Today HELOC funding is actually once more readily available. We’ve got has just put the product back to the marketplace, says Brittney Baldwin, vice president and you may mortgage officer on Federal Cooperative Financial. Recognized in the market while the NCB, that it financial specializes in co-op financing at all membership, delivering hidden long lasting mortgage loans having co-op property, private co-op basic mortgages, and you will equity personal lines of credit such as for instance HELOCs. It absolutely was aside to own half dozen otherwise 7 many years, considering the economic downturn, demonstrates to you Baldwin.

Once the HELOC exists once more essentially about banking society having single-family belongings and you may condominiums, it is a lot less available for co-ops. All over the country we come across that a lot of people simply aren’t comfortable with co-ops. They aren’t always them. From the NCB that’s exactly what we are experts in, says Baldwin.

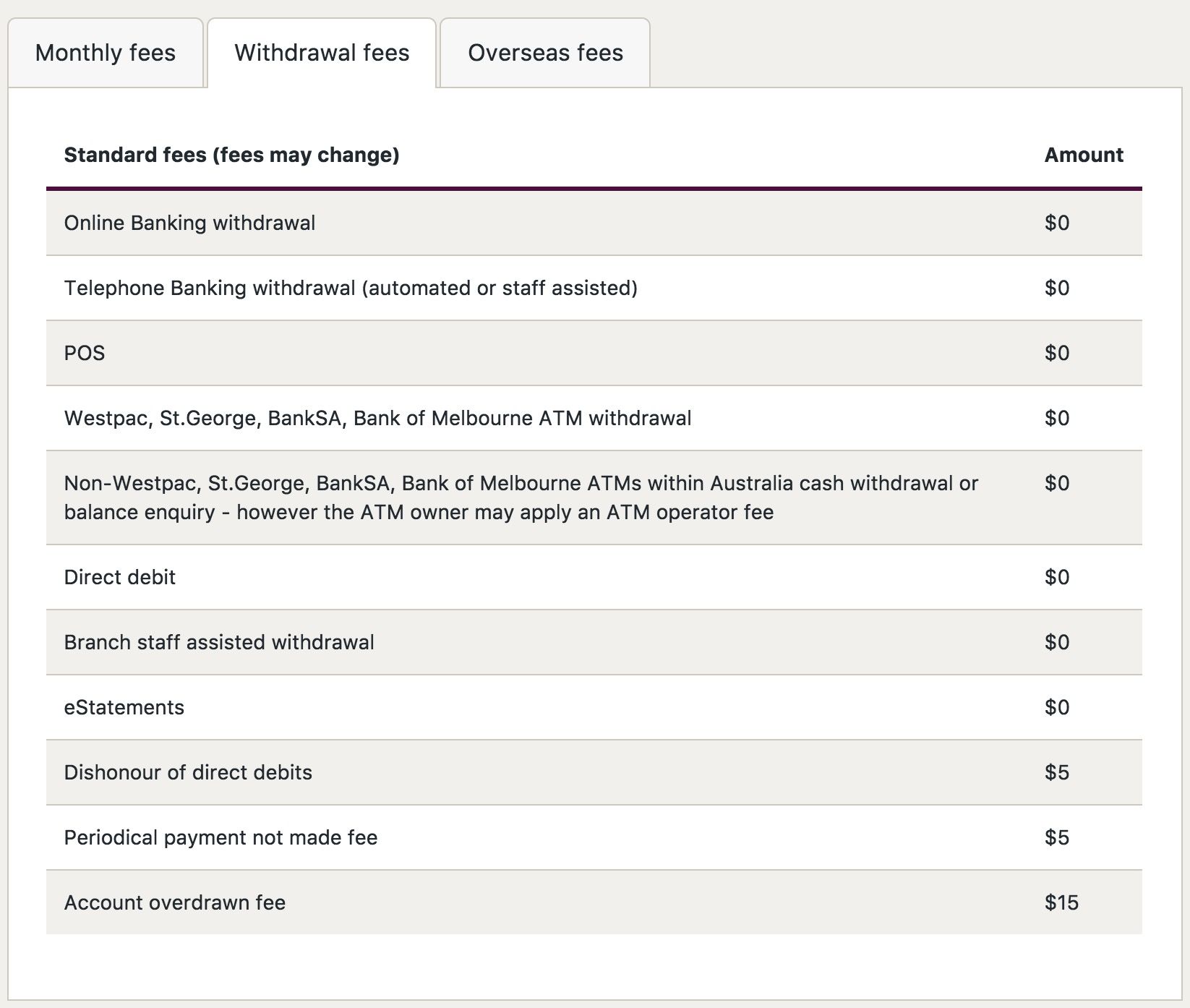

NCB has the benefit of a great HELOC with an intention rate according to research by the perfect speed to possess a 30-season title. There can be an initial ten-season mark several months which have appeal-merely repayments, then an effective 20-season payback months having one another principal and attention payments. The loan-to-value utilizes the difficulty, claims Baldwin. If the tool is free of charge and you can obvious, we shall think around 80% of value. That have a primary financial in position, we are going to just lend around 70% shared mortgage-to-really worth. A credit history away from 700 or maybe more becomes necessary.

