If the tasks are done the home will likely be refinanced which have a longer name home loan at a reduced interest rate.

Approaching relatives for a financial loan

Borrowing from the bank out-of relatives are a good replacement taking out fully a connecting financing, and you can help you save money into fees. It is very important become clear exactly how enough time you’ll require money having and how you wish to spend they right back online payday loan Colorado.

Personal traders

When selecting possessions while the a good investment, such as utilizing the build, refurbish and you will lease model, you can even consider obtain from a lender, otherwise utilize the fund of a private buyer.

Just how these two solutions compare depend on both the price you will be supplied by a connecting loan provider in addition to you to definitely offered by the fresh investor.

Always, a connecting financing financial will be more predictable within means than just an investor and never get embroiled on the opportunity facts.

Private dealers dont usually strive to place standards that will perhaps not be controlled, meaning you may be susceptible to interference on endeavor, or unforeseen transform to your plan. If you plan to utilize personal investors it is better to find legal services to add understanding with the words of your contract.

Discussing which have a preexisting financial

If you’ve come upon issues with your current financial vendor and you will can be found in arrears, you will be questioned so you can get the loan in full, or face this new danger of repossession.

A bridging mortgage can be used to repay your own financial, towards the notice placed into the loan, leaving you no month-to-month payments to make.

This could be a temporary plan while you are would love to promote the property otherwise clean up your bank account before you take out an alternative mortgage.

The expense out of connecting fund try higher than those in the home financing. Even though you aren’t expenses one monthly obligations, you continue to become racking up desire, and that must be reduced.

Of a lot loan providers could well be keen to get rid of last-lodge strategies as well as have specialist groups to simply help those who work in personal debt, that have a range of possibilities. While you are feeling problems upcoming speak to your lender right as possible to classification your role.

Punctual household to buy organizations

Timely family to invest in organizations are often used to release guarantee of a property rapidly. The main differences try bridging financing allows you maintain possession regarding the house or property, while brief domestic selling businesses are getting the resource away from you.

It’s important to remember that timely purchases enterprises usually bring only about 75% of your house well worth, definition they make a considerable profit with the property.

If you’d like money urgently, and don’t desire to preserve a property to live in or generate following a simple-house business is a choice albeit one that contributes to your retaining a reduced amount of your own property’s worthy of.

Interest, charge and you will Annual percentage rate

The pace charged, any charges and the Annual percentage rate (a way of measuring the general price of borrowing) are primary factors. When you are cost isn’t really everything, where other variables within the an assessment was comparable, a protecting on the will set you back are a great way to tell apart facts.

Concurrently, while you are to your an adjustable financial rate their attract payments can go up otherwise down. Whilst the lenders have a tendency to alter costs according to research by the Bank regarding The united kingdomt ft pricing it eventually place her rates and you will do never need certainly to immediately echo one change. If you require certainty regarding the costs you should make sure so that their bank know so it and you can talk about fixed price affairs.

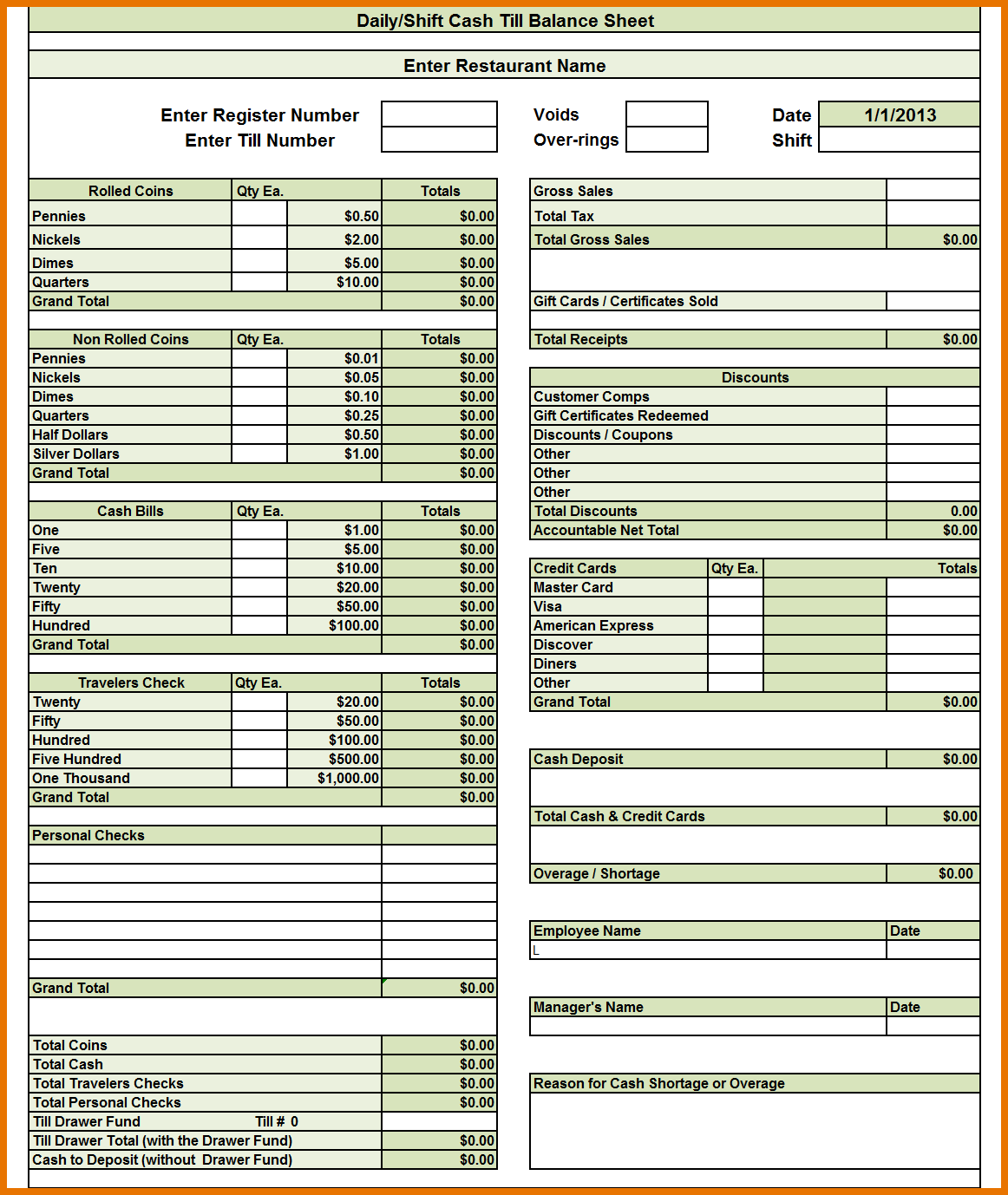

Month-to-month will cost you

Plus complete can cost you, you will need to determine your own monthly will cost you. Bridging financing costs is often added to the loan and you can repaid after you promote property. Other sorts of loan requires monthly installments, as well as in happening out-of another-costs home loan you will need to make several money monthly that can be a long term drain for the resources.