Lucas Horton didn’t expect difficulties when he taken out a home loan. Whatsoever, his credit score was a student in new 800s-which is higher level. And you can, given that holder from a custom jewelry story from inside the Dallas, Horton made a money.

Of numerous notice-operating pros, such as Horton, not be able to become approved to have mortgages. The reason why are many, but primarily boil down compared to that: Of several self-employed experts don’t have a timeless paycheck, and therefore need to have a tendency to keep working harder to prove their earnings. With that in mind, check out suggestions to help you to get approved getting a mortgage-whether or not you will be your own workplace:

1. Remain taxation deductions down

It may sound counterintuitive, however, notice-employed gurus will be disregard fewer expenses for at least two ages before applying to have a home loan, claims Nikki Merkerson, JPMorgan Chase’s People Reinvestment and you will Neighborhood Union Manager.

This is because loan providers check your earnings after build-offs. So taxation filers who deduct an abundance of expenditures commonly reveal a full time income that looks dramatically reduced than it really is. “When you get a home loan, you will want to reveal additional money to pay for alot more domestic,” claims Merkerson.

This plan worked for Horton as he reapplied having their mortgage. Because of the maybe not saying as much providers expenditures, he had been in a position to create a supplementary $25,100 to his money. “Even in the event I experienced to spend far more taxation, it had been worthwhile to get the domestic we need,” he says.

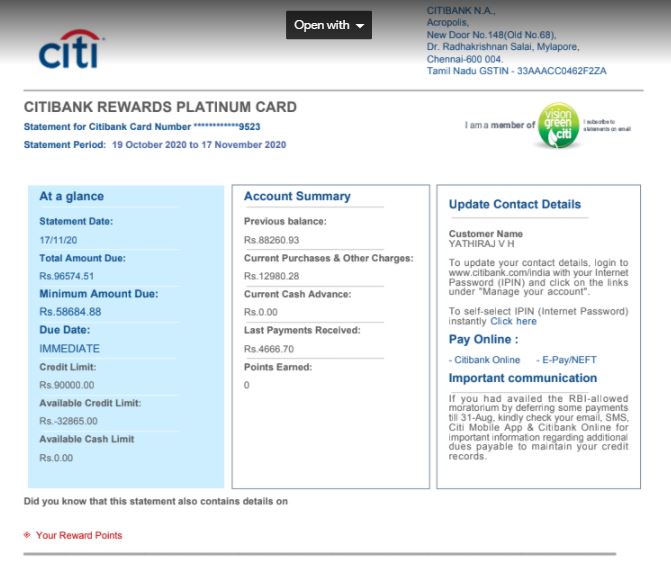

2. Decrease your loans

Whenever Horton’s lender declined their mortgage, it realized that he had $31,100 inside student loan debt, hence generated their personal debt-to-money ratio-the new part of their terrible monthly earnings you to would go to his month-to-month expense-unacceptably highest. To fix the difficulty, Horton dipped with the his deals and you may reduced more 80 percent out of their student loan loans all at once. It decreased their debt-to-income proportion rather and you may removed the way getting their home loan towards the a good $195,100000 household.

Debt-to-earnings proportion performs an enormous role for the in the event your get approved for a financial loan and exactly how much you might obtain. Even in the event you really have an effective credit rating, you ought to seek to keep your loans-to-income proportion lower than 43%.

step three. Keep meticulous suggestions

Most salaried employees just need to show W-dos versions to prove the income. Self-employed workers, on the other hand, need tell you a host of files, along with 2 yrs away from private and organization tax returns, Agenda Cs, 1099s, K-1s, profit-and-losses comments, as well as 2 days away from lender statements. And you may, once they spend on their own a paycheck, they should give W-2 variations off their providers.

It also helps to store invoices and you will independent builder plans, as they may also support the job. “Any file you could bring that assists underwriters find out how far money you are currently and work out is obviously helpful,” says Merkerson.

cuatro. Independent your and you will business expenditures

Whenever lenders evaluate how much debt you’ve got, these include only https://paydayloancolorado.net/kit-carson/ thinking about a personal debt, not your organization obligations. For this reason Merkerson recommends thinking-operating individuals to separate the private and you may organization costs.

If at all possible, you’ll have independent credit cards, examining and you can savings account. You really need to debts any company purchases, such as the acquisition of another type of table or meal with a potential buyer, towards compatible membership. This will clarify their fees and help you retain monitoring of money arriving and you will losing sight of your organization.

5. Make a bigger advance payment

Consumers may find that, the higher its downpayment, the easier and simpler its so they are able rating home financing. A larger sum reduces the count that must be borrowed and you will decreases the borrower’s chance of standard, all of which looks considerably better from the vision of your own loan providers. “More you put down, new stronger their file try,” claims Merkerson.

When your money are located in acquisition and you’ve achieved all the needed papers, you’ll be inside the a much better position to look available for mortgages. Towards correct preparing really works, possible make it through the mortgage processes which have partners unexpected situations.