably will not go well to you personally. It is helpful to look for a loan administrator just who specializes in doctor lenders and no PMI.

Most other Applying for grants Physician Home loans

Particular banks which give an effective deters for residents/fellows compared to physicians used. And, some banking companies restriction its no PMI medical practitioner home loans so you can medical professionals for the first decade of the probably career. The idea here is immediately after a decade used, a doctor can cut back adequate to possess a good 20% deposit. As well as, your normally never fool around with a health care professional loan into the a secondary home or money spent. A doctor mortgage program is made for your number 1 household only.