How will you go-about going for a financial investment financing that’ll not finish causing you monetary aches? Property financing professional throws in their one or two cents’ worthy of regarding how to decide on best loan to you personally, as well as the secret questions to inquire of your own financial.

Committing to assets will be a lucrative strategy, but it need tall savings, and if you’re offered committing to a property, obtaining a financial investment mortgage also have the administrative centre you ought to begin.

Although not, choosing the right financing to suit your investment property produces all of the the difference with regards to strengthening a successful assets profile.

To invest in an additional property is a small dissimilar to buying your first, once the discover even more available with respect to your own means and you will objectives, claims Bankwest General Manager – Property, Peter Bouhlas.

Because of so many mortgage available options, it can be daunting to learn how to proceed but Peter states doing this new groundwork to understand your current financial situation is actually a good place.

Whether it is very first investment property or you are searching to provide towards the collection, these are the issues to inquire of your own financial to find a loan that’s the right fit for debt desires.

Exactly what are the most recent interest rates?

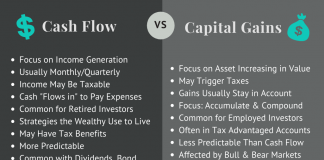

The speed usually change the full matter your pay back more living of one’s mortgage, also it can rather impact their profitability.

Interest rates to possess investment finance are typically greater than those individuals to possess owner-occupied finance, however they can vary significantly between lenders, making it important to contrast rates and you will shop around for the best package.

Those seeking spend money on a rental possessions can find monetary gurus inside the doing this, however, there are some factors to consider, for example just what portion has actually higher renter demand, plus the some other interest rates available for investors as compared to proprietor-occupiers, Peter claims.

When you yourself have several funds or features, it will be worthwhile contacting your own financial otherwise representative, who will assist give an explanation for procedure and give you a concept out of exactly what your finances might look like shortly after.

Just what financing options are readily available?

Variable-price financing have an interest speed that will change over date, if you find yourself fixed-rates loans has actually a set interest rate getting a specific period.

Each type of financing has its pros and cons. Variable-speed finance provide liberty minimizing first will cost you, if you’re repaired-rates financing also provide safeguards and confidence regarding costs.

For those provided repairing, Bankwest’s Fixed Rate Mortgage has got the certainty from being aware what your own rate of interest and you may money was, Peter teaches you.

Homeowners can pick its repaired speed several months from just one in order to four age, and you may installment regularity, feel you to per week, fortnightly or monthly, which can only help people perform the budget.

But before your develop, Peter claims it is worth taking into consideration brand new effects if you choose to split the borrowed funds in repaired months, due to the fact crack costs you are going to pertain.

What are the loan conditions featuring?

More lenders provide other loan have which can apply at your loan’s independency and you may overall cost, particularly offset profile, redraw institution, broke up funds and you can portability (which is the power to transfer your loan to some other assets if you opt to offer an investment).

In reducing your residence financing attract, you might want to hook a counterbalance account on home loan or even be able to make a lot more payments, Peter states.

Or, which will make dealing with your bank account and cost management simpler, you might want even more versatile payment options, the option to-break the loan ranging from fixed and you will changeable, or to consolidate the money you owe to your financial.

When you find yourself refinancing to some other financial, you might like to qualify so you’re able to claim cashback also offers, which could help counterbalance any extra fees or loan organization costs.

Which are the cost selection?

An interest-only mortgage can be an appealing choice for property dealers because the it permits for down costs inside the focus-only period.

This can take back cashflow to have investors for other investments or perhaps to safeguards assets expenditures eg repairs otherwise home improvements.

The cost solution you select get a great deal to do together with your total policy for your investment assets. Picture: Getty

This can end up in highest complete desire can cost you along side life of your own financing, whilst the 1st costs try all the way down.

What other will cost you can i believe?

You should discover brand new upfront will set title loans MI you back that are included with to get an investment property because the factoring during the will cost you outside the deposit – such as regulators taxes – helps you avoid offensive unexpected situations.

It is a state or territory bodies income tax that is billed getting judge files becoming stamped. The latest rules on the stamp duty will always at the mercy of changes, so it’s a smart idea to look at the condition otherwise area government’s construction web site for the most previous advice.

Peter claims those deciding on to acquire a special property features book considerations, for example leveraging brand new guarantee inside their most recent collection and you will refinancing their established finance.