In current years, ATSs have gained popularity among investors and traders, and their trading volume has grown significantly. Trading on ATSs frequently contains 10-15% of U.S. fairness trading quantity, reflecting the increasing demand for these platforms. The rising reputation of ATSs could ats business meaning be attributed to their unique features and benefits, which are discussed within the following sections. For info pertaining to the registration status of eleven Financial, please contact the state securities regulators for these states during which 11 Financial maintains a registration submitting.

ATS buying and selling, or Alternative Trading Systems, provide a different avenue for buying and promoting securities outside traditional stock exchanges. These platforms present a marketplace the place traders can execute orders without the public transparency of a securities trade. Understanding ATS buying and selling may give you extra options for entry and exit strategies, probably main to raised profit and loss management. With their exclusivity, customization choices, anonymity, and lower prices, ATSs have carved out a niche within the trading landscape. However, it is important for market individuals to grasp the regulatory framework that governs these platforms and make positive that they’re in compliance with all related guidelines and regulations.

Peer-to-peer Community

(GSEC) lately adopted a standardized method for counting executed trades in its ATS. Another way that crypto exchanges can execute trades is through a peer-to-peer community. In a peer-to-peer community, patrons and sellers commerce directly with each other.

A Call Market waits till there’s a certain amount of trades before trying to execute them. For that purpose, trades do not execute continuously however as an alternative at predetermined intervals or when the value reaches the clearing worth. That value is set by the securities being offered and the bids by consumers on the community. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealer or an funding adviser. In ATS trading, bids are presents to buy a particular asset at a specified value.

That visibility offers a chance for other trades to front-run the price with a smaller order. This tactic will doubtless push the price greater for the unique trader, probably leading to a lower return. If enough traders take part, the original dealer would possibly even undergo a loss if they’re promoting. Governed by the SEC and FINRA, these platforms should adhere to particular rules and amendments to make sure honest operation.

Traditional exchanges are appreciated for their transparency and regulated nature, but they could be less efficient and extra pricey for merchants. ATS are often characterized by larger operational flexibility and fewer regulatory supervision in comparability with traditional exchanges. Similar to dark swimming pools, crossing networks enable trades to happen exterior of the common public eye.

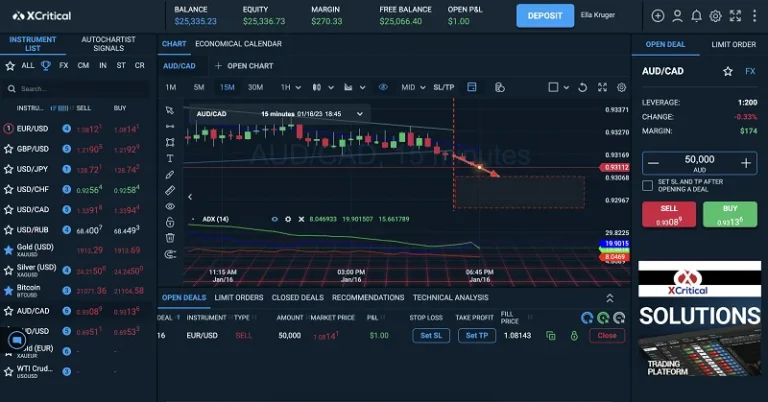

Broker-dealer crossing networks are various trading systems that match buy and promote orders from registered broker-dealers. These methods are used to trade securities that aren’t listed on a proper trade. Broker-dealers are required to reveal their order info to the crossing network, which then matches the orders and executes the commerce. An Alternative Trading System (ATS) is a non-exchange buying and selling venue that matches buyers and sellers to execute transactions, offering an alternative https://www.xcritical.com/ to conventional exchanges. If you’re seeking options to traditional inventory exchanges and are considering ATS platforms, you’ll additionally need to learn about one of the best brokers for day trading. The proper broker can make a big difference in your trading experience, particularly when utilizing ATS platforms.

