Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and what are management fees in accounting many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- A higher expense ratio reduces the fund’s net return, meaning less money is compounded over time.

- For each of the management services offered, you need to prepare detailed invoices which will be given to the corporation.

- What types of credentials (e.g., education and certifications) do you have?

- The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

- Find out more about management accounting jobs, responsibilities, required competencies and salaries.

- When you hire someone to manage your investments, you’re likely paying a fee for it.

Create a Free Account and Ask Any Financial Question

Management fees can also cover expenses involved with managing a portfolio, such as fund operations and administrative costs. The management fee varies but usually ranges anywhere from 0.20% to 2.00%, depending on factors such as management style and size of the investment. The main downside of paying yourself a management fee is that it is more likely to attract an audit.

Will Consultants Raise Their Fees Next Year?

The U.S. Securities and Exchange Commission cites penalty fees for not maintaining a minimum balance in your account. You might also have to pay inactivity fees and various additional maintenance fees. Consulting firms providing services limited to computer programming or software development to other concerns on a fee basis shall be classified as 8859(1), Computer Programming or Software Development. I challenge you to take what you’ve learned here to make your consulting business better.

Ask a Financial Professional Any Question

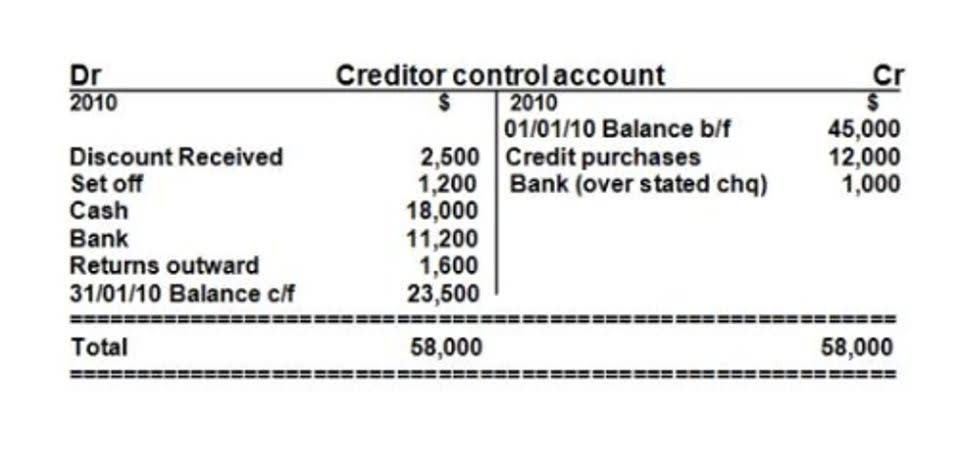

Under a tiered investment management fee structure, different asset levels are assessed their own specific fee rates. By using this structure, all clients pay the same rate at the deposit level, no matter the account size. For example, the investment manager may charge 1.75% on the first $250,000, $1.50% on the next $750,000, 1.25% on the next $5 million and so on.

Management fees, whether paid as a mutual fund expense ratio or a fee paid to a financial advisor, typically range from 0.01% to over 2%. For example, more aggressive investment portfolios tend to have higher management fees because there is more work involved due to the higher turnover of securities. Passive funds may have lower management fees because they select and then stick with the assets within the portfolio. Management fees are charges levied by professionals for managing various types of assets, properties, and projects. Investment management fees cover research, portfolio management, and related expenses for mutual funds, ETFs, and hedge funds. In the investment advisory industry, a management fee is a periodic payment that is paid by an investment fund to the fund’s investment adviser for investment and portfolio management services.

Evaluating Service Offerings

Investment managers and financial advisors who manage client assets charge management fees, just as any other professional charges a fee for services. In this case, services may include advice, expertise, and superior portfolio performance. The management fee is paid by investors to investment professionals in order to gain access to their expertise and resources. Investment professionals in return help investors with stock picking, allocating risk, rebalancing portfolios, and offering personalized investment advice. When you hire someone to manage your investments, you’re likely paying a fee for it. Investment managers use their expertise and time to select securities and manage portfolios for their clients.

These circumstances are uncommon, but they occur when the mutual fund company absorbs some costs, such as when a fund is new and has few assets. When a fund is starting out and has few assets, fixed operating costs are proportionately high. Therefore, a fund company may absorb some costs and show the MER at a level it expects it to be when more assets are gathered into the fund. By reviewing the return net of expenses, investors can decide whether to invest in the fund after better establishing what the fund yields to investors. As a result, comparing fund companies is easier, and the returns are uniformly presented.

- However, according to the efficient market hypothesis (EMH), the current price of a security reflects all available information regarding the security and is a reliable indication of its intrinsic value.

- Focus on gaining real experience in this role and finding opportunities to hone your skills to advance in management accounting.

- When setting your accountant’s fees, you need to consider the needs of your business, the accountant’s expertise or experience level and the specific accounting services they will render to your business.

- Generally, actively managed funds tend to have higher management fees compared to passively managed index funds.

- There are rare instances when the MER is lower than the management fee.

- As a result, no market participant will be able to constantly exploit market inefficiencies since price movements are largely random and driven by unforeseen events.

What Determines a Fund’s Management Fees?

- Management fees cover a variety of expenses including portfolio management, advisory services, and administrative costs, and is typically a percentage of assets under management (AUM).

- When considering the management fee in relation to the size of some funds, the lucrative nature of the private equity industry is obvious.

- These regulations focus on assuring these interests and waivers are subject to “significant entrepreneurial risks” to avoid being considered current ordinary income.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

- Actively managed funds charge higher management fees than passively managed funds but do not necessarily guarantee superior returns to investors.