The typical charge card maximum right now is approximately $31,000, considering Experian. Brand new restriction with payday loan Blue Valley the a consumer loan varies considering lender and you can borrower official certification it is will capped in the $100,000 . But if you may be a homeowner seeking borrow cash, you’re in fortune. The typical quantity of obtainable household collateral nowadays try $214,000 more than double than are going to be lent having your own mortgage and more than 7 times higher than what you are able rating that have credit cards, on average.

Of these trying obtain $90,000 , up coming, a house collateral mortgage produces a lot of feel right now. Not only can the typical resident availableness that it amount of cash which have relative ease now, however, as a consequence of a recently available price reduce and much more planning started, they can do it at the average price somewhat below playing cards (averaging significantly more than 20% now) and personal fund (next to 13%).

Just before borrowing from the bank so it amount, not, residents is to basic calculate the possible monthly can cost you. Since your home serves as equity on these circumstances, it is crucial that you only withdraw an expense that one can without difficulty afford to pay-off. Thus, just how much will good $ninety,000 household guarantee financing costs month-to-month given that costs are clipped? That is what we’ll calculate below.

Here’s what a good $90,000 domestic equity mortgage can cost you monthly now that cost are cut

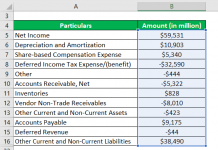

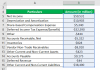

The average domestic guarantee loan speed simply 8.37% nowadays however it is a bit higher when linked with specific cost episodes, including the 10-seasons and you can fifteen-12 months terminology. Here is what a great $ninety,000 domestic collateral mortgage do cost month-to-month if the unwrapped now, associated with rates of these a few terms and conditions:

- 10-seasons home collateral financing within 8.47%: $1, monthly

- 15-season house collateral financing at 8.38%: $ per month

And while no one can predict confidently what happens to help you rates, of many carry out expect new Government Put aside to point a couple extra 25 base area decreases this season. Here’s what monthly payments on a beneficial $90,000 domestic collateral mortgage might possibly be, following, whenever they slip directly in combination:

- 10-12 months household guarantee loan within 8.22%:$1, a month

- 15-year home collateral mortgage from the 8.13%:$ 30 days

- 10-season household equity loan in the seven.97%:$1, four weeks

- 15-season house collateral loan within eight.88%:$ per month

So while you can easily shell out between $880 and $step one,115 monthly today so you’re able to acquire $90,000 that have a home guarantee mortgage, you happen to be able to rescue a little while if you waiting for rates to fall. To have many and varied reasons, however, wishing might not be a knowledgeable approach nowadays.

In the event that you wait for pricing to fall after that?

While it is tempting to wait getting interest rates to help you slide after that to save that most bit of currency, that might be an error . For 1, actually half a percentage area reduction will only produce an effective ount stored every month, regardless of loan name, just like the above numbers demonstrated. Which is provided cost actually slip by the same count that the federal loans price do, which is unlikely to happen.

At exactly the same time, some of the you’ll rates reductions in the future on last days of 2024 might have been priced for the by the lenders, and thus you will find nothing material difference in what you’re considering now and you can what you’re offered in December. However, prepared, although not, form putting-off buying the expense that you already you want our home guarantee mortgage to have. So consider the advantages and cons out of slowing down action cautiously.

The conclusion

A good $ninety,000 domestic security mortgage is sold with monthly obligations ranging ranging from $880 and you will $step one,115 today. And even though people money could potentially refuse because pricing is slash, waiting is almost certainly not useful for the majority individuals. Rather, consider the new monthly costs now rather than what you could spend in the brand new brief-identity to higher influence a knowledgeable highway send. And don’t forget that domestic security financing can still getting refinanced would be to you find a reduced rate at some point later on inside the 2024 otherwise on 2025.

Matt Richardson ‘s the dealing with editor toward Dealing with Your money point for CBSNews. He writes and you can edits posts throughout the individual fund ranging from offers to help you investing so you’re able to insurance policies.