Brian enjoys almost twenty years of expertise exercises within the classrooms and working as a private teacher to own levels seven owing to several. He’s got an excellent Bachelor’s Degree ever with a focus towards 20th century U.S. History.

- What is actually Redlining?

- Redlining History plus the Great Anxiety

- Redlining Definition Today

- Segregation against. Personal Economic Issues

What exactly is redlining in simple terms?

Why is redlining shady?

Redlining form denying monetary features to help you a guy established https://cashadvancecompass.com/installment-loans-ms/blue-springs/ solely on the competition otherwise ethnicity. Its unethical to use race or ethnicity as the a foundation to own being qualified to own borrowing from the bank or any other economic qualities.

What is actually redlining of all time?

Usually, redlining relates to a habit because of the FHA and you will HOLC to help you refute lenders to people living in non-light communities. This type of organizations received reddish traces to low-light communities into charts in order to employ all of them because the unworthy of financing.

Desk off Articles

- What is Redlining?

- Redlining Background and also the Great Depression

- Redlining Definition Today

- Segregation vs. Individual Economic Points

What is actually Redlining?

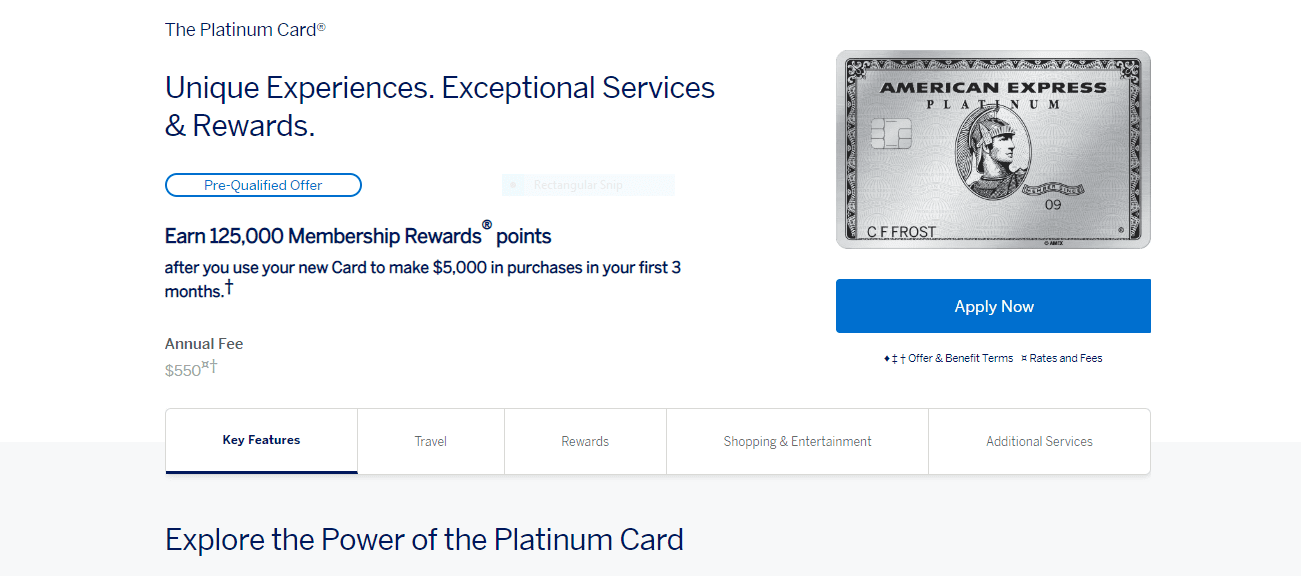

In recent times, the term redlining has actually appeared in the media in the reference to societal things during the Western record, particularly facts over general racism. What is actually redlining? According to Cornell Rules College or university, “Redlining can be defined as a good discriminatory routine you to definitely includes the newest health-related assertion from services eg mortgages, insurance policies finance, and other financial features in order to residents of certain specific areas, based on their battle or ethnicity.” Since the routine first started in the 1930s, the expression redlining try coined throughout the sixties of the sociologist John McKnight.

Redlining Records as well as the Great Anxiety

The history out of redlining first started within the Higher Despair. Monetary adversity strike the usa regarding the later 1920s and you will early 1930s. By the 1933, the jobless speed are greater than twenty-five%, earnings got plummeted of the more than half, as well as over so many Us citizens was indeed up against property foreclosure to their belongings. As a result, Chairman Franklin Delano Roosevelt launched a large personal and you may economic recuperation system he called the New Bargain. Central toward vow of your own The fresh new Bargain try FDR’s trust you to home ownership is actually the simplest way getting Us americans in order to safe and you can accrue wealth. Therefore, the federal government created firms who does bring federally shielded lenders so you can audience. not, particular demographics, predominantly black Us americans, have been systematically declined those people gurus. In essence, it practice of doubting lenders so you’re able to Us americans in the low-light neighborhoods written a system of institutionalized segregation nationwide.

Segregation’s Meaning and the The fresh Deal

Segregation function separating somebody based on competition otherwise ethnicity. This is a familiar habit in most areas of this new U.S., especially in the fresh Southern, following avoid of one’s Municipal Battle before the civil-rights motions of your own sixties. Jim crow regulations from inside the south claims prohibited black colored People in the us out-of restaurants in the same dining, hunting in the same places, and planning a similar schools as the light Americans. From the High Despair, communities in the most common significant Western places was separated collectively racial contours. If you are FDR’s The fresh new Bargain was created to combat the favorable Anxiety, policies created to offer mortgage brokers ultimately cemented these types of segregated communities and you can authored monetary disparities between monochrome People in the us for decades to come.

Segregation and Bodies Organizations

For the 1934, the Federal Property Administration (FHA) was designed to insure mortgage loans so you can personal anyone and you may designers looking to create the brand new construction improvements. Simultaneously, the homeowners Mortgage Enterprise (HOLC) was designed to provide the FHA covered loans. So you’re able to determine how better to distributed the home financing, the federal government commissioned charts of every big urban area in the nation. New FHA and you will HOLC then color-coded new charts so you can designate hence communities had been “safe” to possess resource. Colour codes provided green to own “most useful,” blue having “desirable,” red-colored for “declining,” and red getting “hazardous.” This new designations bankrupt off along nearly entirely racial lines. Mainly black colored areas, or even elements receive near black colored areas, was colored purple, demonstrating this type of elements because the hazardous having funding.

Segregationist policies went beyond merely color-coding charts. Assuming black household getting into light communities manage all the way down assets values, black colored Us citizens was basically positively prevented of to get within the white communities. With respect to the FHA’s Underwriting Instructions, “incompatible racial organizations really should not be allowed to inhabit the fresh same organizations.” New instructions and ideal your building off highways could well be accustomed independent monochrome communities.

In some instances, covenants were used to prevent black group of to find homes within the light areas. This type of covenants eliminated white home buyers regarding subsequently selling their homes in order to black colored customers. Possibly the most famous example of this can be Levittown, one of the primary residential district developments, located in Nassau County, Enough time Isle. People inside the Levittown was indeed needed to sign a rental claiming they you certainly will lease otherwise promote the house so you can “any individual apart from members of the newest Caucasian race.” Utilization of this type of guidelines invited the newest FHA and HOLC to manufacture racially segregated organizations across the nation.