Prepayment charges are there to greatly help guarantee that loan providers would be capable gather desire towards the financing within these first few profitable decades. The fee also helps lenders get well a number of the losses during the focus.

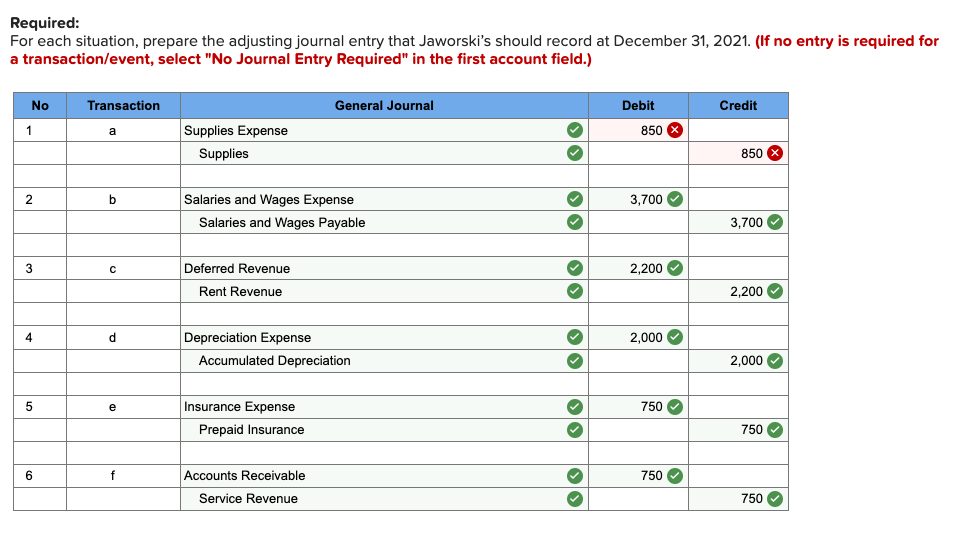

Instance of good Prepayment Penalty

Let’s say you have got good $375,000 home loan that accompany an effective 3.99% rate of interest to possess 3 decades, and also the mortgage bargain you finalized has a prepayment condition to have the first five years of your own financing.

Immediately following 24 months from repayments, the balance on the mortgage try $361,. You come in some unforeseen money and determine that you want while making a supplementary percentage from $100,000.

If you love good 20% prepayment allowance every year and have not put it, find out whether or not it moves out over the second seasons. Whether or not it will not, you merely provides a good 20% prepayment allowance to do business with. For those who go ahead and improve most $100,000 fee, new penalty commission (can you imagine its step one.5%) will be brought about, and you will have to pay an extra $5,.

One which just ortization agenda. Find out if putting some extra fee can save you alot more than simply $5,423 when you look at the appeal. If for example the answer is yes, this will be a repayment-productive choice.

If you have most other expenses with highest appeal than just your home loan, it’s probably useful to a target investing those individuals down basic.

How much cash Was Prepayment Penalties?

- Kept balance

- Amount of loan

- Interest rate

Prepayment punishment are usually depending towards the a sliding-scale. As you become then into the mortgage, the fee lowers and eventually disappears. Here’s an example from a potential prepayment punishment agenda that have an effective sliding-scale:

What if you to definitely inside season cuatro of the financial, pay a visit to an alternate bank and you will realize you might refinance in order to a great step 3.20% rate of interest.

You cannot ignore the speed, so that you decide to refinance. This means you will need to pay off their outstanding harmony of $346, together with your most recent lender by using the funds from your refinance.

According to the sliding scale, you’re going to be recharged a prepayment penalty regarding 0.75%. That means you’re going to have to spend a $2, prepayment punishment payment so you can refinance. Listed below are some your own amortization plan to see if that it percentage usually be beneficial in the end.

1. Find out if the loan have prepayment charges

The Act approved greater-starting monetary reforms towards the heels of one’s 2008 financial crisis, in addition to guidelines around what loan providers should do whenever dispensing a home loan.

One of those guidelines would be the fact lenders exactly who tend to be prepayment punishment conditions within home loan deals need reveal the individuals details on closing of your own the mortgage and include the individuals facts in the package.

2. Learn tough penalties off soft charges

A soft prepayment penalty merely relates to refinancing. For people who offer your home otherwise repay a big section of the mortgage in the 1st lifetime, you might not end in the latest prepayment punishment.

A difficult prepayment punishment pertains to promoting your property, refinancing or repaying a big part of the mortgage very early.

Check your prepayment term to discover if you a softer or difficult penalty. The essential difference between both is notably impact your choice so you can move forward that have attempting to sell your residence, paying off your own home mortgage very early or refinancing.

How can you Stop Financing Prepayment Punishment?

To get rid of prepayment punishment the original source, it’s crucial that you comprehend their loan’s prepayment condition and you can understand hence situations bring about prepayment fees.

- Is actually negotiating towards lender having a possible all the way down punishment payment or require good nonpenalty financing. By the 2010 Dodd-Frank Work, every lenders have to render a beneficial nonpenalty loan alternative. Only keep in mind that the new nonpenalty solution might incorporate a top rate of interest.