Such as, it does thought requesting Congress in order to twice as much statutory lowest share having Reasonable Homes Apps (really FHLBs have voluntarily chose to improve their share to help you on the 15% regarding lowest 10%). A much bigger sum you will sparingly diminish FHLBs’ capacity to build money as a result of income or even to generate distributions on their members.

The FHFA as well as will broaden the fresh FHLBs’ connection with society advancement creditors and other purpose-oriented communities, including build the brand new scope of acknowledged collateral. We https://paydayloanalabama.com/peterman/ think the chances out-of losses–which were lowest having FHLBs because the enhances is overcollateralized with high-top quality guarantee–you will definitely rise if it were to exists with regards to the alter. Since , the computer had from the 5% of advances so you can neighborhood invention creditors, nonmembers, and you will construction associates (look for chart step 3). Still, we might not be expectant of a material escalation in exposure getting.

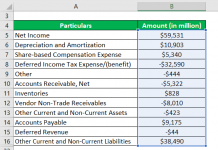

Chart step 3

The new FHFA will even talk about opportunities to boost the FHLB Bodies functional efficiencies, build, and you may governance. Although not, we possibly may not expect possible savings to help you materially work with success. This is because into the basic nine weeks regarding 2023, settlement, advantages, and other doing work costs amounted in order to a currently low 15% away from money (measured as internet appeal income along with noninterest income).

Brand new statement discussed the potential for combining FHLBs to own results. Yet not, we’re unclear if or not that would exists, and you may differing cost formations centered on subscription, area dimensions, or other circumstances ine the brand new panel construction of FHLBs to ensure best constitution.

Lastly, the fresh new FHFA tend to attempt to after that line up administrator settlement that have security and you may soundness and you can objective craft, along with request congressional approval to get rid of any restrictions that preclude the brand new FHFA regarding recommending settlement accounts or range for executive officers of your own FHLBs. Changes to help you forums and administrator settlement you certainly will increase governance and you can goal alignment, but we don’t thought any potential changes will cause us to change all of our evaluations towards FHLBs.

We don’t expect the newest FHFA’s greater increased exposure of construction and area advancement so you can materially transform banks’ enhances regarding the FHLBs

The latest FHFA was planning to has FHLBs offer incentives, eg discounted improve prices or differential dividends toward investment inventory, to people that demonstrate good support of the Body’s purpose.

We have been not sure how extreme particularly incentives might be and how materially they would transform banks’ conclusion. Subsequent, we possibly may not expect new incentives on their own in order to always produce banking institutions to use significantly more improves. We feel banks’ total funding demands, calculated in the large area because of the alterations in finance and places, will remain a rider of their accessibility FHLB advances.

I along with won’t predict a prospective improvement in the word “long-term” advances to substantially affect financial institutions. FHLB people need to hold domestic homes money property comparable to in the least the amount of its a lot of time-label advances. (Since the funds garnered away from borrowings is fungible, people essentially both use those funds to invest in assets not related so you’re able to domestic property fund).

Brand new FHFA indicated it is offered altering new much time-identity meaning by the reducing its current five-year threshold, possibly to a single seasons. Who would mean the minimum level of domestic construction loans assets one individuals would need to keep would be highest.

The new FHFA told you, because the 2020, 10%-30% off the improves got exclusive maturity higher than 5 years and you will forty%-70% had a unique readiness higher than 12 months. That being said, we think very banks currently hold domestic casing loans assets in the excess of their advances having maturities higher than a year. The fresh new fraction out-of finance companies that don’t would potentially need certainly to sometimes eradicate the borrowings or enhance their residential housing loans possessions.