While not mandatory for all pathways, programmatic accreditation may be helpful for accounting students as well. Many of the accounting degrees in New York feature state-specific specializations and pathways. Others meet New York’s unique requirements for professional certification and licensure.

The Average Cost of an Accounting Firm for Small Business

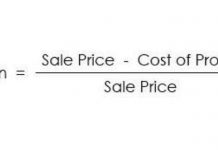

Accounts payable are an important component of your general ledger and a significant indicator of your company’s financial health at any given time. An expert accountant will be aware of every tax deductions or exemption what services do accounting firms provide and credit that a person is eligible to. In simple words, an accountant who specializes in management or managerial accounting can help you assess your finances, analyze market conditions, and make long-term plans.

Milestone Cites Record Growth in 1H 2024, Adds New CFO Practice Leader

The firm can help you with long-range planning, such as buying property or upgrading your infrastructure. It can also help you determine how to break even and what your cash-flow needs are. These services help you plan your next moves, figure out whether you are making a profit and make decisions about your company’s growth. While accounting and taxes go hand in hand, they are distinctly different services.

- Set your business up for success with our free small business tax calculator.

- Turning to an outsourced accountant or CFO can be a much more cost effective solution.

- Eventually, it’s the perfect report to check to see if you have enough funds to cover your obligations and make future payments.

- Often, small business owners outsource tax services first and add payroll assistance as their company grows.

- This insight helps you understand your company’s financial health and make strategic decisions based on accurate data.

- Regular reconciliations help avoid penalties and keep your accounts in order.

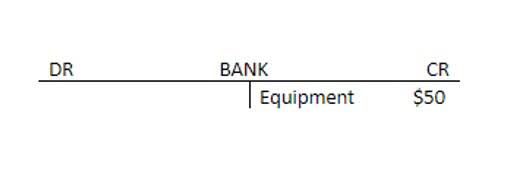

- Accounting is how a business organizes, records and interprets its financial information.

The Advantages of Filing a Tax Return With a CPA

This includes proper classification of employees vs. independent contractors, timely payment of wages, and accurate tax withholding and reporting. Using a mixture of methods is a hybrid approach that offers flexibility and can be tailored to suit different types of clients and services. In addition to recording the daily transactions of a business, an accountant is usually called upon to prepare monthly financial statements for the business. Before this can happen, however, they must first reconcile the balance sheet accounts and analyze the operating results to ensure that everything is accurate. Some small businesses have simple payroll needs because they have a small team of salaried workers. Most, however, have a mix of hourly and salaried employees and more complex payroll needs that require a higher level of expertise.

- This service helps protect your business from fraud and cut down on expenses.

- Some accounting firms oversee a broad range of tasks, whereas others specialize in a specific area.

- Audits and tax preparation are traditional services, but they remain integral to comprehensive CAS offerings.

- Tax accountants are great at what they do, but they are often not experts on operational accounting and not up to speed on the latest technology applications that drive efficiencies.

- You’ll have a deep understanding of their unique challenges and opportunities, making you a perfect strategic advisor.

- Business owners shouldn’t look at an accounting firm merely as an outsourcing cost for bookkeeping but as an integral business partner.

Hybrid Programs

New York does not have any tuition reciprocity agreements in place with other states. However, individual schools may have tuition agreements set up for out-of-state learners. The links below provide more information on the different support channels available. The state has a higher-than-average percentage of students taking no online classes, but it also has a higher-than-average percentage of students taking some online classes. The sheer amount of educational opportunities in New York makes it one of the most desirable destinations for prospective accounting students. According to NCES, New York has over 280 colleges and universities and over 1.5 million postsecondary students.

What are examples of advisory services?

Human error is one of the reasons why professional bookkeeping services are so crucial. Furthermore, a forensic accountant investigates bribery, money laundering, fraud, and embezzlement by scrutinizing financial documentation and transactions, tracking assets, and more. Most businesses function on a different level than the federal, state, and municipal governments. Due to the magnitude of their activities and the public nature of their finances, different accounting rules are required at times.

- Schools must be institutionally accredited in order for learners to qualify for federal financial aid.

- The Empire State hosts more than 200,000 businesses and holds nearly $9 trillion in its financial institutions.

- Tracking the money that flows in and out of your small business is an essential piece to ensuring that you not only stay afloat, but also continue to grow successfully.

- Most accounting jobs in New York require a bachelor’s degree at a minimum.