Away from budgeting in order to sorting your extremely, its worth taking at the top of your money to relieve any home-loan pressures and struggles.

Buying your basic home is a huge (and extremely enjoyable) milestone prior to you can celebrate on the newfound condition since the a great homeowner, it is essential to ensure you get your cash in order for both short and you will long-title.

Listed below are six strategies for controlling your money because the an initial-big date homebuyer, with specialist extremely knowledge off Soul Super’s Tim Lambert.

step 1. Expose a budget

You have already centered a funds to simply help cut to own your own put, but if perhaps not, now’s a good time and come up with that given that a budget often make you a precise notion of money arriving instead of money meeting.

Earliest, work out how much money you can get each week otherwise month. This’ll likely be from your paycheck, however you can also make money using an area hustle or display returns.

Second, manage a list of your expenses: mortgage payments, resources, strata charge if relevant, insurance coverage like domestic and you can information insurance rates, auto costs particularly gas and you may membership, food, fun money, and other things your on a regular basis spend money on.

You ought to actually have a clear concept of what kind of cash you have to explore, and you will and pick you could conserve money in a number of section (for example vacant gym memberships) and you may reallocate them somewhere else (instance a checking account).

dos. Make sure to enjoys a rainy-big date fund

This is exactly a book you might slim for the for folks who started facing unforeseen will cost you, such scientific debts otherwise car solutions.

A wet-time loans is additionally critical for many who abruptly eliminate your revenue and need to live out of savings for a period.

Basically, endeavor to provides step three-six months’ worth of emergency funds reserve, to help you have some assurance in case of emergencies.

3. Put up various other bank account

You’ll have that take into account costs, you to definitely for discounts (otherwise a couple of account divided into quick and you may much time-identity coupons), you to definitely for the rainy-day financing so when a great many other profile as you need so you’re able to manage your currency.

4. Discover an offset membership

A counterbalance account performs just like a regular exchange account where you can put the income for every single pay cycle and you may availability currency whenever you want.

Although not, the real difference is that it is connected to your home financing. The total amount seated within account can be used to counterbalance the balance of your property financing, that may save a little money in the long term.

Eg, for those who have $50,000 on your counterbalance membership and you can an excellent mortgage harmony from $650,000. It means you are able to only pay interest for the $600,000.

5. Have a great just-in-case’ right back-right up bundle

The most effective resource you have if you find yourself to acquire a good basic home is your ability to earn an income, says Tim.

But what happens for individuals who out of the blue reduce your work otherwise you may be unable to works and can’t make your home mortgage repayments?

At Spirit Very, players have the choice to pay for money safety insurance policies, and total and you can permanent disablement defense if they can no further functions on account of a disabling burns or issues.

Tim contributes the advantageous asset of purchasing insurance policies inside your extremely finance would be the fact it doesn’t emerge from a single day-to-go out cash flow, although it does lower your overall very equilibrium.

The guy advises logging in the extremely membership online and evaluating your insurance policies options to make certain that they’ve been right for your position.

6. Don’t forget to believe much time-label

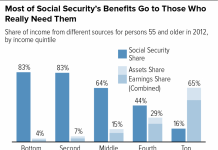

While you’re probably placing really (otherwise every) of time to the paying off your house loan today, you ought not risk treat vision of upcoming earnings that is, your own riches after you retire.

Make use of this day due to the https://paydayloanalabama.com/pinson/ fact a way to log in to ideal off your extremely and make certain you’re accruing as often money to prior to old age.

You can get caught up on the here and then, but keep a permanent contact into finances. Picture: Getty

Tim claims you’ll find five fundamental stuff you should consider to increase the super: even more contributions, expenditures, charge as well as your fund’s show. So you can using this, Heart Awesome players can also supply financial advice within no additional prices.

Extra awesome contributions

Even when your boss tends to make necessary benefits into the extremely account, you’ll be able to create more benefits to boost what you owe, which is an effective option whenever you be able to place a little extra cash aside.

You can not only accrue extra interest in your balance of the which have more money on your awesome membership, nevertheless could be in a position to take advantage of taxation offers on any extra contributions.

Awesome financial investments

Have a look at how money into your extremely is being spent. You could to evolve your own investments for your requirements and you may cravings having exposure, which have selection always ranging from conservative so you’re able to large gains.

Tim claims you might be better messaging to a consultant, including a spirit Awesome Agent, prior to changing your own investment to be certain they work to suit your state.

Everybody’s old age desires vary, and they varies throughout your existence. Conversing with an expert can you get the absolute most from the super.

Extremely charges and gratification

Tim claims you must know what you’re purchasing their extremely fund and compare they contrary to the fund’s abilities. You may find one almost every other funds costs quicker but still do top.

Heart Extremely, are a market awesome loans, meaning charge and you may prices are left reasonable to ensure members’ currency works much harder in their eyes before old age.

Actually, Spirit Super’s yearly fees for the a brilliant account that have a beneficial $fifty,000 balance and you may Balanced (MySuper) capital choices are $475, compared to the federal average of $490*.

And yet, Heart Extremely retains a history of good enough time-identity yields to possess members, averaging eight.60% pa more than 10 years in the Healthy (My personal Very) (to ).