Your way regarding a home loan Software to Closure

If you are a possible homebuyer and you are considering jumping into the marketplace, so it probably means you want a mortgage loan. Eighty-7 percent of homeowners manage, thus you are glad to understand that, with a little context therefore the support out of that loan officer, the process is easier than you think so you’re able to browse.

So you can in route, instant same day payday loans online Nebraska we’ve got in depth the journey off a mortgage below. This simple-to-follow- publication outlines the trail of a typical financial and you can preapproval procedure. All of our mission is to help you see the actions which can be required when you purchase your very first or next family.

The journey away from home financing App to help you Closure

- Getting started on the Home loan Travels

The mortgage procedure initiate, just sufficient, which have determining financing officer. It mortgage lending top-notch will be here to help you while in the your own travels and certainly will begin by helping you to acquire a beneficial preapproval, otherwise a good pre-degree, and they’re going to explain the difference.

Instead of an excellent pre-degree, where an offer exists for how far family you could manage, a good preapproval requires they one step after that and decides the total amount you are entitled to obtain. They do this if you take a further look at your monetary updates and you may specifications.

The latest preapproval techniques is in location to so much more truthfully make sure that you will at some point become recognized for your home financing. Since the majority manufacturers love to deal with also offers out-of a buyer whom is preapproved, that is a critical action you will want to deal with ahead of time your property lookup, especially when the latest housing marketplace try competitive.

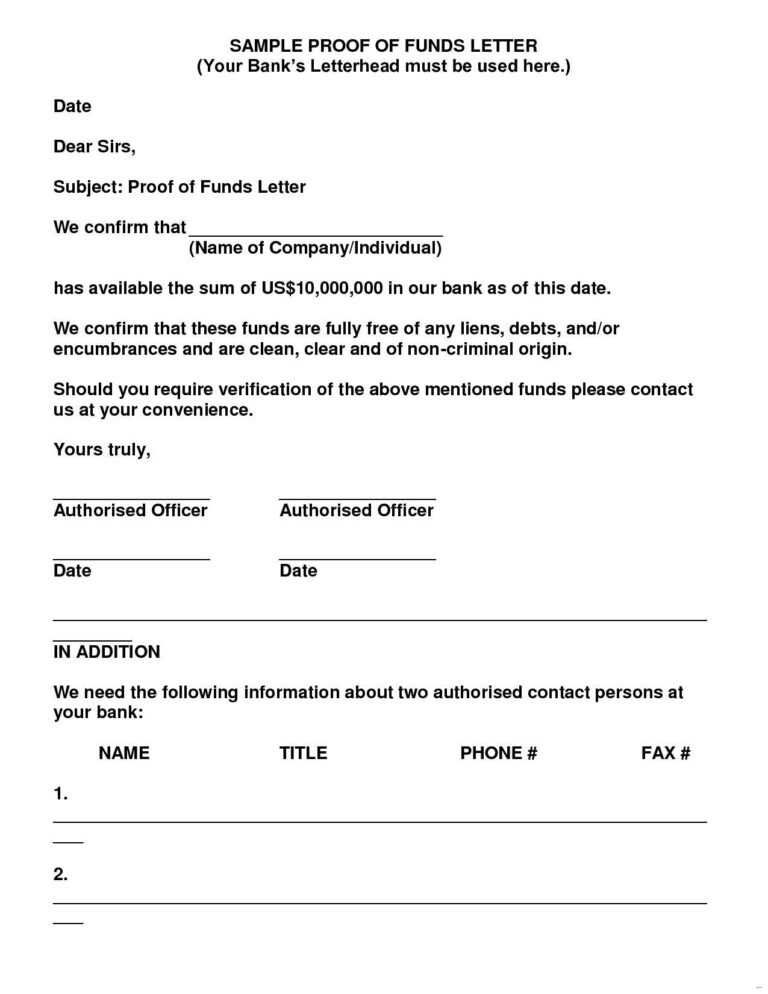

Among the first stages in this new preapproval techniques would be to offer a-two-12 months life style and working history as well as to give permission towards lender to get into your credit score. An extensive article on your credit report, in addition to a check of one’s credit rating, is very important in terms of choosing just how much you want to get upon your purchase plus the appeal rates where you could possibly get be considered. Suggestions acquired courtesy a credit file will also have affect into the kind of financing you should know. Positive thing their reliable financing administrator is by their side!

