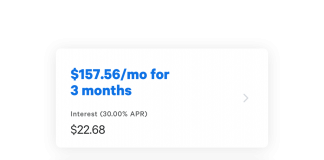

Reviewing the borrowed funds conditions of this a 401(k) Fidelity loan is imperative, whilst concerns understanding the financing contract, cost schedule, as well as the terms detail by detail because of the Fidelity.

Exploring the financing arrangement means you already know the eye prices, costs, and you will any possible punishment with the mortgage. Knowing the repayment agenda helps in making plans for your funds effortlessly, ensuring fast money to get rid of people bad impacts in your later years deals.

Certain terms and conditions lay of the Fidelity for example credit constraints and you may limits are crucial to consider and also make informed behavior regarding the mortgage. From the very carefully looking at these details, you can avoid any surprises and make the absolute most of the mortgage when you are safeguarding your a lot of time-title financial requirements.

Fill in Financing Demand

Distribution your loan demand scratching a life threatening stage regarding the 401(k) Fidelity mortgage processes. The newest demand undergoes investigations within a particular acceptance schedule according to predefined conditions.

This evaluation generally pertains to an intensive writeup on debt background, credit history, and you will newest a position standing to decide your qualification with the loan. This new recognition standards are created to ensure that borrowers meet certain monetary stability requirements.

When your demand entry it initially testing phase, the fresh handling time for mortgage acceptance may vary with regards to the difficulty of the application. Essentially, much easier applications should be approved easier, usually within a matter of weeks, when you’re harder cases takes many weeks getting a last choice to get attained.

New 401(k) Fidelity financing procedure includes acceptance of loan, disbursement from financing, and establishment of a fees plan that have an exact agenda and you will contract terms and conditions.

Because application for the loan are submitted, the brand new approval processes generally speaking pertains to a glance at new borrower’s qualifications. This can include affairs such as for instance a career status, credit score, additionally the adequacy of your own 401(k) money to pay for asked loan amount.

Up on recognition, the money was paid into the borrower’s designated account, constantly within this a designated timeframe. To make sure fast fees, individuals have to develop a payment package detailing the assented-upon agenda, rates, and you can any penalties for late money. The ultimate mission is always to fulfill the loan responsibility according to the fresh new set words.

Financing Approval

Through to conference the desired requirements, financing recognition to possess a beneficial 401(k) Fidelity loan is short for brand new enjoy of your consult, unlocking the key benefits of credit and you may demanding choices with the cost solutions.

When applying for that loan, you should have a great credit history, stable earnings, and you will a reduced debt-to-earnings ratio. This type of activities are cautiously sensed when you look at the acceptance procedure.

As soon as your loan is eligible, you will have access to money used having a sorts of aim, such as home improvements, debt consolidation reduction, otherwise unforeseen expenses. Likewise, financing will provide down interest rates as compared to other designs off borrowing from the bank.

Once recognition, you might choose from different cost possibilities, including fixed monthly obligations, interest-just costs, or flexible schedules predicated on your financial needs and you may points.

Receive Finance

Just after financing approval, the next thing involves the bill off money from new 401(k) Fidelity mortgage, which have disbursement going on in this a specified schedule and enabling usage depending on outlined measures.

Up on disbursement, it is important to stick to brand new put timelines having fund application. Finance are typically released into the latest designated account, ensuring quick access to have intended costs.

This type of money have to be made use of according to the in depth guidelines so you can end one charges otherwise misuse. Its imperative to see the disbursement techniques thoroughly to really make the all the borrowed finance and meet the financial expectations https://clickcashadvance.com/payday-loans-va/ consented abreast of from inside the app procedure.

Fees Package

Starting a payment bundle is extremely important article-loan disbursement. This tactic contours the new schedule, strategies, and you will volume out-of money to your 401(k) Fidelity loan to handle loans effectively.