Finance Strategists has an promoting relationship with a number of the firms included on this web site. We may earn a fee when you click on a link or make a purchase order through the links on our website. All of our content material is predicated on objective evaluation, and the opinions are our personal. Given their reliance on expertise, ATS are prone to operational dangers, including system failures, programming errors, and cyber threats. A hedge fund excited about building a big position in a company could use an ATS to forestall other buyers from shopping for upfront. Hypothetical example(s) are for illustrative functions only and usually are not supposed to symbolize the past or future efficiency of any particular funding.

What Is Another Trading System (ats)?

Alternative trading techniques are largely used by institutional traders trading in large sizes (called block trades). ATSs enable institutional traders to privately hunt down buyers and sellers who might be an excellent match for bigger trades. This is not like a public exchange, which broadcasts trades to everyone on the change. ATS platforms supply a quantity of advantages, similar to lower fees and quicker trades.

Dark pools entail trading on an ATS by institutional orders executed on non-public exchanges. An ATS is particularly helpful for many who are conducting giant quantities of trading, corresponding to traders and skilled merchants, because the skewing of the market value may be avoided as with regular inventory exchanges. It is because trading performed on ATS just isn’t publicly out there and doesn’t appear on nationwide trade order books.

Upon the execution of trades, the clearing and settlement process in an ATS is often handled by a clearing home. The functioning of an ATS depends on advanced laptop algorithms to match purchase and sell orders. Market individuals enter their order particulars into the system, which includes the type of security, quantity, and price. Securities and Exchange Commission (SEC) launched laws permitting digital exchanges. To comply with Regulation ATS, an ATS must register as a broker-dealer and file an initial operation report with the Commission on Form ATS earlier than beginning operations.

What Is Ats Trading?

An Alternative Trading System is a non-exchange trading venue that facilitates the buying and promoting of securities. They may be operated by broker-dealers or other market members and serve as a marketplace for institutional traders and other refined market individuals who meet particular eligibility standards. Unlike traditional inventory exchanges, ATSs are not out there to the entire funding public, and they do not essentially provide public info on one of the best prices obtainable to merchants within their system.

This could be each an advantage and a disadvantage, relying in your buying and selling technique and threat tolerance. ATS platforms provide larger flexibility and could be a helpful a half of a diversified trading strategy. They usually have lower charges and might execute orders more quickly than traditional exchanges. As a first step within the effort to assist enhanced public information on ATS buying and selling exercise, Goldman Sachs Execution and & Clearing, L.P.

Systemic Danger

The extra trades a trader makes, the extra price to them and more gross sales revenue for the ATS. Electronic communication networks are one of the most commonly-used kinds of different trading methods. Investing in alternative assets includes larger risks than traditional investments and is appropriate only for subtle investors.

Low-float shares, for example, can supply unique trading opportunities but come with their own set of challenges. These shares may be highly risky and are often traded on ATS platforms. Some exchanges use a hybrid mannequin, which is a mix of the order book and peer-to-peer model.

What Is The Future Of Ats?

Unlike conventional exchanges, they don’t require a central market and sometimes deal with large sums of cash. An ATS differs from a standard inventory exchange in that it does not have the identical level of regulatory oversight and doesn’t need to disclose as a lot data to the public. A hybrid ATS combines options of both broker-dealers and traditional exchanges. They provide a range of providers and can be a good match for traders looking for a one-stop-shop solution. Dark swimming pools are designed for buying and selling giant volumes of shares with out public disclosure, whereas different ATS platforms could provide totally different benefits like decrease fees or sooner execution.

Many platforms offer series and parts of educational programs to guide you through the complexities of ATS buying and selling. This publicly available “time and sales” information is an integral part of worth discovery, and ATS trading contributes to this in the same manner that public exchanges do. Dark swimming pools are non-public different trading methods that are not accessible to most of the people. These systems are often used by large institutional traders to commerce giant blocks of shares without revealing their intentions to the market however are used primarily as a tool to stop different investors from buying forward of time.