HELOC mortgage conditions are usually 15-thirty years. HELOC’s will often have an earlier closure percentage although for many who intimate the new HELOC inside the earliest three years (essentially the fees they failed to cost you when you gotten the new HELOC), for each and every financial will receive another type of coverage off one. To get rid of one, merely keep the HELOC unlock. You’ll want to talk to an estate lawyer regarding the inheritance matter, but my expertise can be your daughter would inherit your house as well as one financial obligation that’s using it while the security. constantly whether your obligations continues to be paid down as agreed upcoming they don’t accelerate your debt benefits.

I wish to use it since a routine mortgage, i.e., using money and quickly with them; I do not should let it rest seated here and take draws occasionally. I recently want to use they, repay it, be achieved inside. So is this achievable?

Zero restrictions about precisely how in the future you might pay it back, you could potentially repay the borrowed funds harmony 1 day after bringing it if you want

- Mark because the New

- Save

- Subscribe

- Mute

- Join Rss

- Permalink

- Statement Improper Posts

A HELOC means Family Security Credit line, basicly a protected credit card but to your home

First of all you must know exactly what a beneficial HELOC is. They put on the building like any most other home loan. They’ll will always be attached if you don’t personal them. You could potentially pay it back and you can hold it at the $0 balance if you would like. For folks who miss a cost they can loan places Megargel AL phone call your house since a secured item reciprocally via forclosure. The thing they don’t like doing are passing you cash. They are going to clipped inspections having contractors or let you swipe their HELOC’s credit while the commission but don’t anticipate to manage locate financing into your checking account. And Contour simply having fun with prefer purchases in order to suck your within the. What you it’s must do was take into account the actual unit. Are you aware that strengthening valuation it is always done short to have an excellent HELOC and certainly will be way more old-fashioned than what your could possibly sell for for the one financial. step one.3mil towards the an effective 2mil building is mostly about right and they’ll maybe not enable you to supply all financing at home.

- A beneficial HELOC try a mortgage you to will get utilized particularly a card credit. The latest terms and conditions was ten-30yr but if you look closer there is going to never be a good prepayment penalty. You certainly do not need to store an equilibrium towards complete amount of title. I had a creating that have a great HELOC connected for years but equilibrium on $0.

- You have to pay it well early. The bill gets $0 and this will depend on your when you wish to close off they. You can allow it to remain until your next disaster for individuals who particularly.

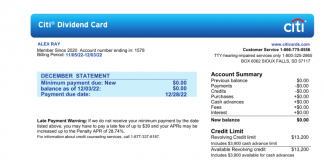

- You to would depend. ‘s the HELOC repaid merely otherwise all of your current bills? If you’re HELOC’s try a mortgage and certainly will forclose into the property as the a secured lender they’re not the only person that is. Whatsoever protected lenders provides grabed the defense and eliminated its personal debt any unsecured financial comes in and you will holds their piece of their property. The fresh unsecured lenders are able to acquisition the home liquidated. Is not important if it’s many and see, Citi, or simply just $ninety with the cord co. Heirs such as your daughter have the domestic dead past. New different is when you are doing a thing that qualifies the brand new advantage so you can sidestep the fresh new estate. In the event the asset bypasses up coming just shielded loan providers one attach directly so you can it does just take they.

What you want is generally doable remember that a great HELOC still has a share on it, regardless if lower, and read very carefully the fresh new fees. The early closure charge keeps a habit out of painful if for example the perhaps not careful.