Scholar at the Ohio College or university

When your credit rating try 696, your slide right in the guts. Considering Experian, at the time of 2021, the average American user keeps a FICO Rating out of 714. A credit history throughout the directory of 670 to help you 739 is basically experienced good.

An effective 696 credit history is normally thought to be mediocre by the extremely lenders, demonstrating that you basically pay your own debts punctually. In this post, we’re going to delve better with the what your 696 credit history represents whenever making an application for fund and just how you might work with enhancing your score.

How much does an effective 696 credit history mean?

As mentioned prior to, a good 696 credit score falls for the range commonly regarded as good credit. Loan providers tend to view score contained in this assortment to possess mortgage approval. However, it get does not put you on ‘very good’ otherwise ‘exceptional’ borrowing from the bank levels, which can apply at their qualifications having an excellent lender’s best interest pricing and you can loan terms and conditions.

Consumers which have a beneficial 696 credit history are considered seemingly lowest risk with respect to paying off debts. New statistical default pricing may include 4.6% getting users that have results ranging from 660-679 to a single.9% for those from the 720-739 diversity. Although their score cannot indicate poor credit, of a lot borrowers in the good credit get variety could have periodic late repayments, a finite credit score, or negative credit guidance (instance financing default) from several years ago, and come up with loan providers take action a little more caution.

Can i see a charge card having a good 696 https://paydayloancolorado.net/meridian-village/ credit score?

The fresh brief answer is sure. Just be in a position to safer a basic (non-secured) charge card with a beneficial FICO Score on the selection of good credit scores. Yet not, there are two significant caveats to look at.

Earliest, youre unlikely to be eligible for some of the best credit card also offers on the market. To gain access to an educated advantages handmade cards, balance import now offers, and you can 0% Annual percentage rate even offers, lenders will look for higher level credit, which have score notably greater than your own. You may receive a diminished credit limit versus customers that have large ratings.

2nd, your credit score is just one the main mastercard approval techniques. Lenders in addition to account fully for your almost every other bills and you can a career problem. Indeed, customers about professional borrowing levels may often get denied due so you’re able to highest degrees of almost every other expense.

Ought i secure a car loan that have a beneficial 696 credit rating?

Indeed. Your own 696 credit score qualifies you to have a car loan, considering your income warrants they. not, it is necessary to remember that your credit score can somewhat impact the pace you receive, especially in automobile credit.

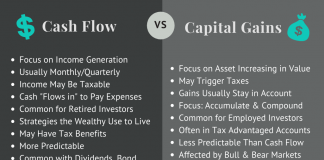

Since , according to MyFICO, the common Annual percentage rate to your a beneficial 60-few days the latest car finance for those that have good FICO Get out-of 720 or maybe more is 5.64%. Having a get regarding the 690-719 diversity, it’s 6.83%. To own individuals with a score from the 660-689 level, the common Apr is actually nine.19%. To place it to the position, consequently with the an excellent $40,000 the brand new car loan, some one that have a beneficial 730 rating would pay as much as $cuatro,000 reduced in desire than simply a debtor that have a good 680 rating, despite one another scores falling towards the ‘good credit’ category.

It’s value listing one rates can differ most certainly one of lenders, for even borrowers with similar credit rating. Which, when selecting a home or car, it’s imperative to look around to discover the best mortgage terms and conditions. The fresh FICO credit history model was designed to prompt price shopping. Numerous concerns on your own credit history for similar types of loan within this a short span (constantly 2 weeks) number just like the one inquiry to possess rating objectives, so it doesn’t adversely effect your credit rating to put on on numerous lenders.