You reside probably one of the best property, therefore investing in it because of the remodeling is a superb cure for add well worth. Exactly what is the best cure for finance such home improvements? Luckily, there are various possibilities regarding looking an effective way to pay for a remodel. Yet not, it could be tough to determine which one is finest for the certain products.

All of us in the Lamont Bros. works together Portland city homeowners each day to alter their installment loan Arkansas houses. For most, investing in the complete enterprise in the bucks isn’t really an option. That is why we focus on our very own subscribers to guide all of them by way of the entire process of finding the right way to loans their home improvements.

On this page, we will explore all of our proven processes to own helping website subscribers money their property improvements. Whether your work on a family particularly Lamont Bros. or someone else, this course of action allows you to ensure that you secure the right particular and you may number of capital for the project’s means. The latest eight measures we’re going to shelter was:

Step one. Assemble Your own Group

The best way to ensure that you can effortlessly loans your own home improvements is always to include your building work group from the start of your own investment process. Working together having professionals who understand the the inner workings from each other structure and you will cost management implies that you make informed decisions if you are examining the best a means to financing home improvements.

The method which our party enjoys discover most powerful comes to creating a collaboration involving the homeowner, the fresh restorations company, and the funds loan providers. This method allows each party to share with you the possibilities and you will collaborate to find the best provider to your homeowners’ requires.

2: Introduce The Project’s Price range

Prior to beginning examining funding alternatives, you’ll want to speak to an expert renovations class to establish a resources range. A remodel design consultant can give you a rough redesign funds predicated on your eyesight on venture.

Remember that this is simply a quotation of the total price of one’s project, and total cost could be virtually versus initially diversity cited. The intention of starting so it budget range is always to help you decide if we should circulate the project give and will be offering your sufficient suggestions to begin discussions having a money officer to possess your residence advancements.

Step 3: Talk with a loan Administrator

If you know around exactly how much your redesign will definitely cost, then you can speak about your funding solutions which have financing administrator.

Whenever you are there are various forms of resource which is often regularly money a renovation, you will find around three popular types of finance we see usually.

You will need to present which one will work perfect for the fresh new project you’ve planned. The purchase price and you can structure means of your remodel tend to connect with and this financing solutions perform best for your requirements, which is why it is essential to know your allowance range before.

Option step 1: Household Equity Investment

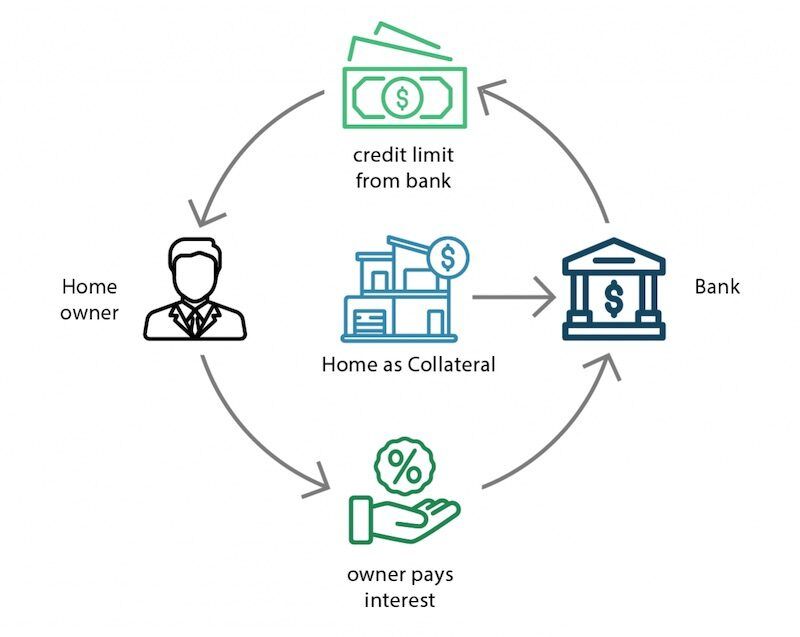

When your home is worth more than your debts toward they, you really have equity. A property guarantee mortgage helps you availability the money one to is tied up on your own house’s really worth and employ it to help you financing individuals home improvements. Such financing is often also known as a great next home loan, whilst fundamentally serves as an extra home loan towards the house.

Family equity funds funding is particularly prominent certainly home owners whom currently has actually a low-value interest on the first mortgage. Property owners that was able to safer low interest rate scarcely require so you can renegotiate new regards to their amazing mortgage. Alternatively, they more often want to funds their home improvements due to an effective second home loan to store the rate lower on earliest you to.