Most other establishments that produce these types of money were JPMorgan Chase, Citibank and you will TD Lender. Wells Fargo and you can Investment You to can make a great HELOC for the an excellent condominium within the Ny but not for the good co-op. Pursue offers a predetermined rate unit having a speed between 4.5% and nine% depending on borrowing from the bank, cash-away and you can mortgage updates. Its financing in addition to deal an initial ten-seasons notice-merely mark months, with an effective 20-seasons amortizing several months.

Citibank’s device is a varying speed mortgage which have a limit during the 18%.; it fees a yearly commission off $. TD Bank’s equipment and its particular words lay somewhere between JPMorgan Chase and you will Citibank, and you will starts at a changeable rates out of cuatro.25%. It give into the Nyc and Washington, D.C. Citibank and JPMorgan Chase offers co-op HELOC financing inside the Nyc, New jersey, Illinois, Maryland and you will Washington D.C. National Cooperative Bank, that has workplaces into the Nyc, California, Ohio, Washington D.C., and you can Alaska, give in places that co-op control is actually well-known.

The fresh new words may have changed regarding decades as the first regarding collateral investment, so it is far better contact the above mentioned creditors for lots more suggestions. An individual Financial Cover Bureau have an internet site . to your HELOCs right here.

Co-op Show Financing Qualification Criteria

- Home loan Things & Selection

Register Now CNYC Email list Discover CNYC condition and you can bulletins by email address! To register, view here and you may complete the on line mode.

Would you like to imagine new costs on the any of these fund? All of our loan calculator makes it possible to on wide variety.

Yet ,, when i searched NCB’s costs in Ny, where you will find good sized quantities out of co-ops, rates try the same as it Ca financial that can provides Nyc co-op mortgage loans.

In the event the environment troubles are understood, the difficulties must be calculated to get appropriate, as the described from inside the Elizabeth-2-02, Ideal Format having Stage I Environmental Issues AssessmentsE-2-02, Suggested Style getting Stage I Environmental Danger Examination .

Co-op people get access to first-rate education and you can knowledge sponsored from the ROC-NH and you may ROC Usa. Graduates of one’s condition-top People Management group earn university borrowing from the bank they can use to your a qualification within Granite Condition University.

Once you’ve a purchase and you may conversion agreement into the a home, you really need to instantly sign up for subscription from the co-op workplace because of the completing a primary means and you may agreeing so you’re able to each other a cards and you can criminal record check. The brand new co-op is needed to approve or reject registration inside 2 weeks regarding recognizing all your software. In advance of closing to the sale in your home, the latest board off co-op tend to play an effective Consent which is linked to the deed if you find yourself approved for membership.

Q. When the our APCO Participants are interested in trying to get an effective HELOC, what actions create they need to sample start, and you may how much does the procedure appear to be just after using? A beneficial. People can put on to own a great HELOC during the the web site right here. The application procedure basically takes about 20 minutes to complete.

Refinancing a current mortgage: “Cooperatives is happy to be able to leverage the land and you can building because the guarantee to get extremely competitive lasting repaired prices,” claims Mary Alex Dundics, vice-president of Federal Cooperative Bank (NCB) in Washington, D.C.

“Cooperative residents may share finance or home security contours away from borrowing, towards stock certification made use of because the security. Express financing was organized similar to condominium otherwise single-family relations fund,” says Dundics. Express financing are either repaired (which have fifteen-seasons in order to 40-seasons repaired) otherwise variable speed mortgage loans (1/step 1, 3/step one 5/1 Possession, 7/step 1 Fingers).

“There are just a handful of loan providers throughout the Northeast exactly who is actually actually fighting in the high height-and you can instead an expert in the industry, on a daily basis, it is hard to learn whenever you are acquiring the best offered price. And you may people error inside the resource a building means cash leftover available, or destroyed within the term owing to worst planning,” says Geller.

Co-op Share Financing Eligibility Requirements

- Financial Factors & Options

The board and you will committee players must follow the newest co-op’s bylaws and personal loans Indiana you will laws, and also to local, federal and state rules. However they are accountable to its other professionals and should manage brand new co-op from inside the a good, consistent, democratic, and you may businesslike trends.

Ahead of employing an agent, be sure to see its relationship with your, its percentage agenda, and you may specific intends to expose your house to help you as many possible people that one may. A home profits are often flexible, therefore interviewing one or more Real estate agent could possibly get last really.

Qualifications Requirements to own Co-op Systems

We fully individual a small coop apartment during the Ny. Due to the fact a senior, I might will create an other home loan inside it but cannot find people provider to take action. Good Heloc plus a mortgage I propose to take to acquire a property when you look at the Florida is just too pricey.

Into the 2008, the year of the economic crisis, of numerous big domestic security loan providers–in addition to Financial out of The united states, Countrywide Economic, Citigroup, JPMorgan Pursue, Federal Urban area Financial, Washington Common, and you can Wells Fargo and others–ceased originating the brand new HELOCs and you will froze, frozen otherwise less of a lot current financing. One of those banking institutions failed to survive the brand new drama, and HELOC community undergone an enormous contraction throughout that months.