Cash Flow from Investing Activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Investing activities include purchases of long-term assets (such as property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds). Cash flow from investing activities is important because it shows how a company is allocating cash for the long term.

Typically, companies with a significant amount of capital expenditures are in a state of growth. The investors and executives we interviewed agreed that biotech innovation continues to increase in quality and quantity despite the macroeconomic environment. Evidence can be seen in the accelerating pace of assets transitioning across which of the following is an investing activity? the development lifecycle. There could be many reasons for this, but it is worth noting that biotechs with Phase I and Phase II assets as their lead assets have accounted for more than half of biotech IPOs. Having an early IPO gives a biotech earlier access to capital and leaves it with more scope to concentrate on science.

Understanding Cash Flow From Investing Activities

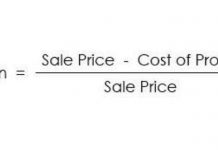

For the year, the company spent $30 billion on capital expenditures, of which the majority were fixed assets. Along with this, it purchased $5 billion in investments and spent $1 billion on acquisitions. The company also realized a positive inflow of $3 billion from the sale of investments.

- “To the extent that inflation is falling below 2%, persistent currency strength poses a deflationary risk for the Swiss economy,” strategists at BCA Research said in a note Friday.

- The parent income statement will also include 100% of the subsidiary’s revenue and expenses.

- When a company invests in the equity of another company and owns more than 50% of its voting shares, it is said to exert control over the company.

- Cash flow from investing activities (CFI) is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific period.

- As a result, these investments and capital expenditures are reported as negative amounts in the cash flows from investing activities section of the SCF.

- This gain or loss is only recognized for tax purposes when it is realized through the sale of the underlying security.

As one biotech investor put it, “There is much more capital available than talent.” Many companies struggle to attract and retain executives with experience in biotech, business development, and commercialization. In addition, a third of the executives and investors we interviewed think that European biotechs lack a sufficiently entrepreneurial mindset. IPO activity has grown faster than any other category of fundraising, with companies raising $34.3 billion in 2020, an increase of 186 percent on the previous year. Although US biotechs represented the lion’s share of IPOs, companies based elsewhere, particularly in China, have also seen significant growth in the past few years. Biotechs tend to source opening capital from their local stock market, with the United States (mainly NASDAQ) being the preferred nonlocal option. VC activity in biotechs grew by 45 percent in a year, taking the 2020 global total to $36.6 billion.

Accounting Income and the Balance Sheet

Executives in many other sectors are becoming more pessimistic about the outlook for their businesses as the global pandemic continues to spread.1McKinsey interviewed more than 2,000 executives from multiple sectors in October 2020. The majority believed that the global public-health response to COVID-19 would be partly effective but with regional resurgence and that economic interventions would be partly effective or ineffective. For example, you can use it to understand the sources of investment cash flow, understand the business long-term investment requirements of the business, and predict future cash flows. However, over the years, investors have begun to look at each of these statements alongside cash flow statements. This helps grab the whole picture and helps in making the most calculated investment decision.