The guy also didn’t understand how difficult it might be to keep within the terms of the latest price, as the the guy didn’t understand how leading site much performs our house do you prefer. There is no requirement you to a house inspector look at the house in advance of a contract-for-deed contract try signed. Whenever Harbour told him the guy needed seriously to score insurance coverage, he states, the insurance providers started delivering him difficulties with our home one the guy didn’t have any idea existed-that document the guy showed myself, instance, advised your you to definitely his rake panel, that is a piece of wood close their eaves, is appearing devastation.

And you may next, Satter told you, each one of these businesses are aggressively targeting areas where owners battle which have credit on account of previous predatory credit strategies, such as those you to fueled brand new subprime-mortgage drama

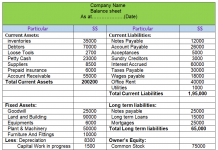

So it map, within the Courtroom Assistance ailment, shows the latest racial structure of the areas where Harbour qualities was located in you to definitely Atlanta state. (Atlanta Legal Help Community)

There’s nothing inherently incorrect having deal-for-deed plans, says Satter, whose father, Mark Satter, aided plan out Chi town citizens from the habit on the 1950s. It’s still easy for suppliers who are not banks to finance attributes from inside the a reasonable means, she told you. A san francisco initiate-up entitled Divvy, as an instance, are research a rent-to-own design in the Kansas and you can Georgia providing you with carry out-become people certain guarantee at your home, even though it standard on the money. But there’s two explanations such bargain-for-deed agreements look such as for instance unfair, Satter said. First, the fresh house that many of these companies purchase are located in terrible condition-of a lot had been empty consistently just before are bought, in place of the residential property sold having bargain to have deed about 1950s, which frequently ended up being left behind by the light homeowners fleeing in order to the fresh new suburbs. Fixer-uppers enable it to be difficult to possess create-getting consumers in order to meet most of the terms of their agreements, as property need a great deal functions.

The fresh financing uck, enabling banks giving subprime fund or any other borrowing products so you can individuals who otherwise might not have the means to access home loans

In a number of implies, the new concentration of package-for-deed services in Dark colored communities try a clinical outgrowth away from how it happened during the houses boom and bust. Commonly, these things recharged exorbitantly large interest rates and you can focused African Us americans. You to study discovered that anywhere between 2004 and you will 2007, African Us citizens was 105 % probably be than white people so you can features high-prices mortgage loans to own home requests, even though dealing with getting credit rating or any other risk circumstances. When most of these someone destroyed their homes, financial institutions grabbed all of them more. Those people that did not promote on auction-usually those who work in mostly African american areas where those with capital didn’t need to go-ended up about profile out of Federal national mortgage association, which had covered the mortgage financing. (Speaking of very-entitled REO, or real-house owned belongings, as bank owned them immediately following failing woefully to promote all of them from the a foreclosure auction.) Federal national mortgage association next provided these types of home right up in the low prices in order to investors just who desired to make them, instance Harbour.

But Courtroom Assistance alleges that Harbour’s exposure for the Atlanta’s Dark colored areas is over happenstance. Because of the choosing to simply get residential property of Federal national mortgage association, new lawsuit claims, Harbour ended up with land inside the section you to definitely experienced the most significant number of foreclosures, what are the same communities focused by subprime-mortgage lenders-groups away from color. Even the Federal national mortgage association home Harbour purchased were from inside the decidedly African Western neighborhoods, this new lawsuit alleges. The average racial constitution of census tracts within the Fulton and DeKalb areas, in which Harbour ordered, try more than 86 % African american. Most other people in identical areas one purchased Fannie mae REO functions bought in census tracts that were 71 per cent African american, the latest suit states. Harbour including focused its products on African Us citizens, the fresh suit argues. They did not field their deal-for-deed arrangements into the push, for the broadcast, or on television inside Atlanta, the newest match claims. Instead, Harbour create cues when you look at the African american communities and you may gave recommendation bonuses, a practice which, new suit alleges, designed it absolutely was mainly African Americans who heard of Harbour’s give.