One of the benefits of homeownership ‘s the capacity to tap into the house’s worth and start to become they to the bucks. That have property guarantee financing, residents normally borrow on this new collateral they’ve got built up within assets and use the cash for things like renovations, studies costs, debt consolidating, plus.

If you are considering with your domestic once the collateral to obtain finance, you will need to make certain you understand a number of the perks- and threats- of the house security financing.

Experts out-of a property Security Financing

Domestic guarantee financing feature certain famous professionals. Allow me to share some of the good reason why borrowers like them more other sorts of funds.

1. You need the income off a home security loan to have people mission.

Exactly what property navigate to this web-site security financing is used for can be you. There are no lay advice on what the bucks can also be and can’t be allocated to. Normally, however, someone go for house guarantee funds on huge expenditures, once the creditors routinely have the absolute minimum loan amount around $twenty-five,000.

- Home improvements: You can expect to your house fool around with a number of enhancements otherwise remodels? That loan can give you the income accomplish those much-requisite projects and household solutions.

- Medical expenses: Unanticipated scientific issues is also hop out somebody thousands of dollars indebted. That loan will allow you to shell out these types of out of and steer clear of getting provided for selections.

- School expenditures: If you’re wanting to return to university to advance your degree or provides an infant planning to go off to college, property collateral loan will be a somewhat lower-prices means to fix pay money for those individuals expenditures.

- Debt consolidating: Are you experiencing most other debt to your cards and you may financing with large interest levels? Pay back such things as playing cards and personal finance together with your home’s guarantee. Merging your debt having a lesser interest rate financing can save your ultimately and also make investing their bills easy.

- Initiate a corporate: For those trying change a successful front-hustle to the a complete-big date concert, a house guarantee financing can provide the administrative centre you need to get your company off the ground.

When you find yourself you will find imprudent strategies for the fund, you have the liberty to make use of all of them as you excite.

2. Interest rates is repaired and frequently lower than most other investment solutions.

Since your mortgage is safeguarded with your home, lenders could possibly offer you straight down rates than they may be able having other forms away from investment including personal loans otherwise handmade cards. They likewise have a fixed interest rate, meaning you don’t need to worry about skyrocketing cost over time.

step three. A home security financing is straightforward so you’re able to qualify for and has now fewer costs.

