The OWC of a company can be expressed as a percentage of sales to compare a company’s ratio to other companies within the same sector. The solution (the entire cash conversion cycle) is also illustrated in a chart, Figure 19.3. Net working capital possibilities can be thought of as a spectrum from negative working capital to positive, as explained in Table 19.1. Understanding changes in cash flow is also important if you are applying for a small business loan. Lenders will often look closely at a potential borrower’s working capital and change in working capital from quarter-to-quarter or year-to-year.

How Working Capital Impacts Cash Flow

Consequently a change in working capital is any net change in current assets and current liabilities over an accounting period. As it so happens, most current assets and liabilities are related to https://www.bookstime.com/ operating activities (inventory, accounts receivable, accounts payable, accrued expenses, etc.). The current ratio is calculated by dividing a company’s current assets by its current liabilities.

Operating Working Capital Calculation Example

Some CEOs frequently see borrowing and raising equity as the only way to boost cash flow. Other times, when faced with a cash crunch, instead of setting straight inventory turnover levels and reducing DSO, these management teams pursue rampant cost cutting and restructuring that may later aggravate change in operating working capital problems. For investors, a company’s inventory turnover ratio is best seen in light of its competitors. In a given sector where, for instance, it is normal for a company to completely sell out and restock six times a year, a company that achieves a turnover ratio of four is an underperformer.

Net working capital and working capital ratio example

However, sometimes it may be operational if a business requires cash to operate, such as a travel shop for currency exchange. If an industry has inventory that cannot be easily liquidated then often an amended version of the metric is calculated. This uses current assets less inventory instead of current assets and is called the acid test or quick ratio. The working capital of a company—the difference between operating assets and operating liabilities—is used to fund day-to-day operations and meet short-term obligations.

Working capital is the amount of current assets left over after subtracting current liabilities. A negative amount indicates that a company may face liquidity challenges and may have to incur debt to pay its bills. Working capital is critical to gauge a company’s short-term health, liquidity, and operational efficiency. You calculate working capital by subtracting current liabilities from current assets, providing insight into a company’s ability to meet its short-term obligations and fund ongoing operations. It is calculated by subtracting a company’s current liabilities (excluding any short-term debt used to finance current assets) from its current assets (excluding cash and cash equivalents).

Free Financial Modeling Lessons

Working capital management ensures that a company operates efficiently by monitoring and using its current assets and liabilities to their most effective use. The efficiency of working capital management can be quantified using ratio analysis. This metric serves as the lifeblood of a company’s operations, reflecting its ability to meet financial obligations. A higher cash flow signifies that the organisation’s income surpasses its expenditures, while lower cash flows indicate that expenses exceed income.

- Since the growth in operating liabilities is outpacing the growth in operating assets, we’d reasonably expect the change in NWC to be positive.

- The larger the business, the larger the number due to the scale of their operations rather than their efficiency.

- Improvements in inventory turnover increased cash flow, all but eliminating liquidity risk, leaving Dell with more cash on the balance sheet to distribute to shareholders or fund growth plans.

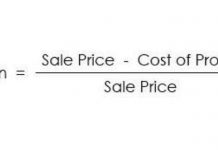

- The formula to calculate operating working capital is equal to the operating current assets subtracted by the operating current liabilities.

- As a business owner, it is important to know the difference between working capital and changes in working capital.

- Working capital represents a company’s ability to pay its current liabilities with its current assets.

The formula to calculate operating working capital is equal to the operating current assets subtracted by the operating current liabilities. Other credit management techniques, some of which are explained in subsequent sections, can help minimize and control the receivables collection period. Working capital is a basic accounting formula (current assets minus current liabilities) business owners use to determine their short-term financial health. Changes in working capital can occur when either current assets or current liabilities increase or decrease in value. Net operating working capital measures a company’s short-term liquidity, meaning its ability to meet short-term financial obligations. If a company has a positive NOWC, it is able to cover all of its liabilities.

Inventory decisions are a crucial factor that can lead to a change in working capital. If a company chooses to spend more on inventory to increase its fulfillment rate, it will use up more cash. Changes in working capital are important to monitor and are often used by investors and lenders to assess the health and value of a business. Read on to learn what causes a change in working capital, how to to calculate changes in working capital, and what these changes can tell you about your business.

- Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

- If the purchasing department opts to buy larger quantities at one time, it can lower unit prices.

- A company can conserve cash by choosing to stretch the payment to suppliers and make the most of available credit.

- When you determine the cash flow that is available for investors, you must remove the portion that is invested in the business through working capital.

- Working capital is one of the most important aspects of a business’s finances.

- For instance, suppose a retail company experiences an increase in sales, resulting in higher accounts receivable (A/R) due to credit sales.

- This indicates the company lacks the short-term resources to pay its debts and must find ways to meet its short-term obligations.

- It is calculated by subtracting a company’s current liabilities from its current assets.

- How do we record working capital in the financial statementse.g I borrowed 200,000.00 Short term long to pay salaries and other expenses.

Put together, managers and investors can gain critical insights into a business’s short-term liquidity and operations. In other words, there are 63 days between when cash was invested in the process and when cash was returned to the company. Get instant access to video lessons taught by experienced investment bankers.

How to Calculate Working Capital Ratio

This extends the time cash is tied up and adds a layer of uncertainty and risk around collection. For many firms, the analysis and management of the operating cycle is the key to healthy operations. The working capital cycle formula is days inventory outstanding (DIO) plus days sales outstanding (DSO), subtracted by days payable outstanding (DPO). Conceptually, the operating cycle is the number of days that it takes between when a company initially puts up cash to get (or make) stuff and getting the cash back out after you sell the stuff. The working capital metric is relied upon by practitioners to serve as a critical indicator of liquidity risk and operational efficiency of a particular business. Current assets are any assets that can be converted to cash in 12 months or less.