Federal and state advice

In terms of financial advertising, federal advertisements laws and regulations affect individual mortgage loans if you are condition laws incorporate so you can one another consumer and you can team mortgages. If you are government statutes connect with every mortgage brokers, attempt to talk to the new legislation of one’s state to help you make sure conformity. Right here i evaluate a number of the government legislation governed of the the newest Federal Trade Fee (FTC) and also the User Monetary Shelter Agency (CFPB).

First-point-of-contact details legislation

First-point-of-contact relates to selling materials built to build first exposure to a potential customer to help you present a romance. Such profit can include everything from company notes and you can stationery so you’re able to emails, other sites, and social media profiles. Any very first-point-of-contact topic you create have to are the broker’s term and the licensing quantity of per agent.

Supply of claimed mortgage loans

For many who highlight particular financial words, these words need certainly to in fact be accessible so you’re able to a debtor. Brand new misrepresentation of a consumer’s probability of home loan acceptance violates Regulation Letter, and that we are going to describe for the-depth below.

Mistaken terms and conditions

Any form away from adverts, together with social networking, should not tend to be one incorrect otherwise mistaken terms and conditions that mislead the new debtor. Including interest rates, costs, costs, taxation, insurance, and you can any potential aspects of a stated home loan.

Triggering terms

The FTC describes people conditions or phrases one market particular conditions regarding a card contract since the triggering conditions. When these types of terms are used within the social networking, disclosures are required. Causing conditions may include the level of a financing fees, what amount of money, and you may a deposit count conveyed given that a percentage or a whole money count. Advice could be Having as low as 3.5% down otherwise 30-12 months home loan.

Most other bans

Together with above mentioned guidelines, home loan advertisements is also banned of advertisements filled with the latest simulation out of a check, because they can misguide consumers to the thought he is secured money that’s not in fact offered to all of them. On the other hand, no brand of home loan sale can discriminate considering ancestry, colour, handicap, marital position, pure resource, race, religion, or sex.

Mortgage advertisements for the Fb

Of several social networking platforms, such as Facebook, are made to help entrepreneurs are still certified along with their governing bodies with regards to wanting target audiences. Eg, when creating Twitter paigns, Facebook necessitates the access to Special Advertising Audiences certainly business owners to choose a standard customers that’s thought to be even more inclusive and you can low-discriminatory.

Statutes regarding the rates

Newest interest levels may be used in the home loan advertising which have standards. To start, any interest rate you highlight ought to be the real rate one to your business is already providing. Consequently in the event the giving rate transform, you need to instantly improve your advertisement so you’re able to mirror the latest rates or eliminate the latest ad entirely. Additionally, you ought to screen the new apr, or Annual percentage rate, prominently.

Addressing mortgage compliance

When it comes to home loan adverts, you can find certain regulations that mortgage lenders need to go after in the acquisition to keep certified. The 3 main laws regarding advertising tend to be rules B, Letter, and you will Z.

step 1. Control B

Regulation B ‘s the Equivalent Borrowing from the bank Options Act (ECOA) and that is designed to ensure that every creditworthy users have access so you can mortgage loans. Although this regulation doesn’t promote particular advertising standards, it does prohibit loan providers out of techniques, plus advertising, one discriminate against consumers according to decades, ethnicity, gender, marital position, and you can nationality.

dos. Regulation Letter

Control Letter try oriented from the Individual Financial Protection Bureau (CFPB) additionally the FTC throughout the Home loan Serves and Practices for the Advertisements laws. That it controls has all earliest advertisements legislation to own industrial marketing product. The objective of which regulation will be to ban misleading financial ads, together with things like mortgage particular misrepresentation, not providing the variability interesting prices, perhaps not appearing potential consumer charge, rather than discussing just how a fixed-speed financial can transform along the long haul.

step 3. Controls Z

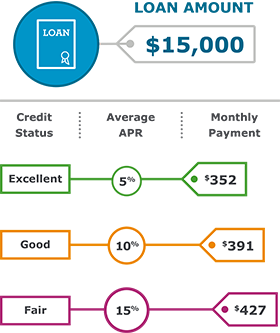

Controls Z is loan places Stevenson the Information in Lending Legislation. The goal of which regulation will be to offer customers into real price of the loan and you can allows for better borrowing label and you may price comparisons between lenders. So it controls necessitates that most of the home loan ads has the details to users and does not include anything mistaken. It will require the fresh new disclosure of interest costs, each other moderate and Apr.

Making certain Myspace selling was compliant

Into the popularity of social network, social media is important having team achievement and generation of brand new prospects. However, due to the fact most of the mortgage lender is actually subject to audits, it is important to make sure that all of your profit efforts, together with social media marketing, stick to the rules and remain compliant in order to avoid fees and penalties otherwise, in the a terrible-situation circumstance, an excellent lockdown.

Within Good Mood Squad, we know how important lead generation is to a successful business. Our Unfair Virtue system helps you improve your prospecting and you can bottom line. Plan a strategy name with our company today to discover more about just how all of us will provide your online business the fresh raise it entails.