Within report, CBO examines how FHA’s House Guarantee Conversion process Mortgage system work, how exactly it affects the newest federal funds, and exactly how some plan techniques you are going to reduce costs and you can risks so you can the federal government or even to consumers.

Summary

Reverse mortgages assist house that have one user many years 62 otherwise earlier borrow funds with the equity inside their house since guarantee. The mortgage are often used to repay a current home loan or even to funds most other expenditures. The us government performs a huge part when you look at the giving support to the industry for opposite mortgage loans, and you may policymakers have indicated demand for altering you to definitely support-including, as a result of change who would keep your charges down on authorities otherwise make contrary mortgages less risky getting borrowers.

How does the federal government Support the Opposite-Mortgage Market?

The newest Government Construction Management (FHA) promises installment into the being qualified contrary mortgage loans created by private lenders. With the Household Security Conversion process Financial (HECM) system, FHA has secured over 1 million opposite mortgages because the 1992. (Financing that found an FHA make sure during that system are called HECMs, noticable heckums.)

People who take aside a beneficial HECM qualify to help you acquire a keen matter equivalent to certain small fraction of their residence’s most recent worth. They could draw on available finance-known as the readily available dominant limit-either instantaneously or higher big date. FHA, the financial institution, while the entity giving (servicing) the borrowed funds charges the new debtor individuals charge, including a fee designed to make up FHA for its make certain. The borrowed funds balance (precisely what the debtor owes) expands because desire and you will charge accrue toward installment loan California direct lender count a fantastic.

Good HECM will get owed and payable significantly less than lots of circumstances, instance when your borrower (and you can spouse, if any) passes away otherwise actions to another number 1 home. This new debtor and/or borrower’s house must up coming match the loan duty, possibly of the paying down this new a good equilibrium or of the forfeiting our home. Typically, if for example the funds received regarding the borrower dont equal this new an excellent equilibrium of your own HECM, the lending company will get allege the real difference away from FHA. Through providing loan providers a hope facing losses, the us government encourages these to issue reverse mortgages easier than they will if not.

Exactly what are the Budgetary Outcomes of FHA’s Claims?

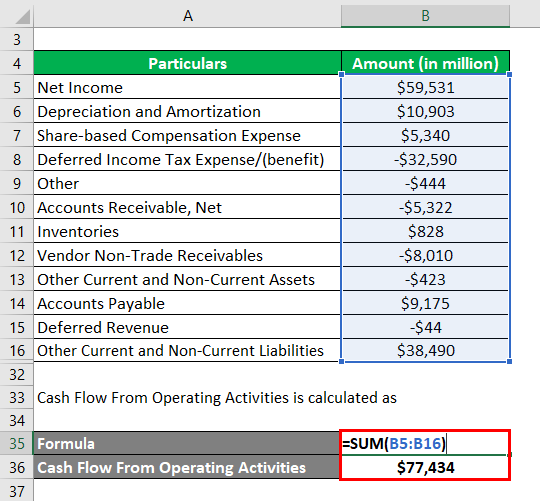

The fresh new HECM program impacts the latest government budget generally through FHA’s repayments in order to loan providers therefore the charge you to FHA fees individuals. The fresh Congressional Funds Workplace strategies whenever current regulations generally remained a similar, the more or less 39,000 the fresh new HECMs one to FHA is anticipated to ensure from inside the 2020 would create an extremely brief budgetary savings more its lifetime. (You to definitely estimated lifestyle amount is registered regarding the budget on 12 months where in fact the pledges manufactured.) One to guess is founded on the brand new accounting steps specified because of the Federal Borrowing from the bank Reform Operate out of 1990 (FCRA) getting government programs that produce otherwise make certain fund.

Having fun with reasonable-really worth accounting-a choice means that more completely is the reason the expense of the risk that authorities is met with when it pledges loans-CBO programs that the 2020 cohort of the latest HECMs perform instead prices the us government in the $350 million over their lives (discover contour).

So how exactly does the fresh new Government Role on the Reverse-Mortgage Field Become Altered?

Policymakers changed the latest HECM program following 2008 overall economy in order to clean out defaults by the individuals and you may costs towards the national, nevertheless program continues to face scrutiny. Specifically, policymakers possess conveyed concern with the risks that the system makes to have FHA and you will individuals together with possible costs ones dangers towards regulators. CBO examined five tricks for changing FHA’s opposite-financial guarantees (based on almost every other federal credit applications):

- Changing brand new HECM program to a primary loan system, where the regulators create funds opposite mortgage loans itself rather than guarantee finance funded because of the personal lenders;

- Decreasing the level of an effective loan’s outstanding balance one to FHA claims to repay loan providers because of the requiring loan providers to market (otherwise assign) a working HECM so you can FHA earlier than sometimes they create around most recent procedures (especially, decreasing the loan harmony that causes the choice to own loan providers in order to assign HECMs);

- Sharing the risk of losings with loan providers because of the requiring these to keep a working HECM lengthier than just they generally create now prior to delegating they in order to FHA; and

- Reducing the growth of your own finance open to a borrower which doesn’t mark an entire level of a beneficial HECM initial.

What number of HECMs guaranteed as well as the level of budgetary deals otherwise will cost you not as much as for every alternative would depend on several affairs, for instance the ways in which FHA, loan providers, and borrowers taken care of immediately the changes. In earliest around three choices, loan providers manage increase charges in order to consumers otherwise reduce the method of getting HECMs, CBO rates. (On the direct financing program, private loan providers do still originate HECMs and you can charges consumers closing will cost you.) Within the fourth alternative, lenders might be mostly unchanged, CBO forecasts, but individuals would both mark a lot more of its offered loans instantaneously or forgo a good HECM and only different ways to help you tap to your collateral in their house (particularly as a consequence of an effective refinancing financing otherwise a property equity line away from borrowing).

Mentioned towards the a beneficial FCRA base, the fresh new last option would have the largest budgetary perception within the variables you to CBO analyzed. Under that method to reducing the organization of one’s borrower’s offered prominent restrict, the fresh HECMs projected to be secured into the 2020 carry out cut the us government $180 million more the lifetime, CBO rates, compared with the newest minimal offers projected from inside the CBO’s current-rules standard. The new savings regarding 2020 cohort from HECMs could be less in other choices on an excellent FCRA basis: $130 billion below a program regarding direct financing, or around $fifty million should your threat of losings was distributed to loan providers or if perhaps brand new cause for assigning reverse mortgage loans to help you FHA is actually reduced.

Measured towards a fair-worthy of foundation, in comparison, the choice to produce a direct loan program would have brand new most significant financial feeling of your own four approaches one to CBO examined. In head financing system, the HECMs projected is protected in 2020 manage save the us government from the $120 million more their lifetime to the a reasonable-really worth base, CBO prices, in place of prices $350 billion once the not as much as newest plan. Under the most other three choice, the new 2020 cohort out-of HECMs do however generate will cost you towards an excellent fair-well worth basis, nevertheless the costs would be smaller compared to below newest rules: $250 million when the FHA mutual the possibility of losings having loan providers, $230 mil in case the project end in is smaller, and you may $80 billion if the borrower’s available dominating limitation expanded much more more sluggish than it does now.