Once you have received financing you should turn their notice so you can boosting your team credit history for future years to obtain good better financing the next time to.

step one. Shell out your bills timely

The simplest (and you can most likely most useful) answer to improve your crappy company credit rating rapidly is via using their expense promptly. That’s it there is in order to they.

Now that you’ve got a loan you’re in another reputation so you’re able to holder right up a history of towards the-date money in addition to credit history hit that occurs throughout the years out-of doing so.

And, if you’d like to carry it one step after that and look excellent so you can collectors build costs in advance whenever possible.

dos. Keep the lines of credit discover

Many entrepreneurs consider canceling all of their borrowing cards is the better service after they find themselves in an effective safe place, not, it is one of several poor things you can do.

Even when the harmony is actually zero it will help bad credit rating most useful and you can does not have any you only pay mortgage since your not using the personal lines of credit available to choose from.

3. Monitor your own balance

Purchasing your payment per month or any other costs timely is great, but settling your own stability as much as possible to help you not as much as ten% increase your current credit score immensely.

Thus, be sure to screen your own balances and you will bundle repayments consequently very you remain less than that normally as you are able to.

4. Observe your credit history

And you will, with all such points drawn along with her, next time you are looking for business resource that have bad credit for getting a knowledgeable conditions possible.

Zero credit score assessment loans are beneficial getting companies customers that are looking to remain the credit score for the good shape when you find yourself nonetheless obtaining working capital to simply help build the team.

Many unsecured organization lenders does a painful inquiry ahead of stretching a deal which can negatively perception your credit rating, so it is hard to keep the best credit score.

Because of the acquiring small company funds no credit check you could potentially prevent organization investment affecting almost every other personal resource that’s being worked like:

- A home loan

- Car loan applications

- House collateral contours

- or other personal transactions which are not about the business.

Of a lot covered loans have rigorous guidance about your borrowing from the bank so obtaining a zero credit score assessment organization mortgage keeps your own traditional capital securely inside the enjoy.

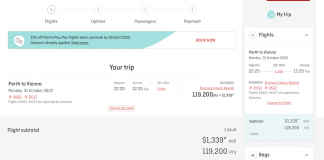

Really loans require no less than an excellent 680 credit rating, of a lot around 720 and significantly more than. But not, mortgage acceptance processes was notoriously very long as well as wanted huge degrees of files. This is why, while you are searching for funds sparingly quick, these include unreliable.

Option financial support that have Prosper doesn’t have feet borrowing requirement and approval (and you may payout) is fast– with a lot of financing activities becoming contained in this twenty-four-72 times.

Sometimes, a business loan make a difference to your credit. Some loan preparations require an individual browse around this site be sure, in which particular case the loan will impression a credit. In other cases, if you have set personal loans off as the security it may also apply to your own personal borrowing from the bank.

For those who have bad credit, a corporate mortgage is a perfect opportunity to replace your individual credit history substantially. Therefore, maximize you to definitely opportunity and make sure to invest for every typical payment timely up until the loan are paid off.

However, many alternative providers mortgage situations don’t have any credit history criteria within most of the. And you will, of them that do, credit rating criteria are low, on the “fair” (580+) variety, rather less than antique business loans.

Supplier pay day loan / Separated financing

Lenders like to see not simply how good your carry out the fresh new money which comes inside the, whether your properly manage the expenditures plus how much cash free dollars you retain for you at a time.