Credit unions need to look to own an approach to build resource middle-assortment orders easier for millennials and other participants.

In the last lifetime, there is naturally viewed research you to definitely millennials check borrowing from the bank in another way than simply earlier in the day generations. He has a lot more student loan financial obligation. He’s got postponed trying out home financing up to a bit later on inside the lifetime. He is less likely to own a car and then have an effective vehicle payment.

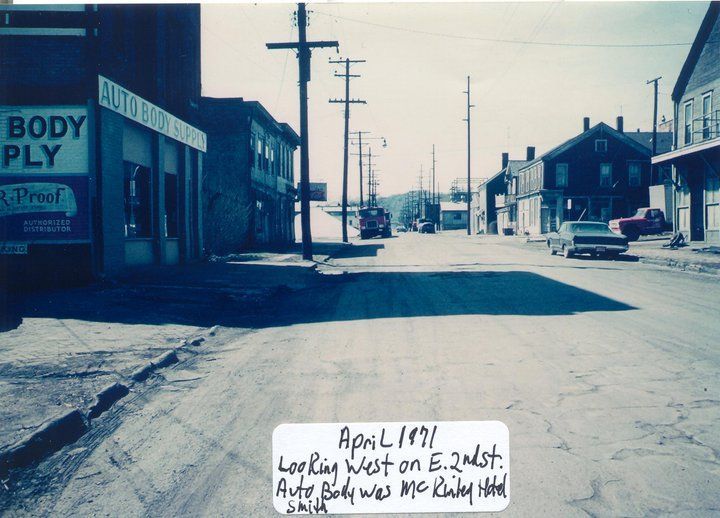

They also appear to have turned-back brand new clock nearly forty decades on their look at handmade cards and you can significant instructions. Whenever i started in the fresh lending team thirty six years back, I found myself with a nationwide consumer finance company having almost 700 twigs. Our bread-and-butter is actually financial support sales from the $five hundred to $dos,000 diversity, mainly furniture and you can equipment, even in the event I recall investment sensible utilized automobiles, very early satellite dishes and you may a personal cool for a good kegerator from Beer Meister!

Financing Viewpoints: Back into the near future … Which have Short Finance?

At the time, such requests was very hard to pay for having a card cards. Regarding the mid-eighties, even individuals with prime credit scarcely had a visa having a great limitation more than $3,000. Limitations on the $step 1,five-hundred range was indeed way more common, and never all creditworthy consumer had a card. Funding orders about $five hundred to help you $2,000 diversity was a giant industry, which have Helpful, Domestic, Norwest, Avco, Coverage Pacific and a variety of missing people dotting the land in just about any city of significant size.

As the credit card issuers turned significantly more aggressive throughout the ’90s and you may very early 2000s, brand new monetary institution enterprize model changed, and you can home guarantee and mortgage credit occupied the new gap. If a buyers did not have a major charge card, they just weren’t planning to qualify for it small-ticket financial support. Individuals who performed features a primary mastercard probably used it instead of the typically more expensive merchandising installment contracts given by these companies (21% so you’re able to 30% APR). As we know, the nice Recession murdered off the monetary institution, although enterprises particularly OneMain Financial enjoys more sluggish built up the company, regardless if just to a shade of their former size.

In comparison to 3 decades ago, credit cards have greater prices and lower money. According to rate and the commission schedule, it will take doing sixty many years to repay a cards putting some minimal paymentsbined into the fact that Millennials appear to be smaller prepared to accept what they understand since a keen evergreen product such as for instance a charge card, spending money on large instructions which have an installment loan that have a small number of costs is sensible. Also non-millennials be seemingly prepared to continue big commands separate away from the greater number of bland commands taken care of by the its handmade cards.

A pretty the business named Inform is actually betting it does blend the very best of both worlds using its this new Inform mastercard. Similar to how particular household equity lenders has invited users so vital link you can protected the interest rate having a portion of their lines of credit to possess a major pick or get better, Upstart can help you protected a performance and you may good term to possess a primary pick produced to their credit.

Carry out borrowing from the bank unions need to go after suit? Given that both of new quoted blogs point out, brand new revival away from small citation otherwise part-of-purchase resource has been triggerred by the enhanced tech. Yet from my experience thirty-five years back and you will understanding how section-of-sale financial support is being made use of now, it’s difficult to create tall increases over a long period of amount of time in a corporate that is reigned over by reduced loan wide variety. You want lots of money! Actually good mil-buck also borrowing partnership inside a major urban markets could easily fork out a lot of cash to grow the technology, but remain status regarding cooler regarding one thing apart from limited degrees of increases. Need a nationwide reach and work out a significant difference in the your own profile, in my opinion.

Exactly what can i do in order to fight this growth in point-of-product sales lending? In my opinion the answer lays together with your bank card, personal loan and you may household equity mortgage situations. Because of excessive risk-taking and you will expensive award applications, charge card rates is located at historical highs when comparing to brief-term financing pricing. Really does your borrowing from the bank connection offer a diminished-speed, low-frills card that will focus individuals who commonly hold balances? If that’s the case, you will be attracting a number of this provider without even understanding it.

Signature loans have been the battlefield of your fintech loan providers to have the greater part of a decade. What have you done to make taking a little unsecured loan smoother, less and you can minimal? It blows my personal mind once i get a hold of some borrowing unions however recharging double-digit rates of interest for personal money on the most readily useful credit-accredited players! To be competitive in the modern market, the loan cost for the high qualified players have to start which have an excellent six otherwise a great 7. You want a feeling of urgency too. Over the last year or so, during the Ent Borrowing from the bank Relationship there is tracked brand new percentage of signature loans financed in this a couple of hours out-of software. We’re around 29% and you may growing, regardless of if usually the latest associate doesn’t need the bucks one easily.

Finally, your own credit union should grab the un-lender eg method to family security loans. Home collateral fund at the most banking institutions never have recovered adopting the Great Market meltdown. Rates one for the 2007 was primary minus a great margin are now actually perfect and. Control a property security loan at the most banking companies is far more like a slightly dumbed-off home loan than just a slightly much harder consumer loan. Your targeted speed is not to alter towards the thirty day period delivered to personal a mortgage, its 3 to 5 months unless you really need an assessment. Over the last 10 years, household security funds within Ent had been increasing within double-digit rates due to the fact we have chosen getting an educated price inside town. We have you to definitely feeling of urgency to acquire fund finalized because quickly you could, yet we have been still providing a product or service which is very profitable having the harmony piece.

This type of solutions in order to credit cards and choices for short-violation money have started to grow and construct company due to how the finance companies look at the more conventional a way to manage business. Imagine for example a credit partnership is because of the centering on professionals and you can their needs, therefore would be to continue to winnings the fight into the American client’s business.

Cues associate Statement Vogeney is the chief funds manager and you can worry about-professed lending technical to have $5.9 billion Ent Borrowing Partnership, Tx Springs.