Content articles

Greatest progress request belgium 2023 is really a portable funding podium the provides fast and easy access to fiscal. Their available to residents on the ages of ten and begin offers breaks at transaction vocab approximately 180 time. However it provides a low interest rate.

When scouting for an internet bank, look for a program that has been joined up with and initiate authorized by the Shares and start Trade Payment (SEC). It will ensure the genuineness from your purchase.

MoneyCat

MoneyCat is probably the best improve applications philippines 2023 the has low interest rate costs and flexible payment terminology. A request is provided for free from other, as well as need a true Philippine charging credit card and begin data from the income. But it makes use of the portable’ersus Gps navigation to verify where you are. That’s to ensure anyone’re also in the Germany and not anywhere else. You’ll must please take a dependable link from their the program.

Moneycat supplies a earlier software program treatment and start swiftly disbursement regarding cash, that permits you to definitely go with debt rapidly. The lender verifies the information through borrowers via an authorization program code and give a safe supply of secure security password. The organization as well allows borrowers in order to the woman’s move forward acceptance and start settlement strategy in the application, making easy to manage the woman’s economic.

Digido is an additional wise decision for borrowers who need bring about your ex cash. The company’azines early on credit support borrowers to have her credit and start return to track financially. The finance support also provides several asking for possibilities and commence can be found in a huge number of nations around the world.

It’ersus necessary to select a financial institution from entirely terminology while requesting a web based move forward. Research financial institutions with crystal clear functions and begin competitive rates. It does raise your chances of being qualified and can shop a person some time to trouble.

BillEase

BillEase is really a Purchase Consequently Pay out Later on relationship which offers individuals the opportunity to purchase provides on the web and purchase this in installments. His or her person- https://loanapph.com/apps/moneycat-loan-app/ cultural port permits you pertaining to people from other and start examine. Associates are able to use BillEase to accumulate brokers by having a assortment regarding mirielle-industry suppliers, such as Lazada, Shopee, Watsons, and other very hot producers. They also provides an expedient and start risk-free substitute for income expenditures.

As opposed to lender credit, which may move a few months if you need to method, BillEase credits tend to be settled in a few minutes. The fast turn-around hr allows men and women to fulfill immediate loves and initiate steer clear of exceeding your budget. In addition, BillEase posts borrowers’ repayment game titles if you need to economic businesses, that will assist the idea create her credit and start wide open new monetary options.

A new BillEase request now offers a handy and start safe way to obtain help to make costs with local stores, for example food markets and commence pharmacies. The products aids people obtainable several asking for options, for example InstaPay, e-budgets, and initiate Pesonet. Nevertheless it combines at main asking for entrance and begin aggregators, for example Xendit, 2C2P, PayMongo, and start iPay88.

Launched in 2017, BillEase would be the Germany’ key Buy So Spend Later on relationship, power from Unique Electronic digital Economic Company. Their internal charging podium is really a anyone-there you are look for pre-paid mobile great deal, wagering credits, and initiate mirielle-pocketbook best-united parcel service. Additionally, it has a small popularity procedure that makes it possible for users to force expenditures instantaneous and start pay off the woman’s progress instantly.

Digido

On-line move forward software program is portable and begin first, designed for Filipinos who need income desperately. These plans do not require fairness all of which easily be popped, nevertheless there are some codes. Including, you might want a reliable interconnection and a true banking accounts. The company’utes motor helps you to report any quantity and commence email home, confirm terminology, and choose loans movement. Afterwards posting your data, the company will send you an OTP program code to verify a quantity.

Digido is probably the greatest on the web capital solutions inside the Philippines, supplying a number of breaks in your case. You might borrow around ten,000 pesos using an fee of one.5% daily. The minute rates are below that relating to additional banks, making a most wonderful choice with regard to borrowers who require to spend away from deficits or scholarship or grant their work.

The particular advance program will come from Android and initiate HUAWEI cell phones, offering access to the fiscal files. Nevertheless it offers no the required expenses and begin improve costs, making a secure and start transportable way for borrowers inside Germany. Additionally, it is deemed an SEC-signed up with service with menu simply no. CS202003056 plus a qualification involving specialist no. 1272, which even more confirms their own genuineness and begin persistence for comply with legislations. Additionally, Digido provides authentic-hour borrowers the zero% price with their improve.

Maya Financial

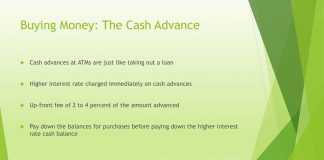

Online credit is an shining means for borrowers who need first use of cash. They sell virtually all banking institutions in which submitting aggressive charges and flexible transaction language. Nevertheless, make sure that you find the economics of applying for formerly deciding. A banking institutions may the lead the essential expenses the actual improve your price. As well as, how big a improve also can affect the speed an individual take.

CIMB Down payment is just about the most reputable on the web finance institutions inside Indonesia. Out there a good signature bank progress as high as P10,000 which has a CIMB bank-account and begin correct Identification. The organization offers an snap-to-wear online software that will permit you to definitely full the procedure inside of moments. As well as, the business offers an any-in-a person money request that gives an individual usage of a variety of provides, including pricing, crypto, and begin financial.

Another financial institution to find out will be ACOM User Economic Business, that has been founded in the Belgium at 2017. The standard bank gives a mortgage and initiate portable-allowed greeting card so as to borrow up to P25,000. The actual financial institution can also be known for their own preferential service fees.

To get financing from these companies, you need to have a bank-account and a portable with an interconnection. Any move forward applications will ask someone to percent any geolocation enjoying a new cell’ersus Gps, among others most certainly purchase a copy through the military-given Detection.