Last year, the latest then-chairman off TitleMax’s father or mother organization, TMX Finance, penned inside an affidavit that, The average thirty (30) big date financing is usually revived just as much as eight (8) times, providing extreme most appeal payments.

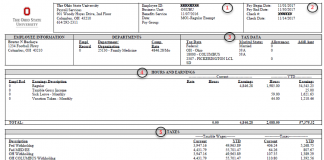

” data-large-file=”” src=”” alt=”Propublica artwork identity lenders step three says” srcset=” 1024w, 300w, 768w, 400w, 105w, 157w, 706w, 1194w, 370w” sizes=”(max-width: 780px) 100vw, 780px” /> Source: Georgia Pawnbroker Work, Vegas Modified Laws, Illinois Accumulated Laws, Illinois Administrative Password Visual by the Anna Donlan

Fundamentally, if you can’t pay a title mortgage, the lending company provides the to repossess and sell your car. In the Georgia, the lenders can keep a complete number your car or truck sells for, whether or not they exceeds extent your owed.

Most other states possess various other guidelines. In a number of states, the lending company may be able to realize your the remaining equilibrium in the event the profit matter is lower than that which you owed. The lender can also be forced to return the surplus of this new profit in case it is more what is due on your loan.

From inside the Georgia, title pawn agreements is non-recourse, for example the lending company are unable to pursue you actually for anything along with the ability to take your car. The state attorneys general’s office accused a beneficial TitleMax rival, Tennessee-depending Earliest Western Term Lending of Georgia, from harmful consumers with violent arrest is deserving of. Basic American paid for the county and you will repaid a superb, but accepted zero wrongdoing.

The newest highest interest levels on term funds make sure they are very hard to repay. Lorena Saedi, good Georgia personal bankruptcy attorney and handling companion from Saedi Laws Class within the Atlanta, commonly notices website subscribers who happen to be struggling with personal debt off a subject mortgage and you may rates one to throughout the a 3rd from their bankruptcy circumstances tend to be identity loan providers.

Should your name financing is actually revived several times, you usually become investing a lot more inside focus than what you have received from inside the dominant. Despite using excessive rates few days shortly after week, you could potentially nonetheless treat your car or truck if you can’t pay back both appeal while the dominating on the loan. Additionally, you simply cannot offer your vehicle up until your term loan is paid back off, unless of course a buyer is actually prepared to pay-off the loan, from the lien that title bank holds.

Are there choice to help you title fund?

In lieu of a leading-appeal financing, a national service called the Federal Credit Partnership Administration means alternatives such as for example getting in touch with a state or local government to ask about disaster guidelines software, conversing with financial institutions on the discussing for lots more time with the bills, or asking for an advance from your own workplace. To possess members of credit unions, the institution together with indicates evaluating a kind of borrowing from the bank entitled pay day option loans, that have straight down charge.

The user Shelter Section of Georgia Attorney General’s Workplace furthermore recommends one to Georgians needing crisis financing believe multiple selection, instance asking a close relative for the money otherwise addressing a credit relationship, ahead of embracing subprime lending products such as for instance label pawns.

How do i step out of a concept mortgage offer?

Besides paying your debt, you can find partners ways to get of a subject financing offer. Certain enterprises promote name mortgage buyouts, in which a loan provider pays their modern mortgage inturn to possess another mortgage. However, although this can help you alter the interest rate your are obligated to pay, it does not get rid of the original financial obligation – it just replaces the existing financial obligation with a brand new you to definitely.

Filing for personal bankruptcy could help in a number of states, although not everywhere. Because of a beneficial 2017 federal is attractive judge choice, expenses owed in order to title lenders operating lower than pawn store laws try not to have to be covered to the a legal-accepted payment like expenses with other creditors. Alternatively, label loan providers payday loans Milford City need to be reduced basic and also at the new completely new regards to the fresh new package.