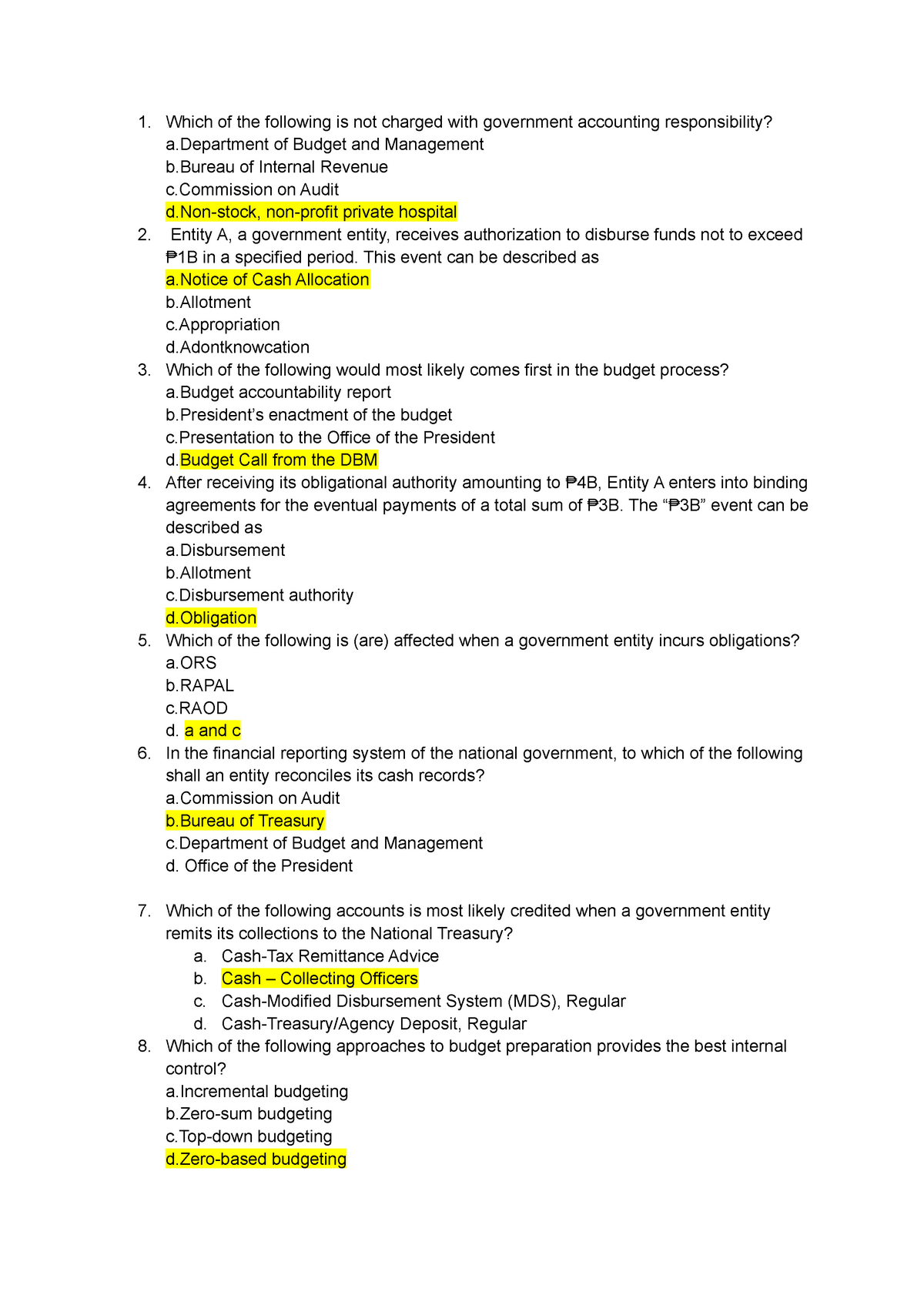

How come the lender you want my personal bank comments and exactly how manage I get them?

