When you have bad credit, getting accepted for a funding can be an obstacle. Nonetheless, in South Africa, there are choices readily available for people with less than perfect credit report. Payday advance for poor credit rating are just one of these options that can supply fast access to urgent 50k loan funds when you need them the most.

What are Payday Advance for Bad Credit Report?

Payday advance loan for bad credit rating are short-term loans created for individuals that have a poor credit rating. These finances are usually tiny in amount and are meant to be paid back in full on your next cash advance. The application procedure is normally quick and very easy, making them a convenient alternative for those looking for reserve.

While payday loans for bad credit report may feature greater interest rates compared to standard fundings, they can be a feasible remedy for individuals that are not able to obtain funding via various other resources.

It is essential to keep in mind that payday loans must just be made use of for temporary economic needs and not as a long-lasting solution for continuous monetary difficulties.

- Quick access to funds

- Easy application process

- Offered for people with same day payday loans south africa bad credit score

Just How Do Payday Loans for Bad Credit Scores Job?

When you look for a payday advance for poor credit report in South Africa, the lender will commonly examine your income and work information to determine your qualification. Once accepted, you will receive the funds straight into your bank account.

Repayment terms vary depending on the lender, yet the majority of cash advances for poor credit scores schedule on your next cash advance. Some lenders may offer adaptable repayment options, allowing you to prolong the car loan term for a cost.

It is necessary to thoroughly assess the conditions of the funding before approving to guarantee that you recognize the settlement routine and any additional charges that might apply.

Advantages of Cash Advance Loans for Bad Credit Scores

Payday loans for bad credit history have numerous advantages that make them a popular option for individuals in need of quick cash money. Several of the crucial benefits include:

- Quick authorization procedure

- Access to funds when you need them the most

- Readily available for people with bad debt

- Flexible payment options

Points to Think About Before Using

Prior to requesting a payday advance loan for bad credit history, it is essential to think about the following variables:

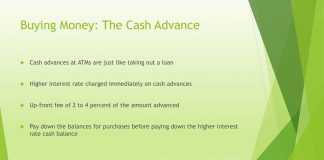

1. Interest Rates: Cash advance for poor credit rating commonly come with higher rate of interest compared to typical financings. See to it to thoroughly examine the terms to understand the total expense of loaning.

2. Payment Terms: Make certain that you can easily pay off the loan on your next payday to prevent extra fees and costs.