Consider all of our composing people such as your Yoda, with pro financing suggestions you can trust. MoneyTips teaches you principles simply, instead special features otherwise formality, so you’re able to live your very best monetary life.

Nathan connects with people, organizations, and you will information channels to help instruct all of them with the currency things and you can activate monetary feel. The guy thinks one gaining monetary triumph starts with pinpointing their priorities and you may up against all of them head on. You have viewed Nathan on your own regional news channel speaking about playing with handmade cards responsibly, strengthening a good credit score, and.

Found in most of the higher house sale contract is an excellent financial backup condition. When you’re like most of the house to get inhabitants, you’re probably getting home financing purchasing a house.

Due to the fact there is no make sure might be eligible for a home loan, adding home financing backup clause to help you a genuine estate price often cover your in case you apply for a mortgage but do not qualify for the mortgage.

The borrowed funds backup (aka mortgage backup otherwise financing contingency) is a clause one becomes put into the actual property purchase contract. This new condition provides homebuyers a set period of time so you can secure a mortgage.

In case your buyer cannot have the financing at that moment physique, the customer can also be back out of the product sales without having any court consequences, in addition they can get its serious money put right back.

Home loan contingencies are important. Discover more about how they work, just how long it last and all the significant info you can easily wish to know.

Serious cash is good good faith put the consumer sets down to demonstrate that they’ve been intent on purchasing a property.

How does a mortgage Contingency Works?

To get a home is not as straightforward as handing the vendor good take a look at and you may getting in touch with they 1 day. If you’d like to purchase a house, the first thing you need to do is make a deal on provider.

A home loan backup comes in useful once you understand you will end up taking out fully that loan to the family, you haven’t accredited but really. Such backup can also be a useful device when you might be suffering from your bank account, and you are not knowing about your possibility of bringing approved to own a loan.

If you believe you’ll need a home loan contingency, work at your own real estate agent to provide brand new condition to help you the provide purchasing (aka you buy contract). Think of the term as the a back-up. Incorporating it can will let you disappear in the package no penalties.

Shortly after the client and you will supplier indication the acquisition arrangement, the buyer can make an earnest money put, and also the vendor needs their residence from the sector.

Areas of a home loan Contingency Condition

A mortgage backup was a thoroughly created clause (both one or more condition) one both the vendor and you can client have to acknowledge.

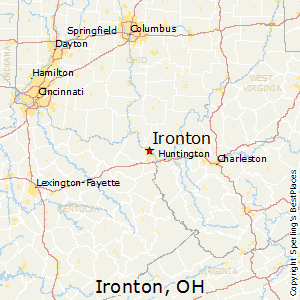

- Financing type of: The consumer and seller need to agree on the sort of mortgage Selmont West Selmont loans the customer becomes (antique, FHA, Va, an such like.), so that the buyer can be move on for the closing techniques.

- Loan amount: They specifies how much cash the consumer must be accepted having.

- Rate of interest: The buyer need to suggest the utmost interest they’ll accept to your mortgage. In case the consumer gets acknowledged however the interest rate is a lot more than the max, they are able to leave.

- Origination items (fees): The number of origination factors or charges the consumer will pay to obtain the loan.

- Deadline: The conclusion big date of your home loan backup months.

Most a residential property buy arrangements past as much as 29 – 60 days. The consumer are certain to get you to definitely long in order to qualify for financing.