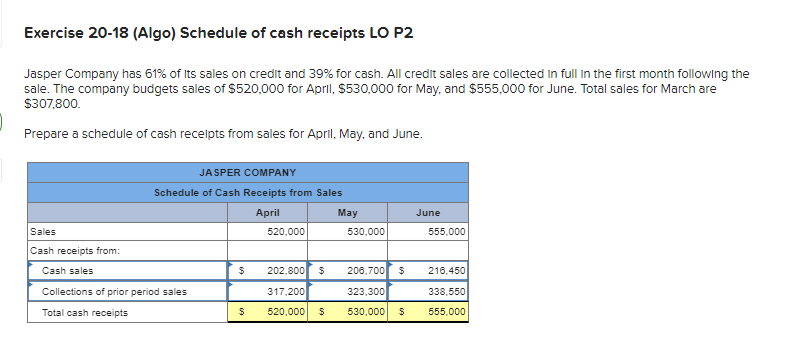

Looking to buy a house and get home financing a bit soon? Know very well what you are signing up for that have is the reason mortgage repayment calculator. Finding out how far your monthly home loan repayments could well be is a must to getting a mortgage that one may manage.

Our mortgage repayment calculator helps guide you far you will have to shell out per month. You may also evaluate issues for various down costs wide variety, amortization periods, and you can variable and you can repaired financial cost. In addition, it exercises their financial default insurance costs and you can home import income tax. Advertisements Revelation

To utilize the newest calculator, begin by entering the price, next pick an enthusiastic amortization months and financial price. The newest calculator suggests the best prices for sale in their state, but you can also add an alternative speed. The fresh new calculator will now direct you what your home loan repayments commonly feel.

By default, the loan percentage calculator will teach four various other monthly payments, according to the measurements of the deposit. It will automatically calculate the cost of CMHC insurance policies. You might change the size of their advance payment and the commission volume to see how their normal commission could be inspired

The calculator along with shows you exactly what the home transfer income tax have a tendency to become, and you will up to exactly how much necessary for closing costs. It’s also possible to utilize the calculator to estimate the full month-to-month costs, see just what your payments will be if the financial pricing rise, and show what your a fantastic equilibrium might possibly be over time.

If you are to shop for a special domestic, it is better to use this new calculator to determine what you can afford ahead of time thinking about a house listings. While you are renewing otherwise refinancing and you will be aware of the total level of the mortgage, use the Revival or Refinance case so you can guess mortgage repayments as opposed to bookkeeping for an advance payment.

Yes, our very own mortgage repayment calculator is free of charge. Indeed, our very own hand calculators, articles, and you can rates analysis dining tables are 100 % free. earns revenue as a result of marketing payment, instead of of the charging pages. We offer a decreased pricing when you look at the per province provided by brokers, and allow them to arrive at people online.

How does their month-to-month calculator have four articles?

We think it’s important on precisely how to contrast the options top because of the side. We begin brand new calculator from the detailing brand new four most typical selection having downpayment problems, you are not limited by people alternatives. I and additionally allow you to will vary amortization period and rates, so you will be aware how an adjustable against. repaired financial rates alter their fee.

How can payments differ because of the state inside the Canada?

Extremely financial controls from inside the Canada is consistent over the provinces. This includes minimal down payment of 5%, additionally the restriction amortization period thirty-five age, such as. Although not, you will find some financial laws one to differ ranging from provinces. It desk summarizes the differences:

What is actually CMHC Insurance?

CMHC insurance policies (otherwise financial default insurance coverage) protects loan providers from mortgages that standard. CMHC insurance policy is required for all mortgage loans when you look at the Canada with down costs of below 20% (high-ratio mortgages). It is an added cost to https://paydayloancolorado.net/berkley/ you, that is computed as the a portion of your own complete financial count. For additional info on mortgage default insurance policies, delight realize our help guide to financial standard insurance coverage (CMHC insurance coverage).

What is an enthusiastic amortization agenda?

An amortization plan reveals your monthly payments through the years while having suggests the fresh portion of for each percentage paying off your dominating versus. attract. Maximum amortization for the Canada are twenty five years toward down money less than 20%. The most amortization months for everyone mortgage loans is 35 age.

Even in the event their amortization can be twenty five years, their identity is much quicker. Most abundant in prominent term in the Canada are five years, the amortization is upwards to own restoration in advance of their mortgage is reduced, this is the reason all of our amortization plan teaches you the bill out-of your financial at the end of their name.