A debtor desires you to definitely as a result of their mastercard merchant otherwise good lender that offers this service to find an advance loan

Payday loan offer high autonomy into the usage, since they’re without difficulty gotten and useful nearly any urgent expense. The outcome to your borrowing from the bank are unfavorable; even if and come up with money on time will not help the borrower’s borrowing from the bank score, failure to settle causes business collection agencies you to definitely harms it. The new fees and penalties associated with payday loan was extreme, related raised rates of interest and you will penalties and fees for defer repayments otherwise ineffective bucks. The newest installment plan is frequently stringent, requiring the brand new borrower to settle the loan on the next pay check completely. It presents a threat if your borrower’s economy have not increased at the same time.

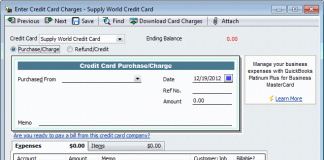

10. Cash advances

Cash advances was small-identity fund provided with financial institutions otherwise through playing cards, enabling individuals immediate access so you’re able to loans. He’s highly relevant to personal loans as they bring a fast capital solution, regardless of if constantly in the higher interest levels and you can reduced repayment attacks than traditional signature loans. Borrowing is particularly useful for covering urgent dollars need however, impacts an excellent borrower’s credit rating negatively if you don’t treated very carefully.

The procedure concerns verifying brand new borrower’s borrowing limit having availability, conducted at the an automatic teller machine or by way of a lender exchange. Changeable interest levels all are which have cash advances, definition the eye varies according to the credit business.

Payday loans tend to be a shorter mortgage term and you can an amount borrowed restricted to the new borrower’s credit line. Freedom in need was a button feature, as the financing can be used for many different immediate expenses instead restrictions enforced from the financial. The flexibleness has extreme fines to possess later repayments, which significantly improve cost of borrowing from the bank.

Fees times for the money enhances usually are strict, with high standard to own timely money. Inability to stick to the newest fees schedule leads to large penalties and further problems for the latest borrower’s credit score. Payday loans render quick finance, however their terms and you may possible influence on economic fitness need to be cautiously considered before taking out you to definitely.

- Liberty and you will Freedom: Signature loans are used for many purposes, as opposed to auto loans or mortgage brokers, hence can be used to own certain aim. Individuals explore personal loans for debt consolidating, family home improvements, scientific problems, wedding receptions, and travelling.

- Unsecured Nature: Personal loans do not require equity, meaning that brand new borrower doesn’t have to help you pledge possessions instance a property otherwise vehicle resistant to the mortgage. They pros people who do not individual tall assets otherwise like to not risk its assets.

- Simpler Qualification Conditions: Signature loans usually have smaller stringent qualification conditions, like from credit ratings, versus installment loans in Vermont other sorts of funding. Lenders provide personal loans predicated on financial health insurance and money balances rather than just credit scores.

- Repaired Rates of interest and you will Costs: Extremely signature loans incorporate repaired rates of interest and you may monthly obligations which do not change-over living of one’s mortgage. The brand new predictability makes it much simpler to help you budget and you can package monetary expenditures.

- Fast Financial support: Lenders procedure personal loans rapidly. Specific lenders give financing recognition and disbursement contained in this days of a keen software, including useful for urgent economic means.

- Debt consolidation reduction: Signature loans are commonly used in combining financial obligation. Individuals eradicate their attention pricing and simply their money towards one payment by paying out-of numerous expense that have just one private financing.

- Credit rating Improve: Taking out fully an unsecured loan and you may and then make typical into-day repayments assist in improving a credit score. They displays to credit reporting agencies your debtor can perform managing and paying debt sensibly.