- You are not confident with the chance of starting 5-10% under water on the home (to put it differently, you won’t want to produce a giant check to leave from it in the event the points changes).

The conclusion

Out-of a threat view, it’s generally better to wait until you may have at the very least 20% to put down on the home before buying. Like that, you’re going to be quicker at the mercy of downturns and you will probably also provide availableness into the finest mortgage prices. However, more importantly, which decision (and really all your larger financial conclusion) is focused on life a lives. I am aware part of that’s trying to minizine chance. But there’s more to they! Sooner it comes down towards the book affairs and you may preferences.

https://speedycashloan.net/loans/safe-payday-loans/

If you’ve obtained so it much inside our article, sweet business! Since you dig towards issue, be looking having problems interesting underpinning the material you happen to be understanding.

The greatest dispute you may see ‘s the almost all new doc loan info on the internet now is written by the article authors that are lenders on their own (they sell loans) or they have been authored by third party article writers that will be repaid so you can promote loan providers. We really do not accept advertisements bucks out-of lenders (or people even). I also are beyond the organization away from selling fund. Whenever we refer anyone, it’s because we know they have a substantial tool or there is had a beneficial feel using them. This is very important for you to discover since these particular issues usually make it a lot likely to be the author usually force your in a single particular assistance. Whenever you are currently aware of so it, you happen to be a lot less planning rating corralled into the an invisible conversion mountain.

Although we create a supplementary work to minimize disputes of great interest, we are really not completely free of those. All of our disagreement of great interest is that we are monetary coordinators on team of taking face to face financial advice about medical professionals and you may physician family members. Delivering top quality guidance necessitates that we get knowing the website subscribers that assist him or her make a whole economic plan. That it will get the cornerstone from big decisions such as purchasing property. We’d choose to learn you too, and you may explore the way we could possibly assist. In the meantime, all the best in your travel to order property!

Almost every other Home loan Resources

- The loan Teacher is a great web site to possess looking towards the wide variety and you can choice a whole lot more. He’s got a number of higher home loan calculators and you may spreadsheets to assist get acquainted with home loan choice.

- Light Coating Buyer Selection of Doctor Mortgage brokers in america: Listed below are some Jim’s set of many physician lenders in america planned because of the state.

And, when you are impact weighed down by a few of these alternatives, excite contact all of us. We let customers navigate these types of choices all round the day. We’re willing to setup a free consultation to determine whether our company is a good fit.

- Convenient and much easier financing can dictate one to spend more to the a house (believe New iphone investment).

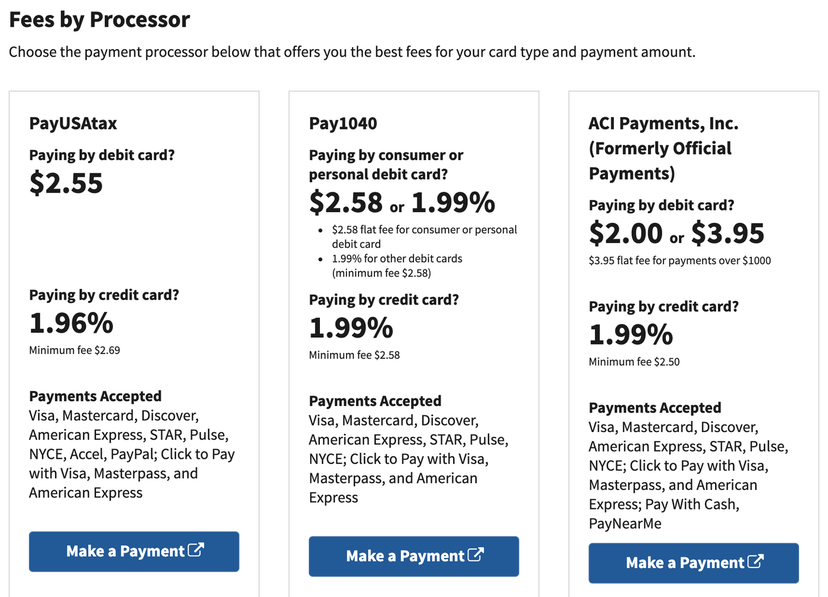

Mortgage Expenditures:

If you’re considering a supply, feel extremely mindful when there is a go you plan to get in our home beyond the identity period. It could be best that you manage the fresh amounts towards terrible circumstances (higher rate) situation. Keep in mind that nobody extremely knows just what future retains. All we know for sure is the background in addition to present. If you find yourself interested just what past historical 30 year mortgage pricing have been, select lower than graph off FRED:

Whenever you’re not throughout the military and cannot score a Va Mortgage, you ought to foot so it decision on how long you can own this new house as well as how far you intend to pay to your home loan. Let’s discuss the best options based on these types of items:

- You are in the army and you are clearly disabled. In this case, consider a good Virtual assistant loan as an alternative.