In this article

- What’s an excellent Jumbo Mortgage?

- Jumbo Finance with ten Off

- Jumbo Financing and you may Borrower Exposure

- Jumbo Mortgage Certification

- Jumbo Financing Mortgage Insurance

- Can i Score a beneficial Jumbo Mortgage as a first-Big date Home Visitors?

Jumbo money having ten off commonly because uncommon as you may think. Of a lot home buyers are looking to pick more expensive properties one to meet or exceed conventional conforming home mortgage constraints. This will generally speaking require a jumbo mortgage. And you will, naturally we have been speaking of a ten percent advance payment when dealing with ten off.

What is actually a great Jumbo Mortgage?

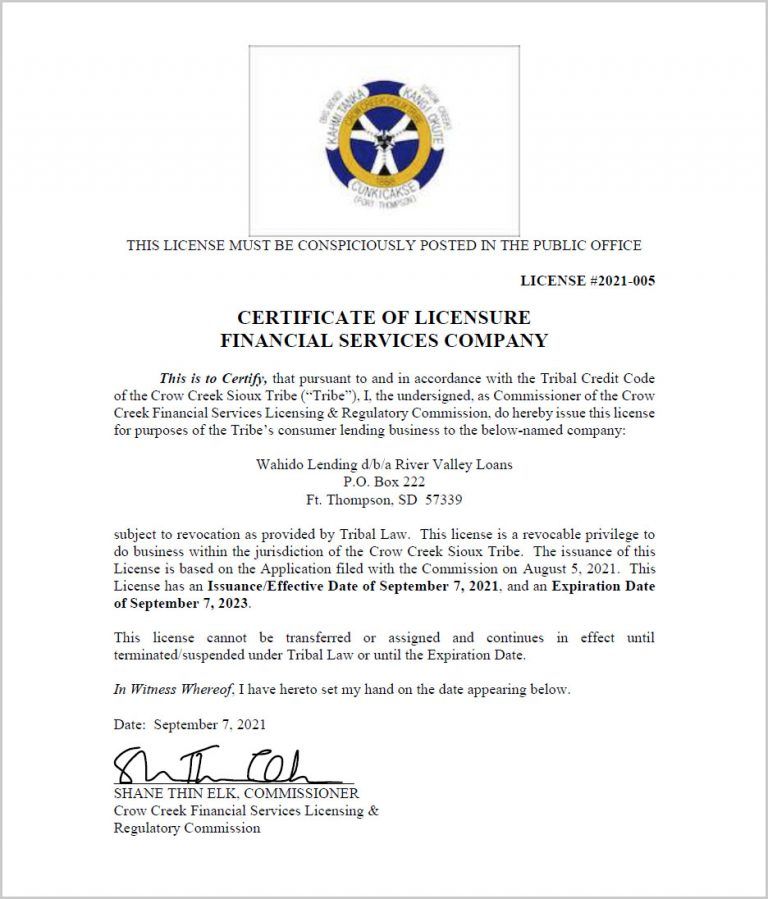

Let us begin by a quick recap out of just what a installment loans online Wisconsin good jumbo financing in fact is. Federal national mortgage association and Freddie Mac computer is the authorities agencies which guarantee of many mortgages. not, they won’t back home financing significantly more than a certain amount. Utilizing the Government Construction Money Agency (FHFA), they place conforming loan restrictions (CLLs) on a yearly basis. These types of limits are standard across the every country, whether or not they’re able to are very different according to place. Specific highest-charged locations are certain to get higher CLLs since the average home values in those counties try significantly high.

The quality conforming loan limitation to have solitary-product residential property in most American a home try [default_lon_limit]. Regarding the priciest markets, it does wade all the way to $step one,089,300. There are even various other CLLs to own multiple-device functions. Brand new restriction rises based on how of a lot systems there are. When you’re to invest in a house and its own rates is higher than the brand new conforming mortgage limitation regarding city, you will likely need certainly to get an effective jumbo mortgage. You might click on this link [link to an alternative jumbo financing article] to get more facts about jumbo fund.

