Into , the fresh new FRBNY, AIG, therefore the Treasury inserted to the an agreement the theory is that having a good variety of incorporated deals in order to recapitalize AIG, including the installment of all of the wide variety owed on FRBNY below the brand new revolving borrowing from the bank facility. Regarding meantime, one of AIG’s subsidiaries, Western Life insurance policies Company (ALICO), was offered in order to a third party, and one part, Western Around the world Assurance Organization Ltd. (AIA), effectively complete an initial personal offering (IPO). First dollars continues ones transactions in excess of $twenty six mil take deposit inside the segregated membership on FRBNY pending brand new consummation of your recapitalization package. This new activities is continuous to be effective for the definitive files to make usage of the fresh arrangement in theory.

The fresh rotating borrowing facility was oriented within the expert off Area 13(3) of your own Government Reserve Act, and that enabled brand new Panel, inside the strange and you will exigent items, to authorize Put aside Finance companies to give borrowing from the bank to prospects, partnerships, and enterprises.

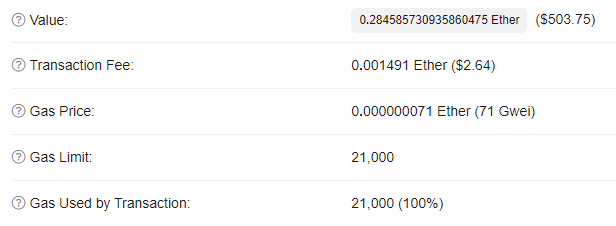

The mortgage has an interest rates of the you to-week Libor in addition to 100 base issues

Affirmed, these drawdowns had been used, in part, to repay purchases having counterparties returning ties that were lent out of AIG in exchange for cash. Within the white of your presumption you to most securities borrowing from the bank counterparties carry out pick to not ever replace its securities borrowing from the bank positions with AIG, and also the continued delicate updates of the financial , brand new FRBNY is actually authorized to give borrowing from the bank to certain AIG subsidiaries in exchange for a range of securities. Around this choice, the fresh FRBNY you will definitely obtain up to $37.8 mil within the capital-amounts, fixed-money securities away from AIG in exchange for bucks collateral. This option enjoy AIG so you can renew the exchangeability, additionally the ties supported because the collateral to safeguard the new FRBNY.

The mortgage longer because of the FRBNY is actually collateralized by the asset collection

The fresh securities borrowing from the bank business to possess AIG was deserted after the place of the Maiden Way II facility, that is talked about into the more detail lower than. All securities was in fact gone back to AIG as well as cash equity was returned to FRBNY. As part of the restructuring established towards , the fresh FRBNY created Maiden Lane II LLC, plus the arises from the brand new establishment of the LLC were used to settle entirely the fresh new securities credit plan and you can cancel you to definitely system.

The loan balance transfer fresh bonds credit studio is actually created within the power out-of Part 13(3) of one’s Government Reserve Act, and that allowed the newest Panel, within the unusual and you may exigent items, in order to approve Set-aside Banking institutions to increase borrowing from the bank to individuals, partnerships, and you will agencies.

To the , brand new Government Reserve and Treasury revealed a great restructuring of one’s government’s financing so you can AIG. As part of this restructuring, a couple brand new limited liability enterprises (LLCs), Maiden Lane II LLC and you can Maiden Lane III LLC, are made. On the , the latest FRBNY first started stretching borrowing to Maiden Way II LLC, that has been formed to get home-based financial-supported cover (RMBS) possessions off AIG subsidiaries. Specifics of the fresh terms of the mortgage are blogged into the FRBNY site . Maiden Way II LLC are funded which have a great $19.5 million senior loan from the FRBNY and you can $1 million of AIG due to good contingent cost improvement. New arises from this new property kept by Maiden Lane II LLC are used to pay back the loan to the FRBNY, as well as accumulated attention. The borrowed funds has a reported six-12 months label that is certainly expanded during the discretion of the FRBNY. Within the terms of the deal, arises from the brand new profile are paid out throughout the following the acquisition: functioning expenses regarding Maiden Way II LLC, prominent into the FRBNY, appeal because of the FRBNY, and you can deferred commission and you may attract due to AIG. One leftover money will be common from the FRBNY and you will AIG, that have 5/6 going to the FRBNY.