We have as well as incorporated one relevant charge and charges. Spoiler aware ahead, there isn’t any monthly fee otherwise one early commission costs.

- Whitegoods

- Seats

- Home fixes

- Kitchen areas

- Solar power systems

- Home improvements

|

||

| You can even like this loan in the event that: | You prefer the certainty of a fixed repayment. | You might be to buy otherwise refinancing an auto or motorbike up to 7 years of age. |

| Rate of interest diversity | 6.99% p.a good. to help you % p.a. | 5.69% p.an inside % p.an effective. |

| Assessment speed variety | seven.24% p.a good. so you can % p.an effective. dos | |

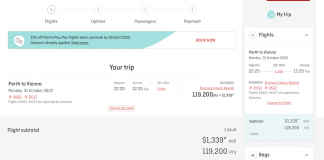

| Amount borrowed | $5,000 cuatro so you’re able to $75,100 | $5,one hundred thousand cuatro so you’re able to $100,one hundred thousand |

| Financing term | 1-7 ages | 1-7 ages |

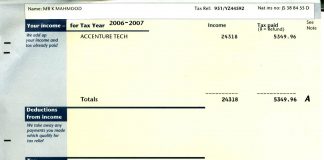

| Organization payment | $175 | $175 |

| Security government percentage | $0 | $90 |

| Monthly account Payment | $0 | $0 |

| Very early payment rates | $0 | $0 |

| Fee-free extra costs | Sure | Yes |

Mortgage purpose

Such as for example, when you find yourself to order a unique vehicles, a protected Fixed Car loan can offer a reduced interest rate than simply a keen Unsecured Fixed Personal loan. Or if perhaps you want to so you can combine obligations, financing which have $0 monthly charges and an aggressive interest, could help you save money and have now to come together with your earnings.

What is actually an effective personalised rate of interest?*

When you yourself have a beneficial credit history and you can a good record out-of paying down financing, credit cards or any other costs, you might be given a diminished interest rate.

When you make an application for a consumer loan your own personal disease and you may your credit score would be considered whenever calculating your own customised appeal rates. Once your loan application might have been assessed, you will get that loan price together with your finalised interest.

Provides

When comparing unsecured loans, possess is the icing to your pie. Keeps are overshadowed by interest cost nevertheless the greatest of these helps you pay your own personal loan eventually.

Be looking having money that offer 100 % free a lot more repayments and flexible fees choices. You’ll have additional control more the loan and can pay they out of your path.

A no cost redraw facility is another a good-to-learn feature which allows that availableness their extra repayments. If unforeseen expenses arise, you will not become stuck small! step 3

It’s time to read the conditions and terms to own fees. Very signature loans possess a place commission, but don’t forget about in order to twice-seek out additional charges eg a monthly account remaining payment for your loan. Otherwise charge and you will fees if you spend the loan away early.

These types of sneaky charges may sound quick, nonetheless they may cost your moreover living of your own financing as well as block out a low-value interest.

Fun facts: High Southern Bank Personal loans don’t have any fee every month otherwise charges having early commission, to help you see that have some extra cash in your pocket.

Personal loans told me

A protected financing is ‘secured’ from the resource you’re credit getting instance an automobile, or household. When you’re incapable of pay off the loan, the lender are available the house to cover will set you back regarding the mortgage. Extremely secured finance has actually a lesser interest in comparison in order to a keen unsecured personal bank loan while there is a valuable asset affixed.

A keen unsecured personal loan is a loan that does not wanted an asset since the shelter. Your income and you may power to repay the mortgage is still examined, but you do not online payday loans Brush require a secured asset so you can hold the mortgage.

Whenever you are to shop for a car or motorbike less than 7 yrs old, a great Southern Bank Shielded Repaired Auto loan tends to be best to you personally.