Jumbo Funds having ten Down

Now why don’t we get back to the initial question. Do you really qualify for a great jumbo loan that have a 10% downpayment? The easy response is yes, however it is not necessarily that easy. The high quality advance payment required for an excellent jumbo mortgage could well be 20% of the loan amount (we.e., brand new house’s price point). Particular lenders may request a good jumbo mortgage downpayment while the very much like 25% otherwise 30%.

Meanwhile, particular borrowers will get be eligible for good jumbo loan which have a beneficial ten% deposit if not a 5% advance payment. As to the reasons? It can depend significantly for the household consumer and their economic disease. Consumers which have better financial standings will normally do have more financial loans, especially when you are considering jumbo finance.

Jumbo Loans and you will Borrower Exposure

It all boils down to chance. While the jumbo fund meet or exceed the latest CLLs consequently they are maybe not covered of the Federal national mortgage association otherwise Freddie Mac, the lender are immediately just in case significantly more risk. You may be working with an immediate bank such as for example a bank or thanks to a large financial company who isn’t providing the money actually. Regardless, anyone should financing the home financing and tend to be getting with the way more exposure when providing a great jumbo loan. In the event that a debtor defaults into an excellent jumbo loan, it will also create much more complicated damage to the newest lender/financial.

Jumbo Mortgage Qualification

When you get a jumbo home loan, you will have to proceed through an initial qualification procedure (mortgage pre-approval) after which in the course of time a last recognition before the mortgage is funded. The lender tend to review your credit score, your debt-to-income (DTI) ratio, earnings, a position, taxation statements and other monetary information. They will certainly and additionally ask just how much you want to get on the your deposit.

Really jumbo loan companies require a credit rating out of at least 700 and a DTI away from only about 43%. Of course, your own average monthly money might also want to feel sufficient to fund the fresh new month-to-month mortgage payments. Your own certification standards could possibly get decide how much downpayment could well be necessary. People who have strong monetary standings could probably get a great jumbo mortgage having a lesser down-payment. Those in a weaker standing may need to pay a high advance payment in order to be considered. Remember the advance payment number also can significantly affect your own qualified financial price, so people expenses straight down upfront may possess high fixed attract prices since the another way to counterbalance the lender’s chance.

Jumbo Mortgage Financial Insurance policies

When you find yourself in a position to qualify for good jumbo real estate loan having below 20% off, you happen to be required to spend individual financial insurance policies (PMI) otherwise a mortgage insurance premium (MIP) inside your month-to-month mortgage repayments. Home loan insurance policy is an additional payment reduced of the a debtor in order to help safeguards each other all of them and lender in the example of a loan default. Make sure to ask your financial about home loan insurance policies or any other charges which is often of the jumbo financing.

Sure, jumbo fund are available to earliest-date home buyers. Although not, lenders will pertain significantly more scrutiny whenever reviewing debt degree conditions. Extremely jumbo financing borrowers are move-up homebuyers who will be using an enormous percentage of collateral out-of a previous property on the fresh down payment. This needless to say brings an advantage when trying to get a beneficial jumbo mortgage.

A primary-go out domestic visitors will demand an excellent FICO rating, reduced DTI and you can expert income/a career history so you can qualify for a beneficial jumbo mortgage. Increased bucks down-payment will also create a primary variation. Jumbo money that have ten down may be harder having earliest-big date consumers discover, but it’s a chance if they’re economically good for the such other places. Mortgage insurance rates certainly will be required toward people earliest-date consumer jumbo finance that have lower than 20 percent off. It may be also requisite for individuals who set 20 percent off, nevertheless bank was requesting twenty-five-30 percent.

You will need to consult a skilled mortgage lender or financial broker. See if an effective jumbo financing is a good option for your and have now pre-acknowledged for your jumbo mortgage to find out if your be considered. Contact Moreira Party | MortgageRight today to discover more about jumbo fund and get already been together with your application.