Your loan manager will also discuss their mortgage options with you and determine which type of loan is best suited for your circumstances. Repaired or variable, Antique otherwise FHA? There is a large number of alternatives, and your loan officer could well be an invaluable capital whether or not it arrives bringing all of them and you will assisting you to make most readily useful choice for another course of action.

The journey regarding home financing Software so you can Closing

- Moving on on your Application for the loan

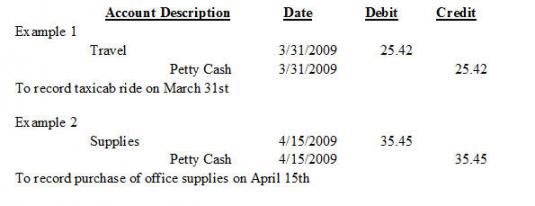

After you’ve made a deal into a house, and it’s accepted, you will need to officially make an application for capital. In addition to filling in and you can entry the application form within the preapproval processes, you are able to today be required to render particular documents, such paystubs, tax files and lender comments to name a few.

Once most of the files are registered, the job movements to a loan chip. It’s the processor’s jobs to examine for each and every file and ensure that all the latest bits are in set. If necessary, the brand new processor get demand much more information making sure that your loan is ready for another step-on their travels.

The journey off a mortgage Application in order to Closing

- Purchasing your house Appraisal

As chip confirms the information you may have offered, he or she usually acquisition a house assessment, an estimate of the worth of the property you want to buy. A licensed appraiser will make an in-webpages remark and you can examine your purchase in order to anyone else in the community (comps). The aim is to make sure the rates you accessible to spend isnt overinflated, demanding one save money as compared to home is well worth.

After that, with papers registered and you may confirmed, and you can a house assessment finished, the application is able to proceed to the next step regarding their trip if it is received by an enthusiastic underwriter.

Your way out-of a mortgage App in order to Closure

- Looking at The loan App

The brand new underwriting process is generally one of the the very least know actions inside the obtaining a home loan. This basically means, it is a past check of your own recommendations you may have offered and you may when you discovered recognition towards the final number of one’s home loan mortgage.

While an enthusiastic underwriter could there be to protect the eye of the financial institution, the fresh new halo effect covers you, the buyer as well. That’s because an underwriter usually ensure what you really have registered by the examining study that have 3rd-team source. He/she may also ask for even more documentation. The procedure has been designed to ensure that you try not to romantic with the a home loan you cannot pay for.

Since the t’s is actually entered and you will i’s are dotted, their underwriter often offer acceptance to suit your financing, delivering your onward to a higher step in their home loan journey.

The journey regarding a mortgage App to Closure

- Getting Your own Mortgage Recognition

As underwriting techniques shall be finished in only a short while, it normally means an enthusiastic underwriter merely over each week and make the past verifications and supply approval. Definitely, the loan might require more hours from inside the underwriting depending on the newest particulars of your role, therefore avoid being concerned if it takes a little longer.

Immediately following recognition is provided, the loan after that moves in order to a deeper whom helps make a final verification of your a position and establishes the bucks necessary to completed the closure. At this point of your own process, their closer together with begins handling the latest name providers. The fresh title company is responsible for finalizing new buying procedure and you can facilitating the fresh new closure of one’s financing.

Your way away from a mortgage Software so you can Closure

- You have made They-Closing Big date Is here now!

When closing time comes, it’s time to suit your happier moving, because you are not totally all actions of getting control of one’s new house. But not, the method most kicks to your large knowledge three days just before closure, after you receive disclosures from the bank. Its essential that you make sure to comprehend them and get questions you have before you can appear into the closing day.

At your closure, you will end up expected in order to sign this type of documents as well as others about their home loan and family get. You could feel like you are including your own John Hancock into documentation seem to from inside the process, however, in the near future, you are passed the new keys to your house. That is when a fabulous the chapter you will ever have starts.

For your loan, their travel actually done, but that’s in which you come into: week from the times, you are able to cultivate the financial with costs and discover since your capital flowers toward house security!