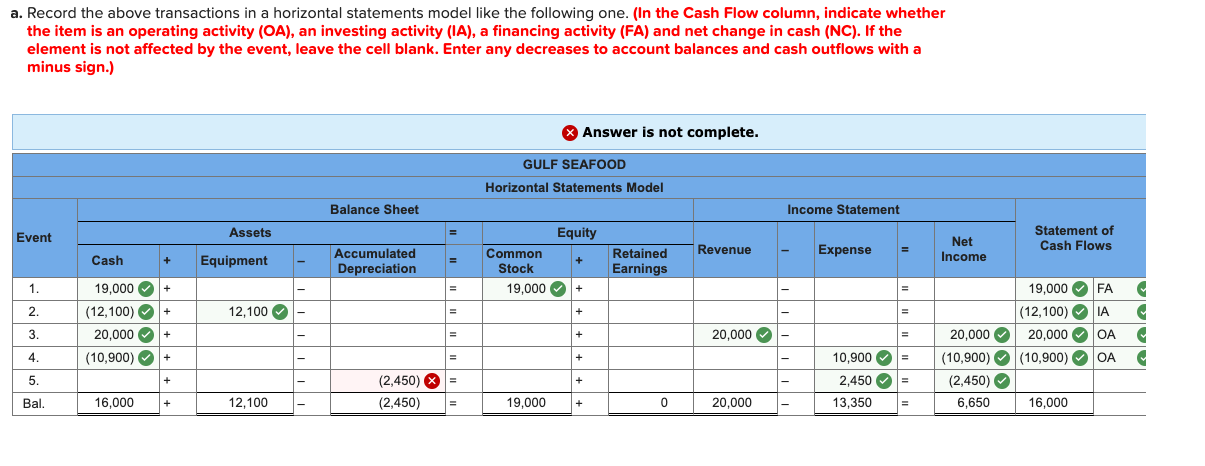

Editorial Notice: The content of article will be based upon the fresh author’s feedback and advice alone. May possibly not was indeed assessed, accredited or otherwise endorsed by the any kind of our very own community people.

Without someone lovers new You.S. Company regarding Agriculture (USDA) that have home loan funding, a great spot to find out about USDA money will be to start with brand new USDA qualification map.

USDA mortgage loans promote one hundred% investment and you will reasonable home loan costs getting lowest- and average-earnings borrowers exactly who purchase possessions from inside the an outlying city. But do not assume that means you must survive a farm. The latest rural meaning boasts locations which have a society as much as 20,one hundred thousand if they are maybe not inside a great area urban area plus don’t possess homeownership software to own reduced- and modest-income buyers.

- What is the USDA qualifications map?

- What does property eligibility’ suggest?

- USDA possessions eligibility requirements

- Exactly what qualifies just like the a selected rural urban area?

- Utilizing the newest USDA qualifications chart

What is the USDA eligibility map?

Brand new USDA qualifications map has the benefit of a great searchable method of dictate where you will find land which might be financed which have a good USDA financing. Since the USDA funds is simply for home one meet up with the definition of a rural area, one of the primary tips to obtaining a beneficial USDA financing would be to find out if the neighborhood for which you need it a house qualifies because the outlying.

For individuals who currently have a home planned to find, you can use brand new USDA qualifications map to evaluate you to definitely target to see if USDA financial support try an alternative.

In the hop over to this site event the a home is found in a place designated given that rural with the USDA qualifications, that does not mean you can obviously funds they with an excellent USDA financing. The newest USDA has actually a good disclaimer to spell it out one eligibility towards chart is not a promise away from qualification or of a prescription mortgage. A credit card applicatoin have to be reviewed to choose qualifications.

What does property eligibility’ imply?

While all the loan providers review the value of a home before making a decision when they will accept a mortgage, brand new USDA mortgage system was created to promote loans having reasonable- and you may reasonable-income property surviving in rural parts. The borrowed funds system is all about improving use of reasonable homeownership inside rural section.

This new USDA qualification chart also provides a primary answer to search urban centers and you can choose areas where USDA loans arrive. Only attributes in this areas appointed once the outlying qualify for the loan system. When you find yourself trying to find a property in the an area which could getting defined as outlying, examining the latest USDA assets qualification map is actually a first action to help you find out if USDA capital is present.

USDA possessions eligibility criteria

Mortgage programs usually need borrowers in order to meet particular criteria and you will a house appraisal. The new USDA financing program has even more requirements from the program’s goal to help with affordable homeownership when you look at the rural areas to own reduced- so you can average-earnings property.

- The home have to be found within an outlying town that is designated as eligible for USDA financing.

- The home have to be a single-family relations house and not a condo building. Of the USDA’s meaning, this consists of detached single-relatives house; attached home particularly an excellent duplex, townhouse or villa; an apartment; a standard household otherwise a created home.

- The house can be purchased inside a fully planned product invention.

- Your house have to meet up with the Company out-of Homes and you will Urban Development’s (HUD) 4000.step 1 minimal requirements which also affect property financed that have a keen FHA loan.

What qualifies since the a designated rural urban area?

While you might imagine a rural town is scheduled of the facilities, areas and you will tiny villages, the latest USDA definition of a designated rural town is actually greater.

How to use the new USDA qualifications map

Whether or not you’ve got a property in your mind that you like to help you buy or you want to find USDA eligible belongings, begin by opening the latest USDA qualifications chart and you can follow this type of steps:

Zooming inside and out to your USDA mortgage chart offers you a concept of in which services come that may meet USDA certificates. If you find yourself USDA loan standards start by the spot from a house, there are many more USDA financing certificates to fulfill.