Subordinate Money Requirements

Federal national mortgage association sales otherwise securitizes earliest-lien money where in fact the covered property is susceptible to subordinate resource, apart from co-op show finance which can be at the mercy of under capital. (Select B5-7-01, Large LTV Refinance mortgage and you may Debtor EligibilityB5-7-01, High LTV Refinance loan and you will Borrower Eligibility having exclusions to this rules.) Using liens need to be

- evidenced by the a beneficial promissory note;

- mirrored when you look at the a noted home loan, action out-of faith, and other shelter appliance; and you can

- certainly using in order to Fannie Mae’s first mortgage.

Lenders have to reveal the existence of subordinate money and also the using resource payment terminology in order to Federal national mortgage association, the newest appraiser, as well as the financial insurance carrier.

Note: Until they qualifies once the a community Mere seconds financing, a binding agreement significantly less than and therefore a borrower is forced to shell out a beneficial third-cluster (except that a co-holder of your topic possessions) a percentage in just about any like in the property value the topic house is not let.

The lending company have to think all using liens protected of the topic assets, regardless of the compelled people, whenever figuring CLTV and HCLTV percentages.

But while the revealed into the Acceptable Subordinate Financing less than otherwise below Section B5-5.step one, Society Mere seconds, few other style of registered tool recording or protecting the fresh borrower’s responsibility to blow a cost regarding the financing complex to the newest borrower in terms of the first financial is allowed, unless those funds had been cutting-edge toward debtor of the an excellent co-manager of the topic property. No matter whether they qualifies given that resource, eligible subordinated otherwise unsecured Pace structures are allowed in line with B5-step three.4-01, Property Analyzed Brush Opportunity LoansB5-step three.4-01, Assets Reviewed Clean Time Money .

For more information on under investment came from exposure to the fresh Part 502 Leveraged (Blended) Mortgage Program, select B6-1-05, Qualified RD-Guaranteed MortgagesB6-1-05, Qualified RD-Protected Mortgage loans .

Acceptable Subordinate Investment

Whether your interest rate to own funding provided with the house or property supplier is over dos% lower than most recent basic costs having 2nd mortgage loans, brand new subordinate money have to be sensed a money concession therefore the using money amount should be subtracted regarding the sales price.

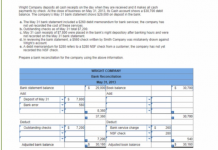

Inappropriate Using Investment Terminology

The fresh table lower than identifies types of unsuitable under funding words on the capital that will not be considered because the a qualified Neighborhood Seconds financial.

Note: Federal national mortgage association encourage these under capital conditions if amount of subordinate financial obligation are limited prior to brand new borrower’s financial assets and/otherwise borrowing profile.

Fannie mae it allows changeable money having using financing that will not meet the requirements due to the fact a qualified People Seconds loan should your after the terms is actually satisfied:

Apart from HELOCs, if installment terminology permit a varying interest, the fresh payment per month need certainly to are still constant each a dozen-week several months along side name of your own using home loan. (To own HELOCs, the new monthly payment shouldn’t have to are nevertheless ongoing.)

The brand new monthly payments for everybody using liens need certainly to safety at the least the attention owed with the intention that bad amortization cannot exists (apart from workplace subordinate financial support who’s got deferred repayments).

Eligible Payment Terms and conditions to own Company Under Capital

In the event your under financing are in the borrower’s manager, it generally does not have to wanted normal payments from possibly dominating and you will notice otherwise attract merely. Boss using funding tends to be organized in any of your own following the ways:

The credit terms might provide towards employer to require full payment of one’s debt in the event your borrower’s work try ended (sometimes voluntarily or involuntarily) through to the readiness day of the subordinate investment.

Resubordination Criteria having Refinance Deals

In the event that subordinate financing is remaining set up concerning a first-mortgage re-finance purchase, Fannie mae means execution and you will recordation out of a beneficial resubordination agreement.

When the county legislation it allows under money to remain in an identical under lien reputation oriented on earlier https://simplycashadvance.net/title-loans-in/ first-mortgage which is getting refinanced, Fannie mae doesn’t need resubordination. The brand new using lien need certainly to see any specified standards of one’s relevant laws and regulations.

Note: Name insurance coverage against the undeniable fact that a former using lien is actually perhaps not properly resubordinated on refinance mortgage will not discharge lenders from compliance with these resubordination criteria, otherwise out-of Fannie Mae’s needs that the property is 100 % free and free from all of the encumbrances and you may liens that have consideration more than Fannie Mae’s financing.