Regardless if you are an initial-big date home customer or someone who has purchased several land that you know, having a great set of attributes to select from tends to make all the difference in helping to get your perfect domestic. And here HomePath by Federal national mortgage association will come in.

Federal national mortgage association , a federal government-paid business one shopping mortgages out of lenders, sells properties it possess regarding HomePath – to the goal of supporting neighborhood stabilization and helping group look for just the right domestic.

Continue reading for additional info on Fannie mae HomePath attributes, whether purchasing one ‘s the proper one for you plus.

A federal national mortgage association HomePath property is an article of a property which was acquired by the foreclosure or a deed in lieu property foreclosure. People can purchase a good HomePath home out of Fannie mae having once the little just like the an effective step three% deposit and you may found an ending rates credit as huge as 3% of your own purchase price whenever they make use of the HomeReady mortgage program.

Federal national mortgage association is actually an authorities-backed firm that provide exchangeability and you may stability into housing market by buying mortgage loans regarding loan providers and you may promoting them in the great outdoors business. When a homeowner is having difficulties and work out their mortgage payments, Federal national mortgage association works together their individuals to learn the options and you will stop foreclosures. Regrettably, one to both isn’t you can easily.

HomePath try a bona fide home platform in which Federal national mortgage association marks and offers brand new land it has obtained courtesy property foreclosure. Federal national mortgage association HomePath features include a wide selection of features, and single-nearest and dearest homes, multifamily property and you may condominiums. Federal national mortgage association works to transfer these functions so you can new citizens inside a punctual trend to incorporate stability into neighborhood and minimize society perception.

To order a home using HomePath comes with numerous professionals, including the capability to initiate the latest to acquire process with just you to definitely click. To shop for due to HomePath gets borrowers entry to a federal national mortgage association HomeReady Mortgage, which is available in order to earliest-date home buyers and you can helps green homeownership.

Customers may also gain benefit from the HomePath Ready Customer Program, an on-line degree path enabling these to located doing 3% in closing rates guidance.

See just what You Be eligible for

Congratulations! In line with the pointers you may have given, youre entitled to remain your residence mortgage techniques on line which have Skyrocket Financial.

Frequently asked questions About the Fannie mae HomePath System

Will you be a house consumer otherwise a home trader that questions relating to the new HomePath system? Reading the fresh new responses lower than might help offer quality regarding the program and you may respond to any queries loans in Shoal Creek you really have.

To invest in a good HomePath possessions provide an excellent chance of first-date homebuyers to track down an inexpensive home with flexible resource. But not, there can be a large idea to consider: Fannie Mae’s home had (REO) features are sold because the-was.

While some of your property is circulate-for the in a position, anybody else might require light repairs or thorough renovations. If you are considering purchasing a good HomePath assets, a property inspection is a must so that you learn initial just what solutions was needed to transfer to the house.

How will you be eligible for a federal national mortgage association HomePath financing?

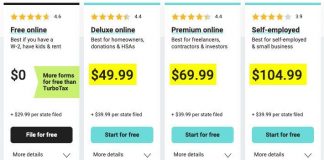

Federal national mortgage association also offers HomeReady Mortgages to your people away from HomePath land. It increased lending product is reasonable and versatile and will be offering invaluable homeownership degree to help you buyers. In addition, such loans can help customers which have below-mediocre borrowing get home loans. However these loans aren’t offered to folk.

So you can qualify for a federal national mortgage association HomePath financing, you must not features owned a property going back around three age. You are and expected to use the HomePath assets as your no. 1 residence inside two months shortly after closing.

- Low-earnings borrower

- First-date customer or recite customer who has not had a property for the during the last three-years

- Minimal bucks for a down-payment

- A credit rating with a minimum of 620 (on finest cost for credit scores over 680)

- An optimum loans-to-income ratio (DTI) out of thirty six%

- Supplemental boarder otherwise rental earnings

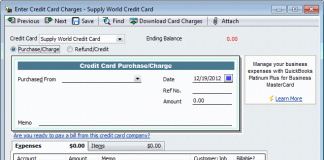

The whole process of to buy property can feel daunting to own basic-date customers, which really HomePath borrowers was. Contrasting and you can familiarizing on your own into the steps initial makes brand new processes go a little more effortlessly. Below are the new steps to buying good FannieMae HomePath assets.

Locating the best agent can make otherwise crack your home buying procedure. To shop for good HomePath property, you will want an authorized real estate professional by your side.

Whether you’re investment your residence due to a federal national mortgage association HomeReady Mortgage otherwise due to another type of lender, it is important you will get preapproval just before taking a trip house and you may submitting people also offers. Preapproval can help you learn how much you are accepted getting, make it easier to protect a reasonable interest rate, and you may enhance your promote.

Once you have been preapproved, you could start browsing functions on the web at the HomePath . This site is simple in order to browse – just go into the town otherwise Postcode the place you need certainly to browse. You’ll save your chosen homes and agenda tours on line.

One of several requirements of an excellent HomeReady Home loan courtesy Fannie mae is that you over homeownership training owing to a beneficial HUD-recognized company. You are able to participate in the fresh HomePath Ready Buyer System, which has a property consumer training coursepletion with the path can help you get step 3% in conclusion costs direction on your own mortgage.

After you’ve discovered the perfect house and done almost every other standards to order, it’s time to submit their offer. The real estate agent can help you pastime the ideal provide. And once the bring was accepted, you could start preparing for the new closure, when you are able to technically buy the family.

The conclusion: An excellent HomePath Assets Could be the Best Selection

This new Fannie mae HomePath system provides a different chance for basic-date home buyers to buy a reasonable home with an easy financing techniques. This type of HomeReady finance keeps multiple criteria that individuals must consider.

While doing so, because homes can be bought since-is actually, consumers must be ready to make any requisite repairs. However, in spite of the drawbacks, good HomePath property and you can HomeReady financing should be a option for the majority customers.