Why you to definitely a mortgage lender must take a look at the bank statements, will be to get a much better comprehension of your because a person and also to see just what youre like with paying your money. Your speech people finances, can impact the quantity you need to use use.

This all relates to the risk so you can a lending company. They must know that you are a responsible borrower and you can are designed for your money within the an appropriate style. A home loan is the prominent financial loans Dotsero commitment youre actually ever most likely and make, thus mindful thought and you will thought will have to enter it.

Possible receive your lender comments sometimes from the bank non-prescription, regarding article, or even the greener choice commonly utilized these days, since a file sometimes emailed from your own lender otherwise found in your on line banking, where you can print of.

What is going to loan providers keep an eye out having on my lender statement?

So taking a look at the head question, what is going to the loan financial end up being examining getting on my financial declaration? Just what will banner upwards by itself?

Better since the chatted about in past times, they have to discover you might be are in charge with your cash. Something right from the start, is actually they’ll be trying to see if you may have one overdrafts.

Entering your own overdraft isn’t really totally crappy, whether or not going into it tend to can be get-off a home loan company so you’re able to question no matter if you will be respected.

It’s also advisable to make certain you cautious having potential returned Direct Debits, which may direct a lender to believe you are unreliable which have your bank account. As well, up-date the financial institution of all of the outbound deals, once the failing to disclose one will get eradicate their believe.

As is the case with one borrowing from the bank, always be apprehensive about overlooked payments towards personal loans, handmade cards, an such like. When you can show to be able to see month-to-month deadlines, this will be gonna are employed in your own favour which have a mortgage lender.

We might want to assist! Drop all of us an email or concern and we will rating into reach immediately.

Often gaming affect my probability of getting home financing?

We have been on a regular basis questioned so it of the consumers, normally a home loan candidate may find on their own having difficulties moving forward, due to a history of betting.

Just a bit of fun the once in a while isn’t really as well destroying, however, apparently betting huge amounts, whether you’re and make your bank account right back or perhaps not, does not turn-to favourable so you’re able to a lender anyway.

Exactly what do I actually do to exhibit the financial institution I’m legitimate?

Throughout our big date employed in the mortgage industry, providing users to track down first time visitors mortgages or even circulate household, we usually find mortgage brokers want to see the final ninety days lender comments.

Influence one in your mind, you should think of the current and upcoming, maybe not your own past. You will find at the very least ninety days nowadays, effectively break down on your money and change your addressing of earnings and outgoings.

Our very own first tip is when you apparently visit a neighbor hood bookmakers or have fun with gambling other sites on the internet, you will want to take some slack for a while. This will be sure to replace your economic system along with your rational county too, since the gambling has been recognized to enjoys a bad impact on rational well-becoming.

Pursuing the into the using this, we could possibly suggest and then make plans to begin preserving enhance currency. Do you wish to big date getting eating otherwise are you willing to plan within the? Do you want to cure you to ultimately low-requirements, or is fundamentally getting their home loan a delicacy itself?

There clearly was lots can be done to at some point place your self in the finest position getting freeing up fund to pay your entire expense in the long run and show one another affordability and you may reliability that have a home loan lender, before home financing app.

Fundamentally, all this boils down to are sensible and you can preparing in advance regarding time on the items you need to get to. The brand new after that previously people debts and economic suspicion try, the higher position there’ll be having a lending company.

Consult with a loyal Mortgage Coach

Though youre a first time visitors using up very first ever before mortgage techniques, moving household along with necessity of financial recommendations otherwise desire in the one-man shop mortgage loans, an important should be to always be accountable for your finances.

When you’re struggling with a bad credit background, there is certainly bad credit mortgage loans nowadays available, even when we may usually recommend taking out fully specialist home loan suggestions inside order to put on your own from the best spot when deciding to take on the the borrowed funds journey.