Even offering the bank at a price off $0 each share wouldn’t likely attract a purchaser, David Chiaverini, an analyst at the Wedbush Ties, published within the a note to website subscribers. “A create-become acquirer do generally getting using $thirteen billion on top of any kind of consideration is offered” in order to Earliest Republic shareholders.

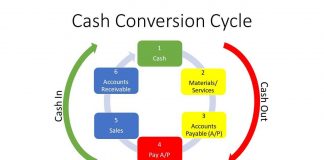

But it’s along with tough to earn cash installment loans in Virginia with so far reduced-attention credit weighing for the instructions. For the mid-February, Very first Republic said it actually was purchasing as much as 5% to own tens off huge amounts of bucks when you look at the capital in the Federal Reserve and you can Government Home loan Financial.

Certainly Wall Streeters, it had been an unbarred magic that San francisco bay area-dependent bank is providing such as for example glamorous words on mortgage loans. New york city possessions records from the early in the day number of years reveal customers originated in all over the economic market and incorporated community leadership for example Goldman Sachs Group Inc. President John Waldron, who grabbed away an $eleven.dos million financial during the , and you will R. Lawrence Roth, a section associate from the Oppenheimer Holdings Inc.

Each of their fund got ten-year notice-merely attacks and you may prices starting lower than step 3%

A new Goldman Sachs mate, an old professional at Blackstone Inc. and you will a controlling movie director within personal equity organization Sycamore People together with lent millions regarding the lender, the home details tell you.

Outside the finance business, most other examples of Basic Republic customers with seven-contour mortgage loans in the New york are songs mogul Todd Moscowitz, and additionally an exec at an occurrence campaign while the holder from a superb-museum, according to property suggestions.

`Spouse for Life’

Interest-simply financing have been popular for decades, with financial institutions providing them to pick customers. The fresh mortgages accounted for a little cut of bigger the prominence arrived at skyrocket because loan providers pedaled these to smaller creditworthy people, nearly all exactly who was speculating from inside the scorching construction places.

Men and women financing have been notorious by the 2007, which have an increasing number of borrowers incapable of keep up with balloon payments otherwise promote their homes. As the casing crisis escalated, interest-simply lending plunged.

Earliest Republic grabbed an alternate strategy, while making appeal-merely finance in order to consumers that have good wide range and you will strong borrowing from the bank records a switch element of the extension over the past decade.

The latest company’s yearly records let you know the organization expanded for a long time and you will then became popular because interest levels bottomed out in 2020 and you may 2021. Where period, a Bloomberg Information studies regarding Home loan Revelation Act details reveals the bank produced over $19 mil in the mortgage loans with desire-only repayments within the about three area areas by yourself: San francisco bay area, La and you can Nyc. The debt including flowed in the a big answer to the brand new Hamptons therefore the wine country north away from Bay area.

Just last year, consumers whom preferred interest-just repayments produced $one million a-year typically, more double the earnings away from Basic Republic customers which joined for mortgages instead which feature, the details let you know.

Of the start of the this current year, Very first Republic’s yearly statement means that money to have single-household members functions accounted for 59% of bank’s complete financing guide. Three-fifths of these – from the $58 mil – were still inside the desire-only symptoms. Dominant repayments towards the majority never start until no less than 2028.

Pleased users was basically an installation inside the Basic Republic’s advertising, that have millionaires and you can company leaders extolling their customer care and you may dubbing the firm a good “companion for a lifetime.” If the homebuyers including left dollars in the financial, it could plow the money towards other investment in order to burnish production towards the people matchmaking. So many rich group, business owners and you will enterprises placed finance you to surpassed the newest Federal Deposit Insurance rates Corp.is why $250,000 coverage limit, one to specific $119 mil – or a couple of-thirds of the bank’s total places – was uninsured at the end of a year ago.