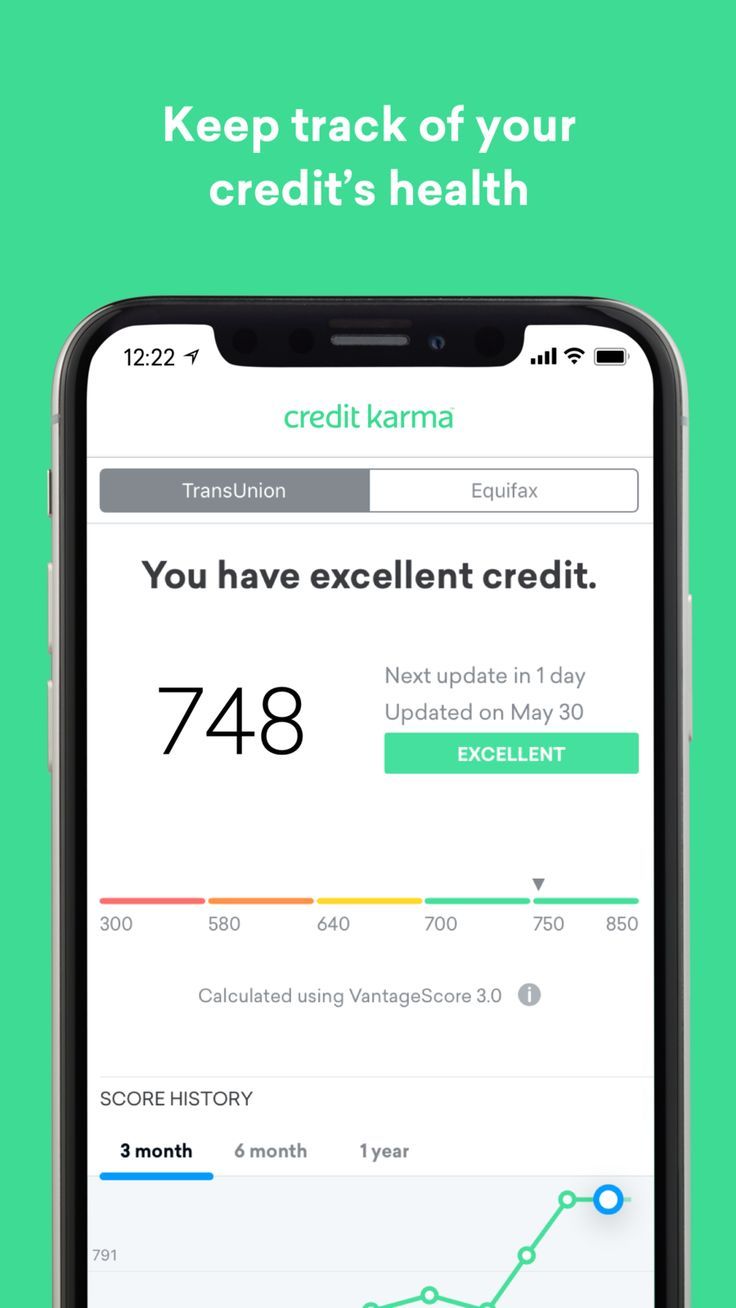

Whenever you are you’re going to have to fulfill specific conditions particularly a beneficial borrowing from the bank score, a reduced loans-to-money proportion, and guarantee criteria, a house equity mortgage is still relatively simple so you’re able to be eligible for because it is covered together with your family.

At exactly the same time, a home collateral financing is a great way of preventing costly closing costs. Certain loan providers will simply charge a reduced, flat fee in the closure. Yet not, they constantly helps to perform a little research, because the particular financial institutions charges dos% in order to 5% of complete financing amountparing lender prices and you may fees can save you thousands upfront as well as over the category of loan.

4. You can benefit from some income tax deductions.

When you’re utilizing the currency to make developments on the house which is securing the borrowed funds, it’s also possible to be eligible for taxation benefits. The latest Internal revenue service states that the desire reduced to the a property collateral loan was taxation-deductible if it’s familiar with buy, generate, otherwise dramatically increase through to the home.

Keep in mind that you could just subtract focus as much as $750,000 off home-based fund as well as the improvements have to be built to our house about what the mortgage are taken out. When you can easily make use of the collateral of the house your live-in while making developments to help you accommodations assets, you can’t subtract the eye.

Cons out-of a house Collateral Loan

When you’re there can be so much is thinking about, it is in addition crucial to understand the disadvantages to help you a great home equity loan.

step 1. A home collateral financing spends your property since security.

With your home to safe financing mode all the way down rates of interest, but it also leaves your house susceptible to foreclosures. When you find yourself incapable of generate money, the bank has a straight to seize your house and sell it to recover its losses. It is important to make sure to tends to make your payments, though unanticipated costs occur.

dos. You take to the so much more obligations.

Although it may be cheaper than other sorts of borrowing from the bank, a home security mortgage is still loans. If you find yourself still to make your first home loan repayments on your domestic, be sure that you have the methods to put a separate monthly payment towards the top of the brand spanking new that.

The higher financial obligation-to-money ratio that include taking up an alternate home loan can and ban you from being qualified some other money while browsing build an alternative large pick soon.

step three. In case the industry crashes, there are your self under water.

In a sad situation, you might find oneself underwater having property security loan. By taking away a large loan additionally the housing marketplace injuries or something like that explanations your residence’s worth to drop abruptly, it’s also possible to in reality owe more on your home than just it is worthy of. Having an underwater mortgage otherwise loan can possibly prevent you from promoting your property if you do not have the funds to expend the loss.

Try a property collateral mortgage wise?

Like any financing device, discover advantages and disadvantages of property equity mortgage. They give autonomy on an affordable, that are several functions which make all of them attractive to many individuals. Although not, it is very important understand that you may have over their borrowing from the bank at stake using this loan- youre in addition to putting your residence on the line. But, when you are confident you’ll pay-off the cash, a home guarantee mortgage may be the finest financial solution getting your position.