Structuring & Giving Lease-To-Own Purchases

Coming residents wanting the next quarters will often buy it to the old-fashioned funding bundle of a mortgage and you will a lower percentage. Exactly what when you have a possible visitors just who can’t score a mortgage with regards to earnings otherwise credit rating? Or imagine if you’re consumer, and you simply don’t want to shell out thousands from cash in the appeal repayments on bank? As it works out, there clearly was still a way to buy or promote a home without being the bank inside. How exactly to Design and supply Lease-to-Own house Deals

- Write a price Arrangement

- Perform accommodations Contract

- Use Lease so you’re able to Prominent

One erican consumers who possess nearly widely is trained to believe one to deposit and a home loan is the only way to help you purchase loans Progress Village FL a property.

The standard Mortgage Means

A resident find they would like to offer their property. It supplier solicits the help of a representative or Real estate professional, that will listing the house or property in the business and you may perform this new standard energy to help make the household browse presentable this can be getting shown to prospective people. The true house agent is even guilty of prices our home relatively by comparables-similar home locally which have has just offered which may help introduce a prices point of your house in question.

Once a curious customer arrives, the real home broker usually facilitate a discussion regarding sales, which will cover negotiation. In lot of claims, an effective caveat emptor (client be mindful) principle prompts the consumer to fund a building inspector in order to check the home and watch people flaws that provider try perhaps not compelled to divulge. Once they have been taken to white, owner and you will consumer could work away a cost in the a price arrangement. This is usually with particular serious currency to prove you to the consumer are invested in getting the possessions.

The buyer will then start to apply for home financing out-of a bank or comparable lender. This action can take several weeks, since financial should glance at the buyer’s money, credit rating, or other items strongly related to choosing in the event the lender is securely extend financing. Element of this process will involve a review of the property because of the bank’s appraiser. That’s because the lender doesn’t point that loan big compared to the worth of the house.

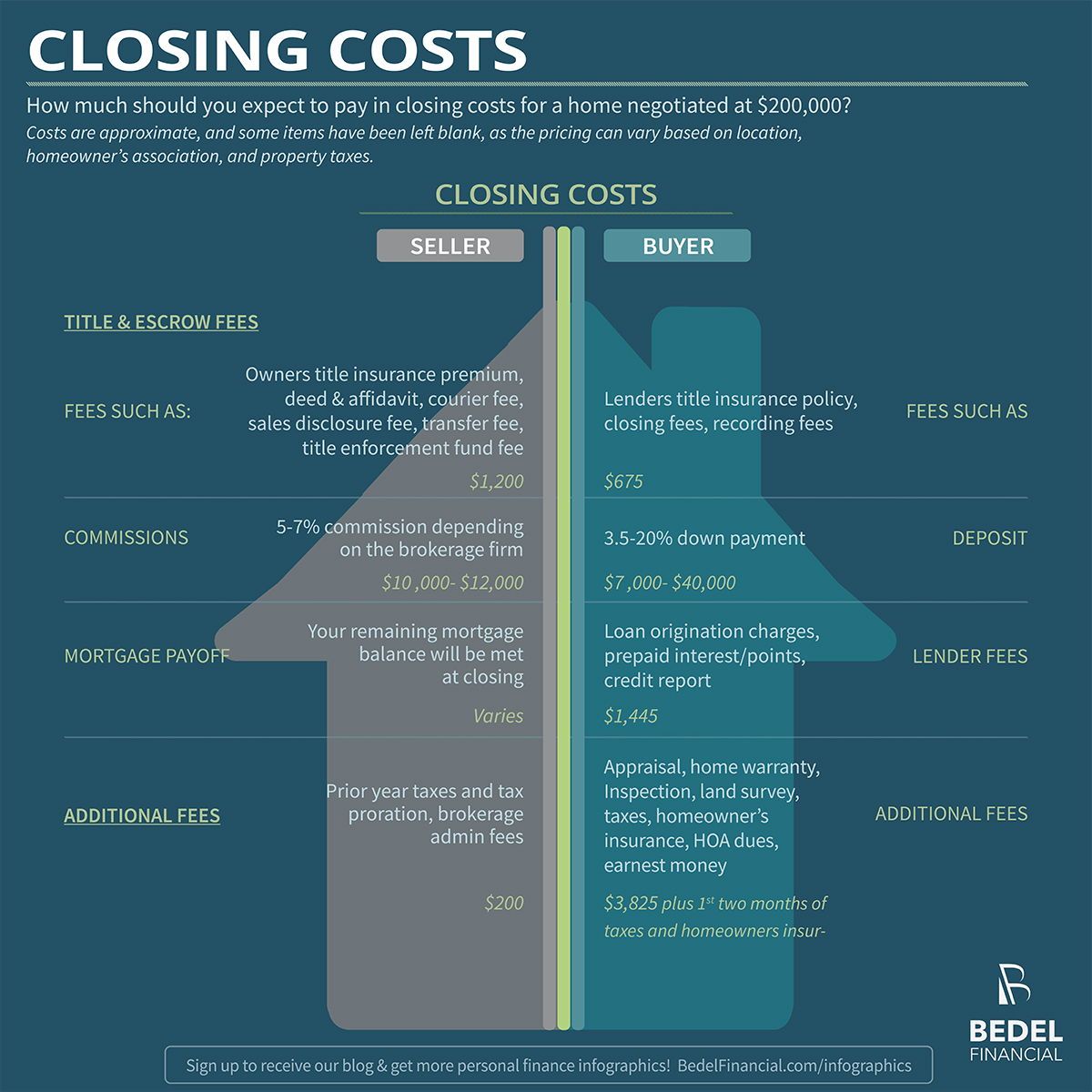

Should your financial is eligible, the customer, supplier, real estate professional, and any other relevant parties (particularly attorneys) will meet to possess closing. The consumer can have the vendor that have a downpayment (will anywhere between 10-25 % of the price) and also the financial offering the mortgage usually front with the rest of the cash, becoming repaid over time because of the consumer, always more an excellent fifteen or 31 12 months time period.

How-to Book-to-Own Belongings Performs

Many methods intricate over are nevertheless a similar, except an agent is not requisite nor is a financial otherwise lender. Instead, the consumer and you can merchant often cam truly and also make a package by themselves. Its good for both parties: the vendor features a better likelihood of obtaining rate they wantand they have certain control across the customer. Whatsoever, owner can still walk away on discussion and you can hold off until a buyer who’ll get home financing occurshowever, that type of client will have significantly more leverage along the provider as they could be providing a lump sum of cash upfront. It means the expense of the property is negotiated down.