Key Learnings

- A beneficial USDA financing denial is not necessarily the prevent of one’s path.

- There are many reasons as to the reasons good USDA loan may get declined.

- Lenders need give you a bad action see explaining why you was basically denied.

Within this article

The entire process of trying to get an excellent USDA loan features on the new line than just finances and you can real estate applicants’ ambitions are with it. When a software gets rejected, it can feel those individuals ambitions is out-of-reach.

If the USDA financing is actually rejected, do not surrender yet ,. A denial does not prevent you from reapplying. But before your is once more, its crucial to select the reason(s) the application try denied to begin with and you can everything you will perform about this.

How frequently do the fresh USDA deny loans?

Brand new denial price to have USDA money may vary of the seasons. In accordance with the most recent Home loan Revelation Act (HMDA) Studies, the fresh denial price getting USDA funds try doing fourteen% across the country.

Can be your USDA financing getting refused once pre-recognition?

Sure, you are able to have a USDA loan are refused despite you obtained pre-acceptance. Also, it is possible for a great USDA mortgage locate refuted within closure.

Providing a beneficial USDA financial has of several levels from inspections and you can verifications, all of your details and the family you need to pick. The past financing recognition happens simply following underwriting processes was done, and all of borrower and you can possessions requirements is satisfactorily fulfilled. Any kind of time payday loans in Canon City CO without bank account point during this techniques, the financial institution has the right to transform their attention.

Reason why a USDA Mortgage Would Score Refuted

Debt-to-Earnings Ratio: Your debt-to-earnings (DTI) proportion steps your own month-to-month debt costs facing their disgusting month-to-month earnings. In case your DTI proportion is simply too highest, lenders will get matter your capability to manage even more mortgage money.

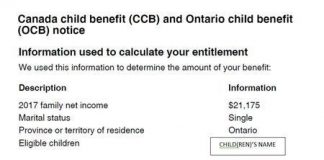

Earnings Limitations: USDA financing are made for individuals which have lowest in order to reasonable earnings. For many who surpass the USDA’s place income constraints to suit your town and you will family dimensions, you may not be considered.

Property Eligibility: USDA finance are especially to own attributes that the USDA features designated because outlying. In case the property isn’t really in an eligible area, it’s not going to qualify for an effective USDA mortgage. You need to use Locals Bank’s Possessions Qualification Map to check if the a speech suits certification.

Credit score and Rating: If you’re USDA fund have more lenient borrowing criteria compared to the antique loans, an incredibly low credit score otherwise a track record of bankruptcy, property foreclosure otherwise quick conversion may cause denial.

A job Balances: Lenders typically need a reliable works background, always a couple of years or higher with the exact same employer or perhaps in an identical type of works. Alterations in a job position or boss are not constantly a great deal-breaker, but they are definitely examined into an incident-by-circumstances foundation.

Insufficient Savings: While USDA loans do not require a downpayment, which have little to no deals are something for lenders. They frequently like to see some monetary pillow to fund closure costs, homeowner’s insurance rates and property taxes.

Assessment Facts: All belongings ordered with an effective USDA loan need proceed through an effective USDA assessment, which establishes brand new property’s well worth and assesses they to own livability and you may features requirements. The house have to appraise to your sales price or maybe more. In the event your appraisal will come in all the way down, it will end up in loan assertion unless improvements are made to the selling price and/or debtor normally safety the difference.

Possessions Designed Use: As reported by the brand new occupancy conditions, USDA funds may be used for no. 1 houses only. In the event your house is designed because the an investment property otherwise a beneficial vacation family, the mortgage could well be refused.

What direction to go in the event your USDA Application for the loan Gets Refuted

In the event your loan application is declined, loan providers need certainly to deliver a bad action find, and that info why(s) for your application’s denial. That it find can be composed, electronic or verbal, according to the things. Should it be improving your credit history, stabilizing your earnings or selecting a home that fits USDA advice, being aware what went wrong ‘s the first rung on the ladder for making winning future loan applications.

If your choice are situated in entire or even in part with the pointers from your credit report, the lending company must provide the name, address and phone number of your own borrowing from the bank bureau you to definitely provided brand new declaration. You are entitled to a free copy of your own credit history of you to agency for those who consult it within this 60 days of searching the new assertion observe. Brand new notice should also tell you about the right to conflict the accuracy or completeness of any guidance on the credit file your lender used in its choice.

If you feel the mortgage denial are unfair or incorrect, or if you need after that explanation to your aspects of denial, you could potentially get in touch with the lender to find out more otherwise speak with a lawyer getting suggestions.