The housing marketplace is during flux. This is what knowing now.

- Email address symbol

- Twitter symbol

- Fb icon

- Linkedin symbol

- Flipboard symbol

Potential and you will newest home buyers really should not be losing sleep more worries that they’ll wake up tomorrow to find the whole construction bles, states Jacob Station, senior economist for LendingTree.

??Home loan cost try off throughout the over-6% levels (understand the lower mortgage costs you could be eligible for right here), and a lot more homes try viewing price drops. So customers can be wanting to know: Has become the time to get, of course, if thus, just what must i learn just before I do? In order part of all of our series in which i correspond with prominent a home gurus towards housing market, we questioned Jacob Station, the newest elder economist for LendingTree. He conducts education for the many subjects related to new You.S. housing marketplace, in addition to getting standard macroeconomic analysis. Listed below are their thoughts on the fresh new housing industry now.

Sellers is actually dropping power

When you look at the pandemic, vendors got loads of leverage. Buyers were very plentiful and you can house was selling so fast one to providers may get away with points that would not be appropriate in the an everyday business, like billing ten% otherwise 20% more to own property than they paid for it simply a few years before. Today, which is switching and you may providers discovered you to they usually have while making a whole lot more concessions so you’re able to offer their homes. It is very good news to own buyers as it means that they are going to have significantly more action room with respect to negotiating such things as a house’s price or if the vendor pays the buyer’s settlement costs, says Station.

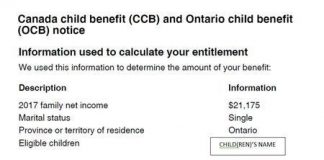

However, customers may still possess value challenges

Whether or not pricing has actually dropped from their June highs (after they were more six%), all round pattern due to the fact start of the 12 months is the fact home loan prices features increased. This means that the fresh customers are likely probably become purchasing considerably more to their housing payments than they would possess had it ordered a house elitecashadvance.com loan for undocumented immigrants in the beginning of the year, says Station. Furthermore, although the housing marketplace is in the end appearing specific signs of air conditioning down, cost will still be filled up with a lot of the world. Such high pricing, combined with ascending cost, renders homes expensive to a lot of, especially low income and you can first-time consumers, claims Channel.

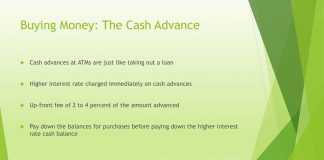

Adjustable-rate mortgage loans make a return – however, understand the caveats before you could diving within the

Route states, Owing inside the large region in order to rates ascending so quickly in 2010, adjustable-rate mortgage loans (ARMs) have begun in order to become much more popular. Indeed, what amount of Arms accessible to consumers provides more than tripled given that 2021.

Because Palms typically provide straight down basic costs than just their repaired-speed alternatives would, capable feel like a good option for some customers. Unfortuitously, Hands is actually high-risk, plus they can quickly be much more costly due to the fact prices go up. In the event the current consumers are generally top provided to deal with Arms than just they were prior to the 2007-2008 construction crash, definition Possession probably won’t assist would some other freeze any time in the future, consumers would be to be sure that these are generally aware of the newest most of the the possibility disadvantages to an arm in advance of they rush out over have one, Channel claims.

You truly don’t need to stress from the a big housing market decline

Whenever home prices rise as fast as he’s over the previous a few-and-a-50 % of many years, it’s only natural for people to ask in the event the record speed development usually turn out to be a similarly amazing atically ahead of the higher market meltdown after which they cratered. Even though no-one can expect the long term and say that have 100% confidence that that which you is An excellent-Okay, the modern analysis that we do have reveals that good 2007-2008-design crash most likely is not in the notes. Whether or not home values create come down in a number of components, customers can be found in a much better location to deal with the mortgage repayments than these were fifteen years before. It means we have been unlikely to see the same old defaulting action we spotted before the High Market meltdown, he states.

Conclusion: This new consumers and you will latest owners are careful that they are not biting regarding more than capable bite and that these include staying with their payments, nonetheless they shouldn’t be having fun with sleep more than anxieties that they may aftermath upwards the next day to discover the whole property bles, says Channel.

The recommendations, pointers otherwise rankings indicated in this article are the ones regarding MarketWatch Picks, and have now not already been analyzed or supported of the our industrial partners.